The top-rated car insurance companies

We scored dozens of car insurance companies based on price, discounts offered, coverage options, customer experience, and financial strength to find the best insurance providers overall.

The 10 best car insurance companies based on their Policygenius scores are USAA, Erie, State Farm, Auto-Owners, COUNTRY Financial, GEICO, NJM, Travelers, Amica, and Encompass

Breaking down the best car insurance companies

While Erie has the best overall score on our analysis of cost, coverage offerings, customer service, and claims satisfaction, that doesn’t mean it’s necessarily the best car insurance company for your specific coverage needs.

The best way to find the right car insurance company for you is to shop around and compare quotes from more than one company.

Best car insurance for customizing coverage: Travelers

Best car insurance for bundling: Auto-Owners

Best car insurance after an accident: State Farm

Best usage-based car insurance: Progressive

Best car insurance for at-home workers: Nationwide

Best car insurance overall: Erie

Erie is our pick for best overall car insurance company because it combines extensive coverage options with top-notch customer service and affordable rates. One of Erie’s few downsides is that it’s only available in 12 states.

Coverage options: Erie offers extras like gap insurance, new or better car replacement, personal item coverage, rate lock after a claim, rental car reimbursement, ridesharing coverage, and roadside assistance.

Customer satisfaction ratings: Erie scored near the top of the J.D. Power Claims Satisfaction Study in 2022, but it receives slightly more complaints than average according to the National Association of Insurance Commissioners.

Price: The average cost of Erie car insurance is $98 a month or $1,181 per year, which is 29% cheaper than the national average.

State availability: District of Columbia, Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Wisconsin

Best car insurance for customer service: Amica

Amica is the best car insurance company for drivers who value top-rated customer service. Amica consistently earns top scores for customer satisfaction and gets fewer complaints than most of its competitors.

Coverage options: Amica offers a range of endorsements, including gap coverage, full glass coverage, new car replacement, rental reimbursement coverage, and roadside assistance.

Customer satisfaction ratings: Amica earned a score of 903 on the 2022 J.D. Power Claims Satisfaction Study, much higher than the average score of 873. Amica also receives a fewer than average number of complaints from customers, according to the National Association of Insurance Commissioners.

Price: The average cost of Amica car insurance is $144 a month or $1,723 per year, 5% more expensive than the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance for customizing coverage: Travelers

Travelers is our pick for the best car insurance company for drivers who want to customize their coverage. Travelers offers a wide range of car insurance coverage options that aren’t available everywhere, including add-ons for rideshare drivers and non-owners car insurance.

Coverage options: You can personalize your Travelers car insurance coverage with accident forgiveness, gap insurance, new car replacement, non-owners insurance, rental reimbursement, rideshare coverage, and roadside assistance coverage.

Customer satisfaction ratings: Travelers scored lower than average on the 2022 J.D. Power Claims Satisfaction and Digital Experience Studies. But Travelers receives fewer complaints than some competitors.

Price: The average cost of Travelers car insurance is $132 a month or $1,586 per year, which is 3% cheaper than the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance for bundling: Auto-Owners

Auto-Owners is the best car insurance company for drivers who want to bundle their home and auto insurance. The cost of a combined home and auto bundle with Auto-Owners is 12% cheaper than average. Auto-Owners also offers a common loss perk that can lower (or get rid of) your auto deductible when your home and car are damaged in the same incident.

Coverage options: Auto-Owners offers accident forgiveness, diminished value coverage, gap coverage, rental car coverage, trip interruption coverage, rental gap coverage, rental reimbursement coverage, roadside assistance coverage, and a waived deductible if you’re involved in a crash with someone who also has Auto-Owners car insurance.

Customer satisfaction ratings: Auto-Owners scored an 865 on the 2022 J.D. Power Claim Satisfaction Study, which is about average. That said, according to the NAIC, Auto-Owners receives fewer complaints than expected.

Price: The average cost of Auto-Owners car insurance is $101 a month or $1,209 per year, which is 26% cheaper than the national average.

State availability: Alabama, Arizona, Arkansas, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Carolina, North Dakota, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Utah, Virginia, Wisconsin

Best car insurance for families with teens: GEICO

GEICO is the best car insurance company for families with a newly licensed driver or a teen with their learner’s permit, thanks to its very competitive rates for young drivers. GEICO’s mobile apps and online tools also make it a good pick for families who are looking for a way to manage their policy online.

Coverage options: GEICO offers just a few coverage options besides what makes up a basic policy. These extras include mechanical breakdown coverage, rental reimbursement coverage, and roadside assistance. GEICO does not offer gap insurance.

Customer satisfaction ratings: GEICO received a score of 874 on the 2022 J.D. Power Claims Satisfaction Study, which is about average. GEICO gets more complaints than average, according to the NAIC.

Price: The average cost of GEICO car insurance for a family with a 16 to 21-year-old driver on their policy is $155 a month or $1,856 per year, which is 30% cheaper than average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance after an accident: State Farm

State Farm is the best car insurance company for drivers with an accident or other violation on their records. That’s because State Farm’s car insurance rates remain much lower than average after an at-fault accident, speeding ticket, or a DUI.

Coverage options: State Farm doesn’t offer many extra types of car insurance, but you can add rental reimbursement, rideshare coverage, and roadside assistance to a basic policy. State Farm does not offer gap insurance.

Customer satisfaction ratings: State Farm earned a score of 882 on the 2022 J.D. Power Claims Satisfaction Study — higher than the industry average of 871. State Farm scores even better on the Digital Experience Study, where it’s ranked among the best for online and mobile offerings.

Price: The average cost of State Farm car insurance after an accident is $117 a month or $1,574 per year, which is about half as expensive as the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance for veterans and military families: USAA

We chose USAA as the best car insurance for drivers who are in the military or a part of a military family for its cheap rates and exceptional customer service. In fact, USAA has the lowest average car insurance rates of any company that we reviewed at just $87 per month for a full-coverage policy. That’s $594 cheaper than the national average.

Coverage options: USAA’s car insurance coverage options include gap insurance, rental reimbursement, rideshare coverage, and roadside assistance.

Customer satisfaction ratings: USAA score of 889 on the 2022 J.D. Power Claims Satisfaction Study is much higher than average, while its Digital Experience score is the second highest of any company J.D. Power reviewed.

Price: The average cost of USAA car insurance is $87 a month or $1,044 per year, which is 36% cheaper than the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best usage-based car insurance: Progressive

Progressive is the best car insurance company for drivers who qualify for a telematics or usage-based discount for staying safe on the road. If you’re unsure about Progressive’s Snapshot program, which tracks your driving and awards savings for safe behaviors behind the wheel, you can try it out for 30 days and see what you could save before you sign up.

Coverage options: Progressive lets drivers personalize their car insurance with custom parts coverage, gap insurance, a lower deductible for every claim-free policy period, pet injury protection, rental car reimbursement, rideshare coverage, and roadside assistance.

Customer satisfaction ratings: Progressive scored an 861 on the 2022 J.D. Power Claims Satisfaction Study — lower than the industry average of 871. But Progressive did better on the Digital Experience Study, where it placed third best.

Price: The average cost of Progressive car insurance with Snapshot is $70 a month or $840 per year, which is 53% cheaper than the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance for remote workers: Nationwide

The best car insurance company for remote workers is Nationwide, since they can take advantage of its low-mileage car insurance program, SmartMiles. Nationwide’s SmartMiles, which bases your rates on how much you drive, is available in every state, comes with a 10% discount, and has a pricing structure that allows drivers to take long trips without fear of getting overcharged.

Coverage options: You can add a lot of extra coverage options to your Nationwide car insurance policy, including accident forgiveness, gap insurance, rental reimbursement coverage, roadside assistance, total loss damage waiver, and a vanishing deductible for every year you go without a claim.

Customer satisfaction ratings: Nationwide’s score on the 2022 J.D. Power Claims Satisfaction Study is nearly identical to the national average. Nationwide also receives fewer complaints than expected, according to the NAIC.

Price: The average cost of Nationwide car insurance is $121 a month or $1,475 per year, which is 10% cheaper than the national average.

State availability: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, Maryland, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Best car insurance for luxury vehicles: AIG

If you have a high-value or luxury car, AIG is the best car insurance company for you. That’s because AIG has lots of experience insuring high-value property (including high-value homes and yachts), and offers a handful of speciality endorsements and very high levels of liability coverage.

Coverage options: Drivers can insure their luxury or collectible cars with AIG’s $1 million liability limits, agreed value appraisement, and cash settlement options.

Customer satisfaction ratings: AIG only receives a fraction of the expected complaints, according to the NAIC, indicating solid customer service. AIG wasn’t ranked by J.D. Power for claims satisfaction, though.

Price: The average cost of AIG car insurance is $267 a month or $3,210 per year, 95% more expensive than the national average.

State availability: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

List of the best auto insurance companies

Best car insurance overall: Erie

Best car insurance for customer service: Amica

Best car insurance for customizing coverage: Travelers

Best car insurance for bundling: Auto-Owners

Best car insurance for families with teens: GEICO

Best car insurance after an accident: State Farm

Best car insurance for veterans and military families: USAA

Best usage-based car insurance: Progressive

Best car insurance for remote workers: Nationwide

Best car insurance for luxury vehicles: AIG

Our in-depth reviews of the best car insurance companies

Here’s a full list of our top car insurance company ratings, along with each company’s average rates and customer service scores (which were based on ratings from the J.D. Power Auto Claims Satisfaction Survey and NAIC Complaint Index).

Policygenius rating | Average premium | AM Best Financial Strength Rating | J.D. Power Claims Satisfaction | NAIC Complaint Index | |

|---|---|---|---|---|---|

5.0 out of 5 | $1,044 | A++ | 890 | 1.02 | |

4.9 out of 5 | $1,181 | A+ | 893 | 1.27 | |

4.8 out of 5 | $1,141 | A++ | 882 | 0.67 | |

4.7 out of 5 | $1,574 | A+ | 903 | 0.66 | |

4.7 out of 5 | $1,165 | A++ | 865 | 0.66 | |

4.7 out of 5 | $1,416 | A+ | NA | 0.14 | |

4.7 out of 5 | NA | A+ | NA | 0.97 | |

4.7 out of 5 | $1,192 | A++ | 874 | 1.07 | |

4.7 out of 5 | $1,262 | A+ | 896 | 0.06 | |

4.7 out of 5 | $1,351 | A++ | 854 | 0.37 | |

4.6 out of 5 | $1,040 | A | NA | 0.22 | |

4.5 out of 5 | $1,526 | A+ | NA | 0.17 | |

4.5 out of 5 | $689 | A | NA | 0.51 | |

4.4 out of 5 | $2,084 | A | 882 | 0.81 | |

4.4 out of 5 | $1,780 | A+ | 861 | 0.65 | |

4.4 out of 5 | $1,041 | A | NA | 0.10 | |

4.3 out of 5 | $1,479 | A | 874 | 0.16 | |

4.3 out of 5 | $1,475 | A+ | 868 | 0.39 | |

4.2 out of 5 | $2,055 | A+ | 889 | 0.73 | |

4.2 out of 5 | $1,405 | A | 865 | 0.76 | |

4.1 out of 5 | $1,923 | A | 870 | 1.18 | |

4.0 out of 5 | $1,341 | A- | NA | 0.00 | |

3.9 out of 5 | $1,987 | A- | NA | 1.18 | |

3.8 out of 5 | $959 | B | NA | 1.04 | |

3.7 out of 5 | $2,134 | A | 847 | 0.64 | |

3.5 out of 5 | $1,898 | A+ | 838 | 5.57 | |

3.3 out of 5 | $2,577 | A | 830 | 0.71 | |

3.1 out of 5 | $916 | NA | NA | 1.79 | |

2.9 out of 5 | $1,967 | NA | NA | 0.00 |

Companies ordered from highest to lowest Policygenius scores

Comparing the best car insurance companies

If you’ve narrowed your search down to a couple of companies, check out our car insurance reviews and compare companies directly.

Best car insurance by state

The best car insurance company for you can depend on where you live. Some of the best-reviewed auto insurance companies (like COUNTRY, Wawanesa, and others) only offer coverage in a few states.

Your rates also depend on lots of factors, especially where you live — costs can even change depending on your city and ZIP code. We found the best company in each state for full-coverage insurance and compared it with the average rate in that state.

Best company | Monthly rate at best company | Average statewide rate | |

|---|---|---|---|

Travelers | $83 | $144 | |

GEICO | $77 | $116 | |

Auto-Owners | $76 | $133 | |

State Farm | $80 | $147 | |

Wawanesa | $80 | $153 | |

American National | $70 | $154 | |

GEICO | $68 | $155 | |

State Farm | $97 | $179 | |

GEICO | $85 | $150 | |

State Farm | $134 | $233 | |

Auto-Owners | $88 | $135 | |

GEICO | $65 | $101 | |

American National | $41 | $91 | |

Pekin | $56 | $111 | |

State Farm | $59 | $101 | |

State Farm | $59 | $97 | |

GEICO | $76 | $128 | |

GEICO | $97 | $182 | |

State Farm | $124 | $211 | |

Auto-Owners | $51 | $91 | |

GEICO | $67 | $149 | |

GEICO | $85 | $129 | |

GEICO | $89 | $202 | |

State Farm | $80 | $118 | |

National General | $75 | $139 | |

State Farm | $62 | $132 | |

State Farm | $71 | $158 | |

Auto-Owners | $86 | $135 | |

GEICO | $96 | $183 | |

State Farm | $56 | $107 | |

GEICO | $84 | $185 | |

State Farm | $72 | $122 | |

Kemper | $79 | $171 | |

Erie | $62 | $90 | |

State Farm | $64 | $117 | |

State Farm | $59 | $84 | |

State Farm | $79 | $143 | |

State Farm | $71 | $120 | |

State Farm | $81 | $139 | |

State Farm | $79 | $153 | |

American National | $57 | $168 | |

State Farm | $93 | $124 | |

State Farm | $68 | $111 | |

Farm Bureau | $87 | $152 | |

GEICO | $82 | $130 | |

State Farm | $52 | $87 | |

State Farm | $70 | $112 | |

PEMCO | $76 | $144 | |

State Farm | $72 | $135 | |

GEICO | $57 | $92 | |

American National | $62 | $116 |

Simple guides to finding the best auto insurance

What are the different types of car insurance?

All of our picks for the top car insurance companies have the basic coverage that every driver needs in order to be fully protected. It’s a good idea to get familiar with the different types of car insurance coverage before you start shopping, so you know exactly what’s going into your policy.

Coverage type | What it does |

|---|---|

Property damage liability | Covers the cost of the other party's repairs if you're at-fault in a car accident |

Bodily injury liability | Pays for the other party's medical bills and related expenses if you cause an accident |

Uninsured/underinsured motorist coverage | Covers the costs if you're hit by a driver without insurance, or who doesn't have enough insurance to pay for the damage |

Collision coverage | Pays for damage to your own car after an accident, even if you were the one at-fault |

Comprehensive coverage | Covers damage to your car not caused by a collision, like damage from extreme weather, fire or theft |

Personal injury protection | Required in no-fault states, pays for your own medical expenses after an accident |

MedPay | Available in at-fault states, pays for medical bills after an accident, usually up to a limited amount |

→ Learn more about the different types of car insurance coverage

What affects your car insurance rates?

Although auto insurance companies charge different rates — and some are better than others for certain drivers — most of the time companies determine rates according to:

While it’s true that companies use these factors when they calculate your car insurance, local laws where you live might keep insurance providers from using certain factors, like your gender or credit history, to determine your rates.

How much does car insurance cost?

The average driver pays $1,638 a month for car insurance, but it’s possible to find cheaper rates, especially if you shop around.

Here’s how much a full-coverage car insurance policy costs at our top 10 car insurance companies:

Average cost per month | Average cost per year | |

|---|---|---|

$87 | $1,044 | |

$95 | $1,141 | |

$97 | $1,165 | |

$98 | $1,181 | |

$99 | $1,192 | |

$105 | $1,262 | |

$113 | $1,351 | |

$118 | $1,416 | |

$131 | $1,574 |

How to find the best car insurance rates

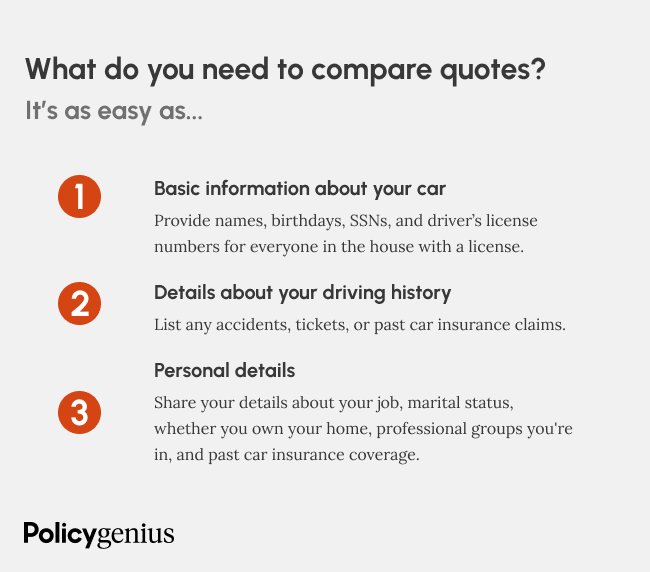

The easiest way to find the best car insurance rates is by comparing quotes from a few companies before you buy a policy. Shopping around, even if you already have car insurance, can keep your rates lower over time.

Here are some other ways to help get better car insurance rates:

Bundle your insurance: Get your auto insurance and your home, condo, or life insurance from the same company and save.

Get the right amount of coverage: If you have two cars but one is old, you may not need full-coverage on both.

Drive safely: Avoid accidents and violations on the road and you’ll get better rates

Pay annually instead of monthly: Most car insurance companies offer a “paid in full” discount if you pay for the whole thing at the start of your policy.

Sign up for usage-based discounts: Many companies offer programs where you share information about your driving through an app or in-car device and earn savings for safe driving.

Make sure your insurance company has the right information: If your rates have gone up recently, check with your insurance company that it’s got accurate information about your vehicle usage and mileage, in case you’re being overcharged.

Switch companies when it’s time to renew: Don’t automatically renew your car insurance before comparing quotes to see if there’s a better deal out there.

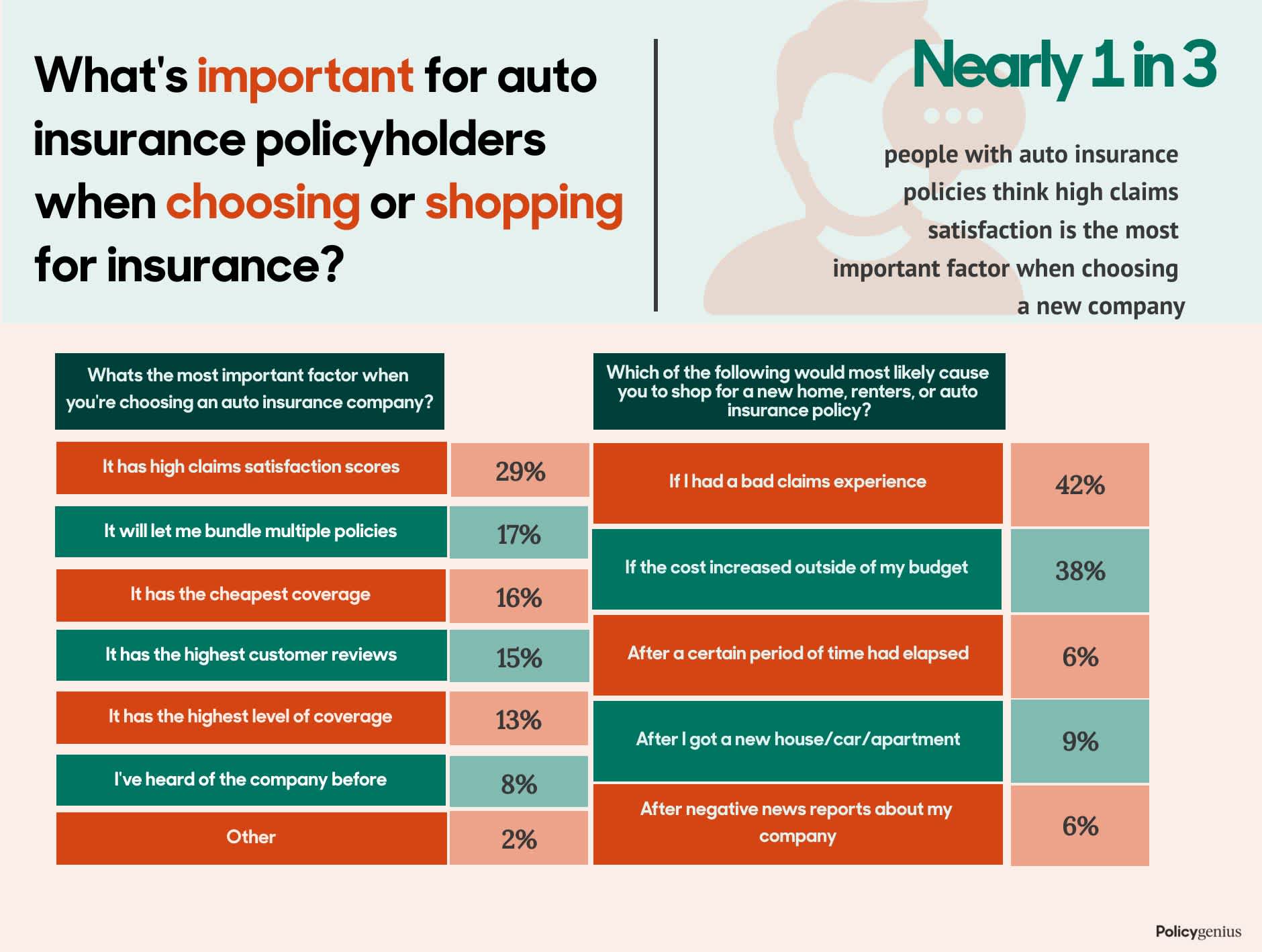

What do people look for in the best car insurance company?

A 2022 Policygenius survey asked 1,500 drivers what the most important factors were when choosing an auto insurance company. The largest percentage (27%) said that claims satisfaction scores were the number one factor in choosing car insurance.

We also found that having a bad claims experience is the main reason why policyholders would decide to switch to a new policy.

Behind claims satisfaction, 17% of drivers wanted the ability to bundle more than one policy. Another 17% said that cheap coverage was the most important factor when choosing a car insurance company.

Car insurance trends in 2024

A mix of factors over the past few years has led to more expensive car insurance rates, and drivers are increasingly looking to switch companies to avoid the price crunch and save money.

According to a 2023 J.D. Power report on car insurance shopping trends, high numbers of drivers were interested in shopping around in 2023, thanks in part to rate increases. And more drivers are looking into usage-based insurance (UBI) as a way to save money — according to J.D. Power, UBI was offered to to 22% of car-insurance shoppers and purchased 18% of the time.

Read more about what Policygenius has written about the car insurance landscape:

How to choose the best car insurance company

We connect you to some of the biggest auto insurance providers to make it easy to find your best car insurance company — whether you’re shopping for your first policy or you need to switch companies because your coverage needs have changed.

While you’re looking for the best car insurance company for you, the questions that you should ask are:

1. Do this company’s rates fit into my budget?

According to recent income data from the Census Bureau, car insurance may take up more than 2% of the typical household income. [1] But other groups like senior-aged drivers, who can live on on a fixed income, may pay an even larger part of their earnings on insurance.

2. Is it easy to file a claim with this company?

You can get a sense of a company’s customer service and claims fulfillment from our auto insurance guides, rankings, and reviews. Customer service is important, since it won’t matter how cheap a company is if it’s unresponsive or combative when it comes time to actually file a claim for damage.

3. Does this company offer the protection I need?

The best auto insurance company for you should offer the right amount of coverage for your needs. You may need more car insurance if you:

Need to insure more than one vehicle: If you have multiple vehicles at home, you might need to find a company that’s willing to insure them all together.

Have a teenage driver at home: Teen drivers are expensive to insure, so look for a company that offers usage-based car insurance or special discounts for new drivers.

Have a history of accidents, tickets, or other violations: You may need high-risk or non-standard insurance if you have past violations on your record, like multiple accidents or a DUI.

Drive a leased or financed vehicle: A lessor or lender will require you to get full-coverage insurance or gap coverage, and sometimes even new car replacement coverage.

What is the best place to get car insurance?

Our top car insurance companies include Erie, GEICO, State Farm, and Progressive. But no matter which company you choose, the best place to get car insurance is online.

That’s because getting online quotes from a marketplace like Policygenius is the best way to see the most competitive car insurance rates from large and small car insurance companies, all at the same time.

What car insurance discounts are available with the top companies?

All the best car insurance companies have at least a few discounts available. You should compare the discounts each company offers and look out for the ones that apply to you.