Update: As of July 2023, Farmers is no longer offering car insurance in Florida. While Farmers is ending its coverage, subsidiaries of Farmers like Foremost and Bristol West will continue offering coverage in Florida.

State Farm has the cheapest car insurance in Florida, according to our expert analysis. The average cost of a full-coverage policy in Florida is $233 per month, but car insurance from State Farm costs $134 per month — $1,183 less per year than the statewide average.

Besides State Farm, the cheapest car insurance companies in Florida are GEICO, Travelers, and Nationwide. You can compare rates to make sure you get the best coverage for your needs.

Company | Average cost per month | |

|---|---|---|

$134 | ||

$149 | ||

$164 | ||

$209 |

Cheapest car insurance companies in Florida

Best car insurance companies in Florida

The best car insurance company in Florida is USAA. USAA scored the highest on J.D. Power’s 2023 Auto Insurance Survey for the Florida region. The survey measures how policyholders in Florida feel about their car insurance company, including customer service, billing, claims filing, and price. [1]

But USAA is only available to drivers affiliated with the military. State Farm, AAA, GEICO, and The Hartford also earned top scores in Florida — and are available to the general public.

Rank | Company | Score |

|---|---|---|

1 | USAA | 858 |

2 | State Farm | 833 |

3 | Automobile Club (AAA) | 813 |

4 | GEICO | 812 |

4 | The Hartford | 812 |

Cheapest car insurance companies by age in Florida

How old you are also plays a part in how much you’ll pay for car insurance. Younger drivers pay significantly more than older drivers. The longer you’ve been driving, the more experience you have on the road, while younger drivers may be more likely to take risks or make mistakes behind the wheel.

The cheapest car insurance for the youngest drivers in Florida is GEICO, but State Farm is cheapest for older teens.

Age | Cheapest company | Average cost |

|---|---|---|

16 | GEICO | $4,471 |

18 | State Farm | $4,036 |

21 | State Farm | $2,757 |

25 | State Farm | $1,823 |

30 | State Farm | $1,635 |

35 | State Farm | $1,617 |

45 | State Farm | $1,581 |

55 | State Farm | $1,513 |

60 | State Farm | $1,485 |

65 | State Farm | $1,480 |

70 | GEICO | $1,521 |

Choosing the right car insurance company in Florida

Choosing the right car insurance company may seem like a daunting task, but it’s easier than you might think. There are some key factors to consider when shopping:

Cost: You don’t want to overpay for car insurance. Get quotes from multiple companies so you can compare.

Coverage: Choose a policy with coverage that protects you, but there’s no need to go overboard.

Customer Service: The service you get when you buy your policy is the service you’ll get when you file a claim. If buying the policy was a hassle, then filing a claim won’t be any better.

Policygenius can help you compare quotes and see which coverage is included so you can make an informed decision about the policy you purchase.

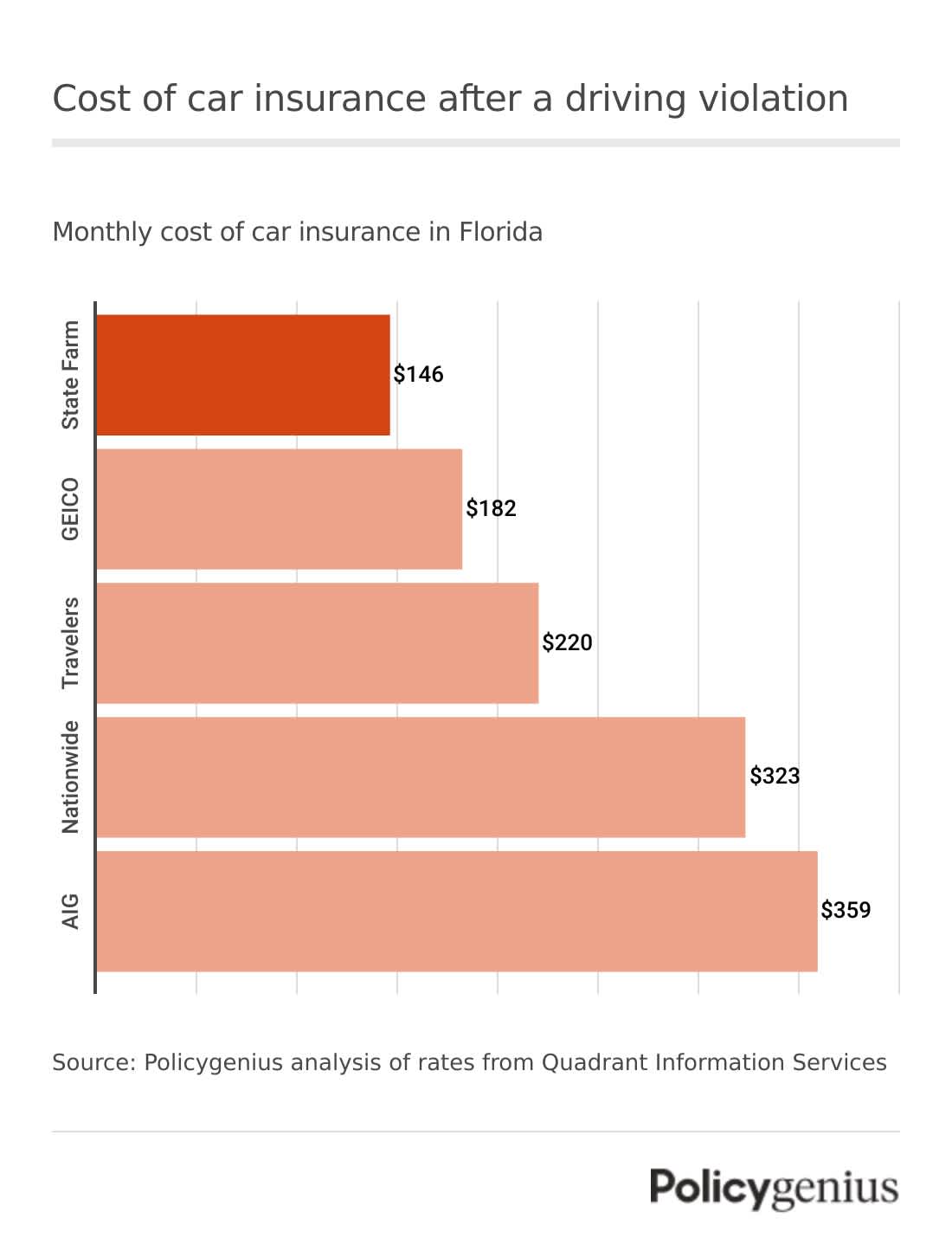

Car insurance rates for drivers with driving violations in Florida

The more violations on your driving record, the more you’ll pay for car insurance. In Florida, we found that State Farm often has the cheapest rates for drivers with a violation on their records.

Violation | State Farm | GEICO | Travelers | Nationwide | Farmers | AIG |

|---|---|---|---|---|---|---|

At-fault accident | $1,882 | $2,365 | $2,671 | $3,545 | $3,774 | $4,618 |

Suspended license | $1,753 | $1,799 | $2,999 | $5,351 | $3,486 | $4,664 |

Open container | $1,753 | $1,799 | $2,526 | $5,351 | $2,897 | $3,665 |

Expired registration | $1,753 | $1,799 | $2,526 | $2,932 | $3,486 | $4,468 |

Driving without lights | $1,753 | $1,799 | $2,526 | $2,516 | $3,486 | $4,468 |

Running a red light | $1,753 | $1,799 | $2,526 | $2,932 | $3,384 | $4,468 |

Following too closely | $1,753 | $1,799 | $2,526 | $2,932 | $3,486 | $4,468 |

Hit and run | $1,753 | $2,956 | $2,999 | $5,351 | $3,487 | $4,664 |

Not-at-fault accident | $1,635 | $1,799 | $2,037 | $2,516 | $2,698 | $3,269 |

Passing a school bus | $1,753 | $1,799 | $2,049 | $2,932 | $3,486 | $4,468 |

Reckless driving | $1,753 | $2,831 | $2,999 | $5,351 | $3,487 | $4,664 |

Cheapest car insurance after an accident in Florida

The cheapest car insurance company in Florida if you have an at-fault accident on your record is State Farm, with an average rate of $82 a month, or $1,882 a year after a single at-fault accident.

Rates for drivers with an at-fault accident | |

|---|---|

State Farm | $1,882 |

GEICO | $2,365 |

Travelers | $2,671 |

Nationwide | $3,545 |

AIG | $4,618 |

Cheapest car insurance for drivers with a DUI in Florida

Florida drivers already pay some of the highest car insurance rates in the nation, and Florida drivers with a DUI or DWI pay even more for car insurance, paying an average of $4,036 per year, or 44% more than drivers without a DUI.

Drivers with a DUI should still compare quotes to save money on their car insurance, since some companies offer better rates than others. According to our research, State Farm, Farmers, and GEICO have the lowest rates for drivers with a DUI.

Company | Rates for drivers with DUIs |

|---|---|

State Farm | $1,753 |

GEICO | $2,956 |

Travelers | $2,999 |

AIG | $3,665 |

Nationwide | $5,351 |

Cheapest car insurance for drivers with a speeding ticket in Florida

A speeding ticket will also raise your car insurance rates. Florida drivers with a speeding ticket on their record pay an average of $3,527 per year for car insurance, which is more than $700 higher than the average rate for drivers with a clean driving history.

We found that State Farm, GEICO, and Travelers had the cheapest average rates for Florida drivers with a speeding ticket on their record.

Company | Rates for drivers with speeding tickets |

|---|---|

State Farm | $1,753 |

GEICO | $2,831 |

Travelers | $2,999 |

Nationwide | $3,312 |

AIG | $4,468 |

→ Read more about finding cheap SR-22 or FR-44 insurance in Florida

Cheapest car insurance for drivers with bad credit in Florida

You might be surprised to learn that insurance companies consider your credit score when determining your car insurance rates. In fact, having bad credit can sometimes affect your rates more than having certain driving violations does.

We found that the cheapest car insurance company in Florida for drivers with bad credit is GEICO.

Company | Rates for drivers with bad credit |

|---|---|

GEICO | $3,198 |

UAIC | $3,204 |

AIG | $3,516 |

State Farm | $3,517 |

Farmers | $3,708 |

Cheapest car insurance in Florida by city

The cost of car insurance in your area can depend on local factors like crime rates, population density, the number of car accidents, and more. Here are the cheapest car insurance companies in the 10 most populated cities in Florida.

Largest cities | Cheapest company | Average yearly rate for the cheapest company | Overall citywide average |

|---|---|---|---|

Jacksonville | GEICO | $1,536 | $2,706 |

Miami | GEICO | $1,902 | $4,015 |

Tampa | GEICO | $1,827 | $3,664 |

Orlando | State Farm | $1,628 | $2,942 |

St. Petersburg | State Farm | $1,897 | $3,125 |

Port St. Lucie | State Farm | $1,633 | $2,626 |

Hialeah | GEICO | $1,802 | $4,036 |

Cape Coral | GEICO | $1,471 | $2,472 |

Tallahassee | State Farm | $1,360 | $2,377 |

Fort Lauderdale | State Farm | $2,080 | $3,497 |

Buying car insurance in Florida

The state of Florida requires car insurance to register a vehicle, but it has very low minimums. Every registered vehicle must have:

Personal Injury Protection (PIP) $10,000 per accident

Personal Damage Liability (PDL) $10,000 per accident

Proof of insurance must be provided at the time of registration and coverage must be maintained even if the vehicle is not being driven or is inoperable.

Additionally, the policy must be from a carrier licensed in Florida. If you move to Florida from another state, speak with your agent about having that policy transferred.

According to Florida state law, driving without the required insurance can result in a suspension of your driving privileges and your license plate for up to three years. It may be reinstated, but it will require the payment of a $500 fee.

Is Florida a no-fault state?

Yes, Florida is a no-fault state. That means that after an accident, you need to seek coverage for your injuries and medical bills from your own car insurance company, even if the other driver was at fault.

This makes it especially important to have enough coverage in the event of an accident. Make sure you’re comfortable with any deductibles you choose and that the full amount of the coverage you select will cover any necessary repairs or medical bills incurred.

How to get cheap car insurance in Florida

Florida is an expensive state for car insurance, but there are still some tried-and-true ways to lower your car insurance rates.

Drive safely: Avoid accidents and moving violations, including speeding tickets, to keep your rates low and qualify for discounts.

Watch your credit: Good credit will help you get a good deal on car insurance while bad credit can raise your rates.

Shop around: Compare rates from multiple insurance companies to see which offers the best rates.

Choose coverage carefully: Look at your coverage options, including deductibles, and choose the best coverage for your needs.

Find car insurance in your city: