Texas Farm Bureau has the cheapest car insurance rates in Texas at $87 per month for a full-coverage policy. That’s 43%, or $777 per year, cheaper than the state average in Texas, which is $1,818 per year.

Our other picks for the best cheap car insurance companies in Texas are State Farm, Germania, Redpoint, and GEICO. You can find your cheapest company in Texas by comparing quotes from multiple providers.

Company | Average cost per month | |

|---|---|---|

$87 | ||

$90 | ||

$112 | ||

$113 | ||

$122 |

The cheapest car insurance companies in Texas

Best car insurance companies in Texas

The best car insurance in Texas is USAA, which is only available to drivers affiliated with the military. USAA scored the highest on J.D. Power’s 2023 Auto Insurance Survey for the Texas region, which measures how policyholders in the Lone Star State feel about their company’s customer service, billing, claims, and price. [1]

State Farm and Texas Farm Bureau also earned top scores and are available to the general public, which USAA is not.

Rank | Company | Score |

|---|---|---|

1 | USAA | 860 |

2 | Auto Club of Southern California | 839 |

3 | State Farm | 838 |

4 | Texas Farm Bureau | 824 |

5 | Farmers | 813 |

Cheapest car insurance companies by age in Texas

Teens and young adults don’t have much driving experience, which means they are more likely to be in an accident than older drivers. Because of this, it can be harder for young adult drivers to find cheap car insurance.

We found that Redpoint has the cheapest average car insurance rates in Texas for younger drivers.

Age | Cheapest company | Average cost |

|---|---|---|

16 | Redpoint County Mutual | $1,356 |

35 | Farm Bureau | $1,031 |

18 | Redpoint County Mutual | $1,356 |

45 | Farm Bureau | $1,031 |

21 | Redpoint County Mutual | $1,356 |

55 | Farm Bureau | $893 |

25 | State Farm | $1,233 |

60 | Farm Bureau | $862 |

30 | Farm Bureau | $1,063 |

65 | Farm Bureau | $844 |

70 | Farm Bureau | $846 |

Choosing the right car insurance company in Texas

Choosing the best car insurance company for you doesn’t have to be an overwhelming experience. There are several factors to consider, including:

Cost: Finding the company that has the best rates and the most available discounts can help keep your insurance costs low.

Coverage: Having enough coverage is vital. If you don’t have enough liability coverage you'll still be held accountable for damage that goes beyond your coverage levels, so having the highest levels of liability coverage you can afford is an important consideration when choosing a policy.

Customer service: Feeling valued by your insurance company is an important part of choosing coverage. Having an insurance company that treats you with respect can be worth paying a little more for insurance.

Are you ready to start shopping for insurance? Our insurance experts at Policygenius are ready to help you find the right insurance coverage for your needs

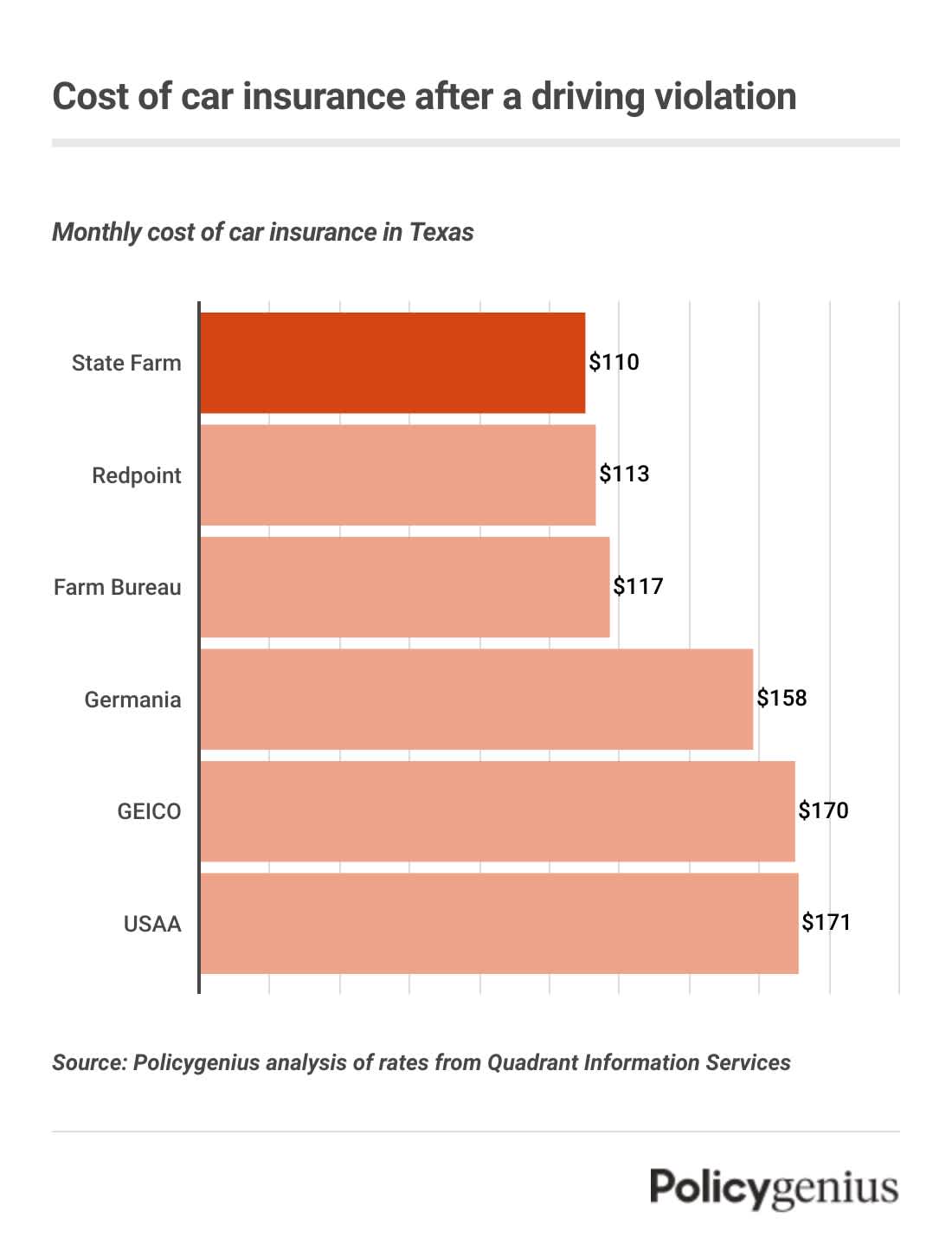

Car insurance rates for drivers with driving violations in Texas

Your driving history is one of the biggest factors insurance companies use to help determine your rates. A single accident or a traffic ticket can make your auto insurance much more expensive.

The cheapest car insurance in Texas for drivers with a single driving violation on their records is State Farm.

Violation | Farm Bureau | State Farm | Germania Insurance | Redpoint County Mutual | GEICO | USAA |

|---|---|---|---|---|---|---|

At-fault accident | $1,761 | $1,280 | $1,821 | $1,356 | $2,231 | $2,460 |

Suspended license | $1,133 | $1,488 | $2,424 | $1,356 | $2,451 | $2,261 |

Open container | $2,162 | $1,612 | $1,434 | $1,356 | $2,451 | $1,849 |

Expired registration | $1,133 | $1,091 | $1,434 | $1,356 | $1,718 | $1,849 |

Driving without lights | $1,133 | $1,091 | $1,434 | $1,356 | $1,718 | $1,849 |

Running a red light | $1,133 | $1,091 | $1,434 | $1,356 | $1,718 | $1,849 |

Following too closely | $1,133 | $1,091 | $1,434 | $1,356 | $1,718 | $1,849 |

Hit and run | $1,133 | $1,697 | $3,028 | $1,356 | $2,451 | $2,436 |

Not-at-fault accident | $1,133 | $1,091 | $1,491 | $1,356 | $1,442 | $1,635 |

Passing a school bus | $1,133 | $1,091 | $1,434 | $1,356 | $1,718 | $1,849 |

Reckless driving | $1,133 | $1,697 | $3,028 | $1,356 | $2,451 | $2,436 |

Cheapest car insurance after an accident in Texas

The cheapest car insurance company in Texas for drivers with an at-fault accident on their records is State Farm. On average, coverage from State Farm costs $107 a month or $1,280 per year after an accident.

Company | Rates for drivers with an at-fault accident |

|---|---|

State Farm | $1,280 |

Redpoint | $1,356 |

Farm Bureau | $1,761 |

Germania | $1,821 |

GEICO | $2,231 |

USAA | $2,460 |

Cheapest car insurance for drivers with a DUI in Texas

Texas drivers with a DUI or DWI are likely to see a significant increase in their car insurance rates. Drivers in Texas pay an average of $1,818 per year for car insurance, but the average rate for a driver with a DUI is $2,962 per year, which is 63% higher than the state average.

But drivers with a DUI can still save money by comparing rates. According to our research, Redpoint County Mutual, State Farm, and Farm Bureau have the lowest rates for drivers with a DUI on their record.

Company | Rates for drivers with DUIs |

|---|---|

Redpoint County Mutual | $1,356 |

State Farm | $1,697 |

Farm Bureau | $2,162 |

USAA | $2,436 |

GEICO | $2,451 |

Germania Insurance | $3,028 |

Cheapest car insurance for drivers with a speeding ticket in Texas

A speeding ticket can also make your car insurance rates go up. Texas drivers with a speeding ticket on their record have an average car insurance rate of $2,296 per year, which is almost $500 higher than the average rate for drivers with a clean driving history.

We found that State Farm, Farm Bureau, and Redpoint had the cheapest average rates for Texans with a speeding ticket on their record.

Company | Rates for drivers with speeding tickets |

|---|---|

State Farm | $1,091 |

Farm Bureau | $1,133 |

Redpoint County Mutual | $1,356 |

Germania Insurance | $1,434 |

USAA | $1,849 |

GEICO | $2,451 |

→ Read more about finding SR-22 insurance in Texas

Cheapest car insurance for drivers with bad credit in Texas

Drivers with poor credit histories and low credit scores can expect to pay more for their insurance than drivers with high credit scores. Working to improve your credit score is one way to lower your insurance rates.

On average, the company with the cheapest car insurance in Texas for drivers with poor credit is Redpoint.

Company | Rates for drivers with bad credit |

|---|---|

Redpoint County Mutual | $1,356 |

Farm Bureau | $2,606 |

Germania Insurance | $2,638 |

Auto Club | $2,728 |

Southern County Mutual | $2,860 |

Cheapest car insurance in Texas by city

Local factors like crime rates, population density, or the number of accidents in a given area all impact the cost of insurance.

Here are the cheapest car insurance companies in the 10 most populated cities in Texas.

City | Cheapest company | Average yearly rate for the cheapest company | Overall citywide average |

|---|---|---|---|

Houston | Texas Farm Bureau | $1,243 | $2,231 |

San Antonio | Texas Farm Bureau | $1,125 | $1,938 |

Dallas | State Farm | $1,293 | $2,170 |

Austin | State Farm | $1,111 | $1,836 |

Fort Worth | Texas Farm Bureau | $1,129 | $1,888 |

El Paso | Texas Farm Bureau | $959 | $1,790 |

Arlington | Texas Farm Bureau | $1,127 | $1,906 |

Corpus Christi | State Farm | $1,101 | $1,889 |

Plano | Texas Farm Bureau | $1,130 | $1,877 |

Lubbock | State Farm | $1,060 | $1,787 |

Buying car insurance in Texas

Texas requires everyone who owns a vehicle in the state to be able to pay for damage they may cause in an accident. The best way to meet this requirement is to have car insurance.

Texas minimum levels of liability insurance are:

$30,000 per person/$60,000 per accident for bodily injury liability

$25,000 for property damage liability

Drivers who don’t have at least the minimum levels of insurance or higher and cause an accident will receive a citation.

Uninsured drivers may also have their driver’s license suspended for up to two years or face other penalties. This hasn’t stopped some people, however, and about 20% of Texas drivers are uninsured. [2]

Texas only requires drivers to purchase basic bodily injury and property damage liability coverage. This means drivers who purchase the minimum required levels of insurance have no coverage for damage to their own vehicle and they have no protection against uninsured or underinsured motorists.

Comprehensive and collision coverage will pay to repair or replace your vehicle in the event of a covered peril, while uninsured and underinsured motorist coverage will protect you if the person who hits your car doesn’t have insurance. These coverages can be purchased for an additional cost as part of your insurance policy.

While some states have programs that allow low income residents to purchase insurance at reduced rates, Texas is not one of them.

Texans who are looking for cheaper car insurance should work with an insurance expert to compare quotes from multiple companies to make sure they are getting the lowest possible rate.

How to get cheap car insurance in Texas

Most insurance companies have a variety of discounts available to their customers, including:

Good student discount - Students who maintain a B average or higher can earn up to 15% off of their car insurance.

Bundling discount - Insurance companies typically offer a substantial discount to customers who carry multiple insurance policies (home, auto, renters, etc.) through the same company.

Safe driver discount - Taking a safe driver course can sometimes earn drivers a discount on their insurance, but some companies offer discounts on your premium for drivers who maintain a clean driving record for three years or more.

Group discount - Insurance discounts are often available to people based on profession. For example, teachers are often given a discount on their car insurance. Some insurance companies also partner with larger employers and offer discounts as part of an employee benefits package.

Low mileage discount - Insurance companies often charge lower rates for drivers who have short commutes.

Military discount - Many insurance companies offer a discount to active military members and their families.

Drivers who don’t qualify for these discounts or want even lower insurance rates can work to improve their credit score, clean up their driving record and compare quotes from multiple companies to make sure they are getting the cheapest price for their car insurance.

Find car insurance in your city: