Most car insurance companies offer a mobile app for their customers, but no two mobile apps are exactly the same. Some are simple and straightforward, while others have lots of features that make it easy to take care of all your insurance needs with nothing more than your phone.

If a robust, user-friendly app is important to you when you’re shopping for car insurance, you’ll need to compare ratings and reviews to make sure you choose an insurance provider that offers the best car insurance app for your needs.

Which is the best app for car insurance?

When it comes to car insurance mobile apps, GEICO tops the list for best rating on both Google Play and the Apple App Store. State Farm and Farmers have excellent (and identical) ratings in both app stores, leaving them tied for the second best car insurance app.

The rating of your car insurance app is important, but it is probably less important to you than some other parts of your insurance coverage. When you are choosing an insurance company you want to make sure they offer coverage that meets your needs, that the company offers stellar customer service, and that your car insurance rate is affordable.

Once you’ve found a few companies that meet your needs, comparing mobile insurance apps can be a good way to help you figure out which car insurance company is the right one for you.

Company | Google Play rating | Apple App Store rating |

|---|---|---|

GEICO | 4.7 | 4.8 |

State Farm | 4.6 | 4.8 |

Farmers | 4.6 | 4.8 |

Mercury | 4.2 | 4.4 |

American Family | 4.2 | 4.8 |

Nationwide | 4.2 | 4.4 |

Auto Owners | 3.8 | 3.1 |

Allstate | 3.7 | 3.7 |

Root | 3.5 | 4.7 |

Travelers | 3.2 | 4.7 |

The Hartford | 3.1 | 3.9 |

Erie | 2.8 | 3 |

Your auto insurance app is usually separate from the usage based apps that help you earn discounts for being a safe driver, but not always. If your car insurance app gives you the ability to track your driving, it will be a feature that must be turned on separately from the rest of the app.

In addition to their basic car insurance apps, most insurance companies have apps that track your driving behavior and offer a discount for good drivers. These programs have different names at different companies, and include:

Drivewise: Allstate offers their customers the option to sign up for their Drivewise app, which comes with an immediate discount just for signing up, followed by a potential discount every six months for safe driving behavior.

Drive Safe and Save: State Farm’s safe driving app could help you get up to 30% off your insurance premium based on how you drive. The company even offers a discount just for signing up.

DriveEasy: GEICO uses its DriveEasy app to automatically detect and record your driving behavior. You can regularly monitor your score that is based on distraction-free driving, braking, and other driving behaviors to make sure you are driving safely and earn a discount on your insurance premium.

SmartRide: Nationwide customers get a 10% discount for signing up for SmartRide, with the possibility of up to 40% off your rates at your policy renewal.

Snapshot: This Progressive app offers a discount for signing up and helps set your rate based on your mileage and driving behavior. Though some companies promise that using their safe driving app won’t increase your rate, Progressive isn’t one of them. This means drivers who don’t meet the company standards for safe driving will see an increase in their rates, but safe, cautious drivers could see a decrease.

Highest rated car insurance apps

The three car insurance mobile apps with the highest rating in both Google Play and the Apple App Store are GEICO, State Farm, and Farmers.

1. GEICO

Rated 4.7 on Google Play and 4.8 on the Apple App Store, the GEICO app gives drivers the ability to pay their bill, access their insurance policy, file claims, review coverage options, and call for roadside assistance. Customers can also use GEICO’s mobile app to check their car’s service history, check for recalls, and create a maintenance schedule.

2. State Farm

Rated 4.6 on Google Play and 4.8 on the Apple App Store, State Farm’s app allows drivers to file and manage their claims, review insurance coverage options, call for roadside assistance, and connect directly with their agent, as well as access multiple benefits for young drivers like their Steer Clear driver training app and their 25% good student discount. The State Farm mobile app also allows customers to upload photos and documents of an accident to expedite the claims process.

3. Farmers

Rated 4.6 on Google Play and 4.8 on the Apple App Store, the Farmer’s app allows drivers to enroll in electronic delivery for their policy documents and billing notices and receive push notifications about important account information. Farmer’s customers can also use their app to view their insurance policy, file a claim, review coverage options, and request roadside assistance.

Most downloaded car insurance apps

Car insurance apps may have more appeal for young drivers, but drivers of any age can benefit from having their policy information available at their fingertips through an auto insurance app.

Company | Google Play rating | Number of downloads |

|---|---|---|

GEICO | 4.7 | 10M |

State Farm | 4.6 | 5M |

Allstate | 3.7 | 5M |

Root | 3.5 | 1M |

Liberty Mutual | 4.7 | 1M |

Farmers | 4.6 | 500K |

Nationwide | 4.2 | 500K |

Metromile | 4 | 100K |

Safeco | 4.4 | 100K |

Travelers | 3.2 | 100K |

Car insurance app customer reviews

Customer satisfaction is an important part of an insurance app. An auto insurance app with lots of features is great, but the most important thing is how user-friendly the app is for the drivers who need it.

Does it load quickly? Is it easy to use? We’ve compiled several customer reviews (both good and bad) for each of the top-ranking auto insurance apps.

GEICO: Customers in the Google Play store say the app is straightforward and super user-friendly. The biggest complaint customers have about the app is that the Drive Easy program, which is an optional part of the app that tracks your driving habits to help you save money on your car insurance, isn’t the most accurate — among other things, customers reviews indicate that it has difficulty sensing when you are the driver and when you are the passenger in a vehicle.

State Farm: State Farm customers say the app is convenient, with one customer saying they were able to pay two auto insurance bills in less than 30 seconds. The biggest complaint customers have about the app is that it can be glitchy and slow.

Allstate: Allstate customers say they are happy with the company’s response to complaints and how quickly issues are resolved. The biggest complaint customers have about the app is that it moves very slowly, sometimes even freezing and needing to be restarted to make the app work correctly.

Farmers: Farmers customers say that the app is easy to navigate and has an intuitive user interface experience. The biggest customer complaint is that the app is sometimes slow or difficult to open, showing error codes or requiring multiple one-time verification codes.

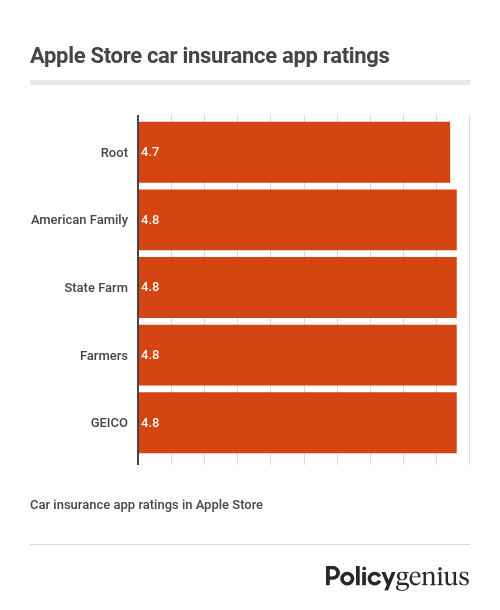

Best car insurance app for iPhone

Based on customer ratings for car insurance apps in the Apple App Store, the best apps belong to Root, American Family, State Farm, Farmers, and GEICO.

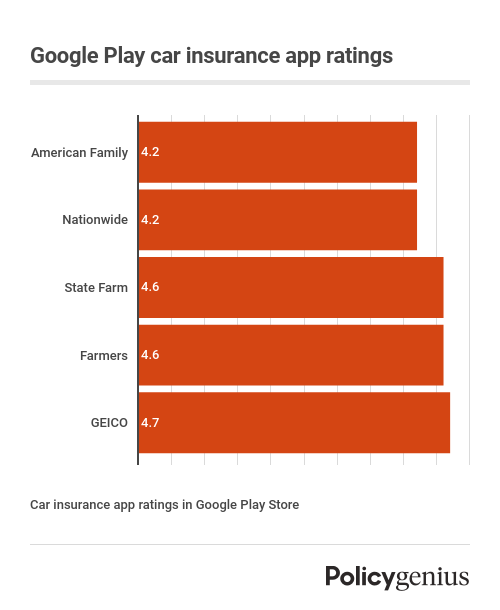

Best car insurance app for Android

Based on customer reviews from the Google Play store, the best apps belong to American Family, Nationwide, State Farm, Farmers, and GEICO.

What can you do on a car insurance mobile app?

While not all car insurance companies offer the same features on their mobile apps, they usually have a range of tools. Things you can do on your mobile insurance app may include::

Paying your bill

Filing a claim

Managing an ongoing claim

Reviewing your policy

Calling for roadside assistance

Uploading photos and documents

Working with a virtual customer service rep to answer questions

Receiving push notifications about your account information

Connecting directly with your agent (if you have one)

Methodology

Apple App Store and Google Play ratings current as of 3/31/2022.

Policygenius has analyzed car insurance rates provided by Quadrant Information Services for every ZIP code in all 50 states, plus Washington, D.C.

For full coverage policies, the following coverage limits were used:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive coverage: $500 deductible

Collision coverage: $500 deductible

In some cases, additional insurance coverage was added where required by the state insurance commissioner or insurer.

Rates for overall average rate, rates by ZIP code, and cheapest companies determined using averages for single drivers age 30, 35, and 45.

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of insurance costs. Your actual insurance quote may differ.