When you shop for car insurance, companies check your credit as a way to determine what you’ll pay for coverage. In most states, you’ll pay higher car insurance premiums if you have a lower credit score.

While your credit score can affect your car insurance rates, your car insurance doesn’t impact your credit at all. This means you don’t have to worry about your credit score going down when you get quotes, but it also means that you can’t improve your credit by paying your premiums.

Does credit score affect car insurance rates?

In most states, your credit score does affect your car insurance rates. Insurance companies use a range of different factors to determine what you’ll pay for coverage, including location, age, accident history, and credit score.

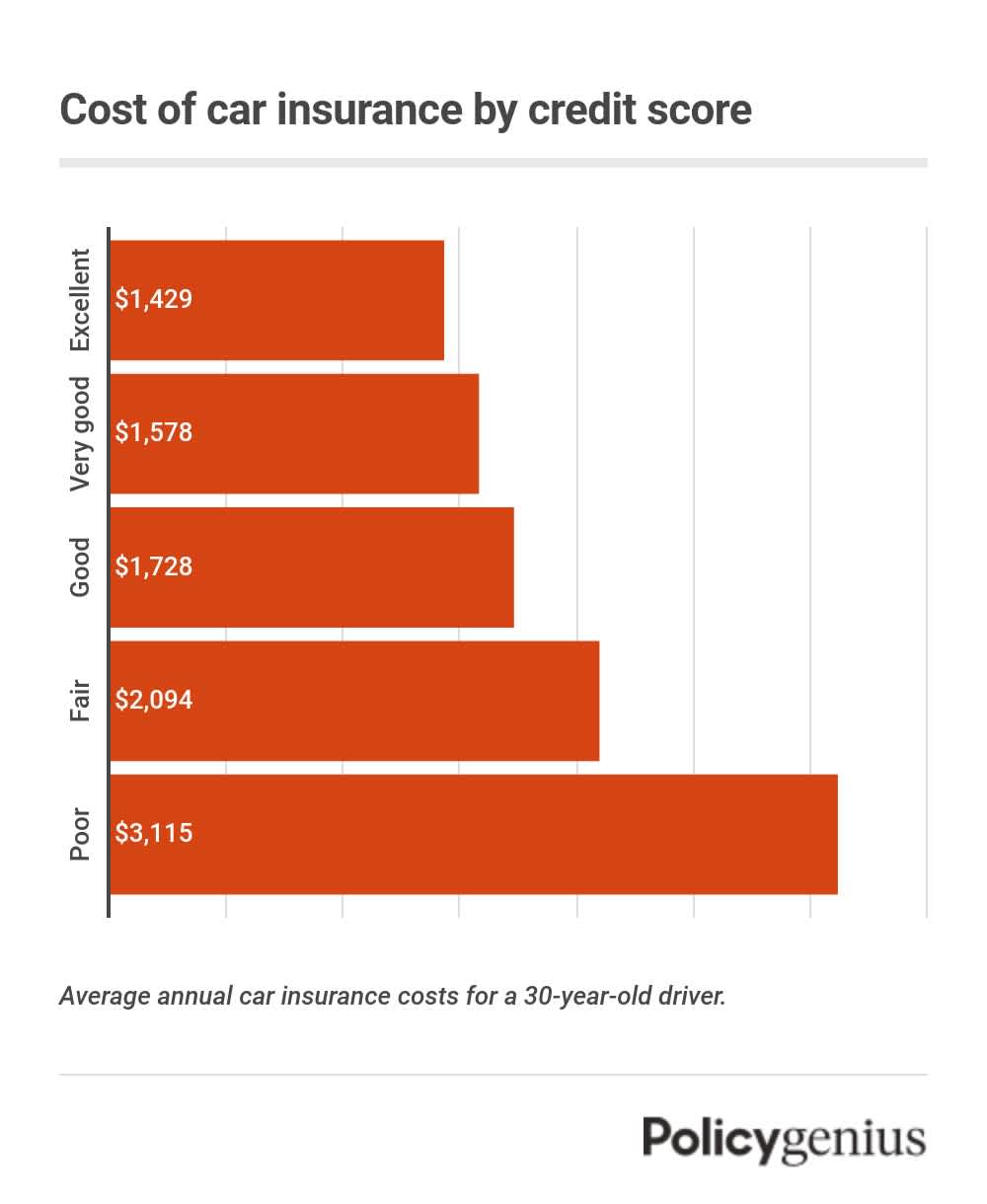

The worse your credit score, the more expensive your car insurance rates will be.

According to our research, having a poor credit score means you’ll pay 80% more for car insurance than a similar driver with good credit. Even drivers with better credit scores pay more for car insurance than others with the best credit. Car insurance is 10% more expensive for someone with good credit than it is for a driver with an excellent credit score.

While all companies check your credit when you apply for coverage, a lower credit score will affect your rates differently at different companies. Some companies are more likely than others to offer affordable coverage to drivers with poorer credit scores.

Among the largest companies, we found that Nationwide had the cheapest auto insurance for drivers with poor credit. (But it’s actually one of the more expensive choices for drivers with good or excellent credit).

Company | Excellent credit | Good credit | Poor credit |

|---|---|---|---|

$1,095 | $1,395 | $3,338 | |

$940 | $1,185 | $2,219 | |

$1,380 | $1,807 | $3,220 | |

$1,706 | $2,007 | $3,335 | |

USAA | $966 | $1,108 | $2,018 |

$1,620 | $1,973 | $3,086 | |

$1,331 | $1,511 | $2,205 | |

$1,101 | $1,321 | $2,206 | |

$1,226 | $1,537 | $2,880 | |

Auto Club | $2,254 | $2,771 | $5,208 |

Companies sorted by market share, from largest to smallest.

How credit score affects your car insurance in different states

In most states car insurance companies can (and do) use your credit score to determine your insurance rates. But there are a handful of states where this is prohibited, and insurance companies aren’t allowed to consider your credit score. These are:

California

Hawaii

Massachusetts

Michigan

In the rest of the country, the cost of car insurance is more expensive for drivers with lower credit scores. The most expensive state for drivers with poor credit is New York. Drivers with poor credit scores in the Empire State pay 131% more than those with good credit.

State | Excellent | Good | Poor |

|---|---|---|---|

$1,524 | $1,818 | $3,161 | |

$1,191 | $1,405 | $2,205 | |

$1,347 | $1,646 | $3,458 | |

$1,531 | $1,861 | $3,620 | |

$1,462 | $1,828 | $3,270 | |

$1,392 | $1,862 | $3,954 | |

$1,740 | $2,139 | $3,673 | |

$1,553 | $1,831 | $3,257 | |

$2,621 | $2,960 | $4,321 | |

$1,466 | $1,760 | $2,988 | |

$1,006 | $1,179 | $2,136 | |

$1,213 | $1,484 | $2,675 | |

$1,083 | $1,298 | $2,069 | |

$1,013 | $1,206 | $2,062 | |

$1,425 | $1,677 | $2,858 | |

$1,860 | $2,267 | $4,414 | |

$2,418 | $3,024 | $5,950 | |

$1,027 | $1,218 | $2,286 | |

$1,662 | $1,886 | $3,019 | |

$1,777 | $2,438 | $5,450 | |

$1,204 | $1,459 | $2,927 | |

$1,526 | $1,797 | $3,162 | |

$1,325 | $1,663 | $3,016 | |

$1,563 | $1,958 | $3,114 | |

$1,546 | $1,837 | $3,350 | |

$1,897 | $2,231 | $3,346 | |

$969 | $1,282 | $2,739 | |

$1,765 | $2,304 | $4,485 | |

$1,330 | $1,527 | $2,489 | |

$1,795 | $2,197 | $5,086 | |

$935 | $1,019 | $1,408 | |

$1,161 | $1,456 | $2,696 | |

$889 | $1,096 | $1,908 | |

$1,804 | $2,043 | $3,346 | |

$1,267 | $1,494 | $2,441 | |

$1,440 | $1,690 | $2,970 | |

$1,569 | $1,957 | $3,751 | |

$1,632 | $1,964 | $3,371 | |

$1,380 | $1,680 | $3,253 | |

$1,175 | $1,404 | $2,828 | |

$1,588 | $1,945 | $3,402 | |

$1,238 | $1,558 | $2,751 | |

$1,007 | $1,178 | $2,203 | |

$1,159 | $1,410 | $2,630 | |

$1,587 | $1,687 | $2,028 | |

$1,412 | $1,735 | $3,185 | |

$904 | $1,111 | $2,214 | |

$1,194 | $1,468 | $2,575 |

Annual average costs of car insurance for 30-year-old drivers.

Do all insurance companies run your credit?

Nearly every insurance company will run your credit when you apply for coverage. Even non-standard auto insurance companies that specialize in insuring drivers with poor credit or a history of accidents, traffic violations, and DUIs will check your credit.

Technically, insurance companies use your credit score as part of a credit-based car insurance score. Your credit score shows how likely you are to pay back your debts when you borrow money, while companies use your insurance score to determine how likely you are to make a claim.

While insurance companies use their own models to determine your insurance-based credit score, FICO considers the following factors when calculating credit score:

Payment history (35% importance): Includes payments made on any credit cards, mortgage, and other loans, along with bankruptcies and late payments.

Current debt (30%): Having multiple accounts with a large balance can show that you’re using too much credit and could hurt your credit score.

Length of credit history (15%): Determined by the age of your oldest account, the time since you last used certain accounts, and how long other accounts have been active.

New lines of credit (10%): Opening too many lines of credit at once lowers your the part of your credit score related to new lines of credit.

Types of credit (10%): As you responsibly manage and pay off multiple types of accounts over a long period of time, this part of your credit score improves.

Do insurance quotes affect your credit score?

While insurance companies do run a credit check when you’re shopping for insurance, your credit score won’t be affected. You can request as many quotes as you want and compare rates from different companies without risking a hit to your credit.

The type of credit check that happens when you shop for car insurance quotes is different from the one that lenders or credit card companies perform. When you get a quote, your insurance company will perform a “soft” credit pull.

Unlike the “hard” credit pull that lenders perform when you sign up for a new account, a soft credit pull doesn’t affect your credit. This is because soft credit pulls aren’t visible to credit agencies. You can view past soft pulls on your own credit report, however.

Does paying your insurance on time improve your credit?

No, unfortunately, your credit score won’t rise even if you’ve never been late paying for your car insurance.Since your insurance company doesn’t report premium payments to any credit bureaus, making your payments on time has no effect on your credit score.

That also means that, because insurance companies don’t report payments to credit bureaus, your credit won’t be lowered if you’re late on a payment one month. However, your insurance company will penalize you if you skip a payment altogether.