This northwestern suburb of Chicago is consistently recognized for its high quality of living, ranking as one of the best American cities to live in.^ Drawing in students from nearby colleges including Devry University and North Central College, Naperville has over 12,000 renters and if you’re one of them you might want to get renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Naperville, including the affordability of policies, chance of break-ins, and the high risk of weather-related damage.

Best renters insurance companies in Naperville

INSURANCE COMPANY | MONTHLY COST - $500 DEDUCTIBLE | MONTHLY COST - $1,000 DEDUCTIBLE |

|---|---|---|

State Farm | $9.58 | $9.58 |

Allstate | $16.00 | $15.00 |

Travelers | $30.00 | $28.00 |

Stillwater | $15.83 | $13.33 |

Lemonade | $6.34 | $5.67 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

STATE FARM | ALLSTATE | TRAVELERS | STILLWATER | LEMONADE | |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property, it also protects you from being financially on the hook if someone is injured in your home, and can pay if you need to temporarily move out of your rental unit. Here’s a rundown of the basic components of a policy that you should know when you're comparing renters insurance rates.

Property coverage: Reimburses you for personal property that is destroyed, damaged, or stolen in your apartment and outside of it. Your coverage extends to your car or storage unit.

Liability coverage: Covers legal costs if a guest is injured in your home and sues you.

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

Loss of use: Pays temporary living expenses if you can’t live in your rented home or apartment due to damage or repairs.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Naperville?

Renters insurance isn’t legally mandated by the city of Naperville, but your landlord might stipulate that you get it as a condition of your lease. You should read the fine print of your lease or check with your landlord if you’re not sure whether you’re required to have renters insurance.

However, even if your landlord doesn’t require it, renters insurance is still worth buying. You can get a policy with a $500 deductible to insure your belongings for as low as $7 a month. Plus there are more reasons to apply, which we’ll go into next.

Reasons to buy renters insurance in Naperville

Renters insurance is among some of the most affordable insurance coverage you can buy, and considering your most cherished personal belongings are typically stored in your residence or storage units, renters insurance should be a no-brainer in any city.

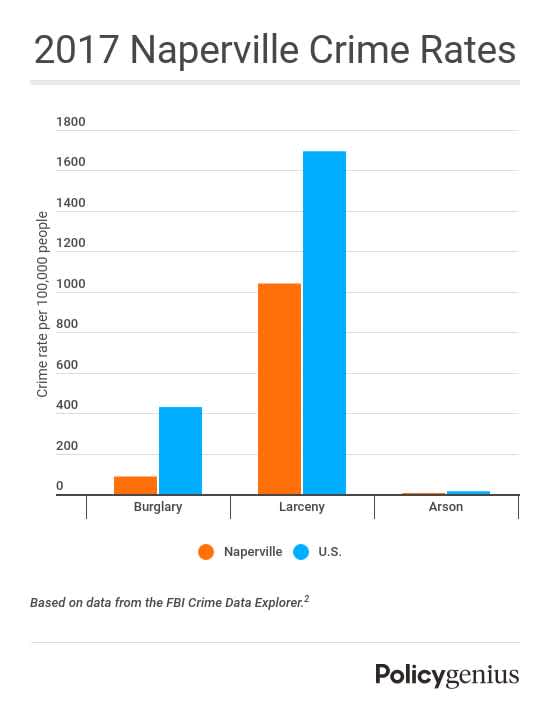

While property crime rates in Naperville fall below the national average†, that isn’t a reason to skip out on renters insurance. If your belongings are stolen outside of your apartment — say from your car, a moving van, or your backpack while you’re on vacation — renters insurance still protects you through personal property coverage.

Another scenario where you might need renters insurance is if you have a pet. Renters insurance will cover you when you have guests over, and your overly playful dog bites or injures one of your friends.

Naperville incidents | Naperville rate* | Nationwide incidents | Nationwide rate* | |

|---|---|---|---|---|

Burglary | 129 | 87.20 | 438,034 | 430.4 |

Larceny theft | 1,540 | 1,041.00 | 1,784,219 | 1,694.40 |

Arson | 8 | 5.41 | 13,982 | 13 |

*Rate per 100,000 people. Based on data from the FBI Crime Data Explorer†

Did you know that with renters insurance, you’re covered in the event a pipe bursts or the heavy weight of snow or ice causes your roof to fall in and damage your stuff? Renters insurance covers certain natural disasters and weather-related damages, so given Naperville’s cold and snowy winters‡ it makes sense for its residents to get a policy.

Helpful resources

Naperville tenants looking for more resources on renting and their rights should visit the following:

City of Naperville: Resources for residents including property maintenance, noise, and utility concerns.

Naperville Fair Housing Ordinance: Municipal code document outlining fair housing laws.

Illinois Tenants Rights: Information on tenants rights, laws, and protection in the state of Illinois.