Best cheap car insurance for young drivers

USAA ($165 a month) is the cheapest car insurance company for households that include teens and young adults (under 22), but in order to qualify, someone on the policy must be affiliated with the military.

Farm Bureau, which has a wide network of state affiliates, or GEICO, available nationwide, are other cheap options for young drivers. Since car insurance costs are different for every young driver (and their family), it’s best to compare rates from at least a few companies before settling on a policy.

Do young drivers have to join an existing policy?

Yes, typically young drivers have to join an existing policy if they’re a part of the same household as an insured parent or guardian. Insurance companies usually require parents to add their children to an insurance policy once they have their license.

Like with any other licensed driver in a household, you can choose to list your teen as an excluded driver on your policy if you don’t want to add them to the coverage, but that means they can’t drive your car. And if a teen or young adult buys their own car insurance, they don’t have to join an existing policy.

Best and cheapest for teens: Farm Bureau

The best auto insurance for teens (and their families) is Farm Bureau, at $168 per month, or $2,012 a year. Since teens usually don’t buy their own car insurance, we measured the cheapest car insurance companies for teens by looking at policies for households that included drivers 19 and under.

Besides its cheap rates for both teens and young adults (not to mention its discounts for young drivers), Farm Bureau also receives far fewer complaints than average, according to the National Association of Insurance Commissioners.

Here are Farm Bureau’s rates for different teenage drivers:

Age | Average monthly cost | Average annual cost |

|---|---|---|

16 | $204 | $2,442 |

17 | $176 | $2,115 |

18 | $149 | $1,789 |

19 | $142 | $1,702 |

Average Farm Bureau car insurance rates for policies that include a teenage driver.

Best and cheapest for young adults: GEICO

GEICO has the best car insurance for young adults (drivers under 22). On average, GEICO costs $175 per month, or $2,099 a year for full-coverage. That’s $1,169 per year cheaper than average.

GEICO doesn’t have the lowest overall insurance rates for young adults, but it’s the cheapest company that also offers coverage to the general public. GEICO also receives a fewer-than-average number of complaints from customers, which can be important if your newly-licensed driver has to make a claim.

Here are GEICO's rates for young adults:

Age | Average monthly cost | Average annual cost |

|---|---|---|

20 | $201 | $2,415 |

21 | $149 | $1,783 |

Cost of car insurance for young adults who get their own policy.

Cheapest insurance for teens and young drivers by age

The cheapest car insurance company for young drivers varies by age. Young drivers should re-shop their car insurance every year to continue to get the best rates.

Age | Cheapest company | Average monthly cost | Difference from average rate |

|---|---|---|---|

16 | NJM | $190 | -$2,083 |

17 | NJM | $175 | -$1,643 |

18 | Farm Bureau | $149 | -$1,337 |

19 | GEICO | $138 | -$1,170 |

20 | GEICO | $122 | -$1,061 |

21 | GEICO | $90 | -$844 |

Cheapest auto insurance for 16-year-olds

We found that NJM (New Jersey Mutual) has the cheapest car insurance for 16 year olds. On average, an NJM policy that includes a newly licensed 16-year-old costs a total of $190 per month.

But since NJM is only available in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania, it won’t be an option for everyone. GEICO, available in every state, is the next-cheapest car insurance company for families with 16-year-old drivers.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

NJM | $190 | $2,279 |

MAPFRE | $202 | $2,420 |

Farm Bureau | $204 | $2,442 |

USAA* | $225 | $2,704 |

GEICO | $231 | $2,773 |

Cheapest auto insurance for 17-year-olds

NJM ($175 a month) and Farm Bureau ($176) both have cheap car insurance for 17-year olds. GEICO has cheap coverage for 17-year-old drivers where NJM isn’t available.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

NJM | $175 | $2,101 |

Farm Bureau | $176 | $2,115 |

USAA* | $180 | $2,162 |

GEICO | $193 | $2,310 |

MAPFRE | $202 | $2,420 |

Cheapest auto insurance for 18-year-olds

The cheapest car insurance company for 18-year-old drivers is USAA, at an average cost of $135 a month. Since USAA is only available for people who are in the military or a part of a military family, GEICO is overall the cheapest car insurance company for 18-year-olds.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

USAA* | $135 | $1,621 |

Farm Bureau | $149 | $1,789 |

GEICO | $154 | $1,848 |

NJM | $160 | $1,923 |

Auto-Owners Insurance | $194 | $2,333 |

Cheapest auto insurance for 19-year-olds

USAA has the best auto insurance rates for 19-year-old drivers. If you’re not eligible for USAA coverage, GEICO also has cheap car insurance rates for 19-year-olds.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

USAA* | $120 | $1,445 |

GEICO | $138 | $1,656 |

Farm Bureau | $142 | $1,702 |

NJM | $149 | $1,786 |

Amica | $176 | $2,114 |

Cheapest auto insurance for 20-year-olds

It gets much easier for young adults to find cheaper insurance once they’re in their 20s. We found that the company with the best rates for 20-year-olds who join an existing policy is USAA, or GEICO if you’re not affiliated with the military.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

USAA* | $106 | $1,269 |

GEICO | $122 | $1,465 |

Farm Bureau | $135 | $1,614 |

NJM | $138 | $1,650 |

Amica | $151 | $1,808 |

Cheapest auto insurance for 21-year-olds

USAA has the cheapest car insurance coverage for 21-year-olds. GEICO is the company for young drivers who aren’t affiliated with the military or a part of a military family.

Company | Annual monthly cost | Annual average cost |

|---|---|---|

USAA* | $76 | $917 |

GEICO | $90 | $1,082 |

Progressive | $98 | $1,180 |

Amica | $100 | $1,195 |

Farmers | $100 | $1,205 |

Cheapest car insurance for teenagers in every state

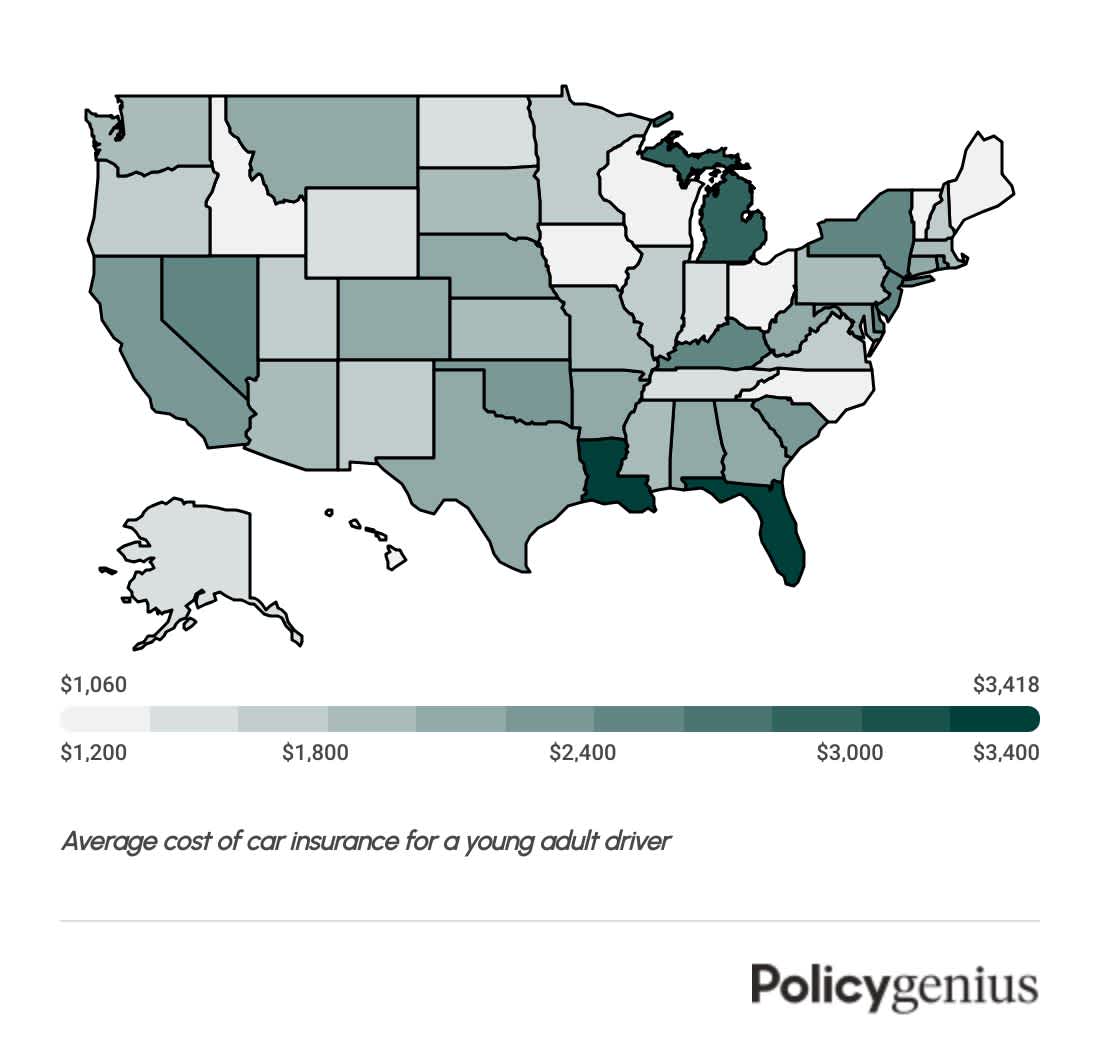

While the national average cost of car insurance for teens is $3,166 per year, average rates for teens will be different depending on where you live, and so will the cheapest companies.

We found the cheapest insurance company in every state for adding a teenager to an existing policy and for teenagers who get their own coverage.

State | Cheapest to add a teen | Cheapest for teens who get their own policy |

|---|---|---|

USAA | COUNTRY | |

USAA | Umialik | |

GEICO | GEICO | |

USAA | Farm Bureau | |

Wawanesa | Wawanesa | |

National General | American National | |

General Electric | State Farm | |

California Casualty | State Farm | |

GEICO | Erie | |

GEICO | GEICO | |

USAA | Auto-Owners | |

USAA | GEICO | |

American National | American National | |

Pekin | Pekin | |

USAA | USAA | |

West Bend Mutual | State Farm | |

Farm Bureau | American Family | |

GEICO | State Farm | |

Farm Bureau | USAA | |

Auto-Owners | Auto-Owners | |

USAA | USAA | |

USAA | USAA | |

Farm Bureau | GEICO | |

Farm Bureau | Farm Bureau | |

USAA | USAA | |

USAA | USAA | |

USAA | State Farm | |

Farm Bureau | Farmers Mutual of Nebraska | |

GEICO | COUNTRY | |

MMG | Auto-Owners | |

GEICO | GEICO | |

USAA | USAA | |

GEICO | American Family | |

Farm Bureau | State Farm | |

USAA | American Family | |

Grange Mutual | USAA | |

American Farmers and Ranchers | American Farmers and Ranchers | |

USAA | COUNTRY | |

Nationwide | GEICO | |

GEICO | USAA | |

State Auto | American National | |

USAA | State Farm | |

USAA | State Farm | |

Farm Bureau | Farm Bureau | |

Farm Bureau | GEICO | |

USAA | Auto-Owners | |

USAA | Farm Bureau | |

PEMCO | State Farm | |

USAA | State Farm | |

West Bend Mutual | USAA | |

USAA | USAA |

Cheapest car insurance for young adults in every state

The national average cost of car insurance for young adults (ages 20 to 21) is $3,268 per year, but average rates for these drivers can be much different depending on the company.

We found the company with the cheapest car insurance company in every state for adding a young adult to an existing policy and for young adults who get their own car insurance policy.

State | Cheapest to add a young adult | Cheapest for young adults buying their own policy |

|---|---|---|

Alabama | USAA | GEICO |

Alaska | USAA | GEICO |

Arizona | GEICO | GEICO |

Arkansas | USAA | USAA |

California | Wawanesa | Wawanesa |

Colorado | GEICO | American National |

Connecticut | GEICO | GEICO |

Delaware | USAA | USAA |

District of Columbia | USAA | USAA |

Florida | UAIC | GEICO |

Georgia | USAA | USAA |

Hawaii | USAA | GEICO |

Idaho | American National | American National |

Illinois | GEICO | Pekin |

Indiana | GEICO | USAA |

Iowa | West Bend Mutual | State Farm |

Kansas | USAA | USAA |

Kentucky | GEICO | GEICO |

Louisiana | Farm Bureau | USAA |

Maine | USAA | GEICO |

Maryland | USAA | USAA |

Massachusetts | Farmers | USAA |

Michigan | Farm Bureau | GEICO |

Minnesota | Farm Bureau | Farm Bureau |

Mississippi | USAA | USAA |

Missouri | USAA | USAA |

Montana | USAA | USAA |

Nebraska | Farm Bureau | USAA |

Nevada | GEICO | GEICO |

New Hampshire | USAA | Auto-Owners |

New Jersey | GEICO | GEICO |

New Mexico | USAA | USAA |

New York | GEICO | American Family |

North Carolina | Utica | GEICO |

North Dakota | USAA | USAA |

Ohio | Grange Mutual | USAA |

Oklahoma | GEICO | USAA |

Oregon | GEICO | COUNTRY |

Pennsylvania | Nationwide | GEICO |

Rhode Island | Travelers | USAA |

South Carolina | State Auto | American National |

South Dakota | Allstate | Kemper |

Tennessee | USAA | GEICO |

Texas | Redpoint Mutual | Farm Bureau |

Utah | GEICO | GEICO |

Vermont | USAA | State Farm |

Virginia | USAA | USAA |

Washington | USAA | USAA |

West Virginia | GEICO | USAA |

Wisconsin | GEICO | USAA |

Wyoming | USAA | American National |

Why does car insurance cost more for young adults?

It can be harder for young drivers to find cheap car insurance because of their lack of driving experience. Since young drivers are more likely to get into accidents while they get used to the road and they don’t yet have enough time behind the wheel to prove they’re safe drivers, their rates are higher.

The good news is that as young drivers age, their rates will get lower (as long as they avoid accidents and tickets). That’s why car insurance is cheaper for young adults than it is for teens, and why middle-aged drivers pay even lower rates. Typically, young adults see their rates average out by the time they turn 25 and are no longer in a high-risk age group.

How to get the lowest insurance rates for young drivers

It’s much easier for young drivers to find cheap car insurance if they join an existing policy. This can reduce the cost of a young driver’s premiums by $1,728 per year, on average.

Young drivers can also lower their car insurance costs by:

Comparing rates before buying: You can find who has the best car insurance rates for young drivers by comparing quotes before getting car insurance.

Re-shopping yearly: Instead of automatically renewing your policy every year, shop around to see if you could be getting better rates somewhere else.

Dropping some coverage: Young drivers with old cars may not need full coverage, especially if their car would cost more to insure than it would to replace.

Trying out per-mile insurance: Young drivers who don’t use their cars much could benefit from a policy that sets rates based on how much they drive.

Keeping a clean driving record: As long as young drivers avoid accidents and moving violations, their rates will go down with more driving experience.

Insurance discounts for young adults and teenage drivers

Discounts can make it easier for young drivers to find cheap car insurance. Nearly every car insurance company offers general discounts (like savings for bundling, requesting a quote early, and paying your premiums all at once).

Some auto insurance companies also have discounts that are only for teens and young adults, like:

Affiliation discounts: Some companies offer discounts to young drivers who are a part of certain fraternities or sororities, clubs, and universities.

Driver’s education discount: Young drivers, especially newly-licensed teen drivers, can get a discount by completing a driver’s education or safety class.

Good student discount: Lots of companies offer discounts to young drivers who are high-school or college students and maintain good grades.

Student away at school discount: Families with young drivers may get a discount if their child attends school at least 100 miles away without a car.

How does car insurance work for young drivers?

Car insurance works the same for young drivers as it does for drivers who have more experience behind the wheel. The main difference is that young drivers simply pay much more for car insurance than older drivers.

After an accident, car insurance will protect teens and other young drivers from having to pay for medical bills or damage themselves like any other driver.

Good car insurance is especially important for teens because of their inexperience driving. It’s also especially important for young drivers who don’t have enough income or savings to pay for a car accident out of pocket – which may be a lot of young people.

According to the U.S. Census Bureau, 15.8 million or 60% of people younger than 25 years old with an income made less than $25,000 in 2020 [1]

That’s why families with young drivers generally need as much liability insurance as they can afford (that’s what covers the costs after an at-fault accident), even if they don’t have full-coverage insurance.