A car insurance declarations page is the first page of your auto policy, and it explains all the basic details of your policy, like how much your car insurance premiums are and the type of coverage your policy contains. You can think of the declarations page as a summary of your auto insurance policy.

The declarations page (also called the dec page) contains your premium, how frequently you pay it, and the deductibles you’re required to pay for each coverage component. It will also list your car, its make, model, and vehicle identification number, and its lienholder, if you lease.

Explore related topics

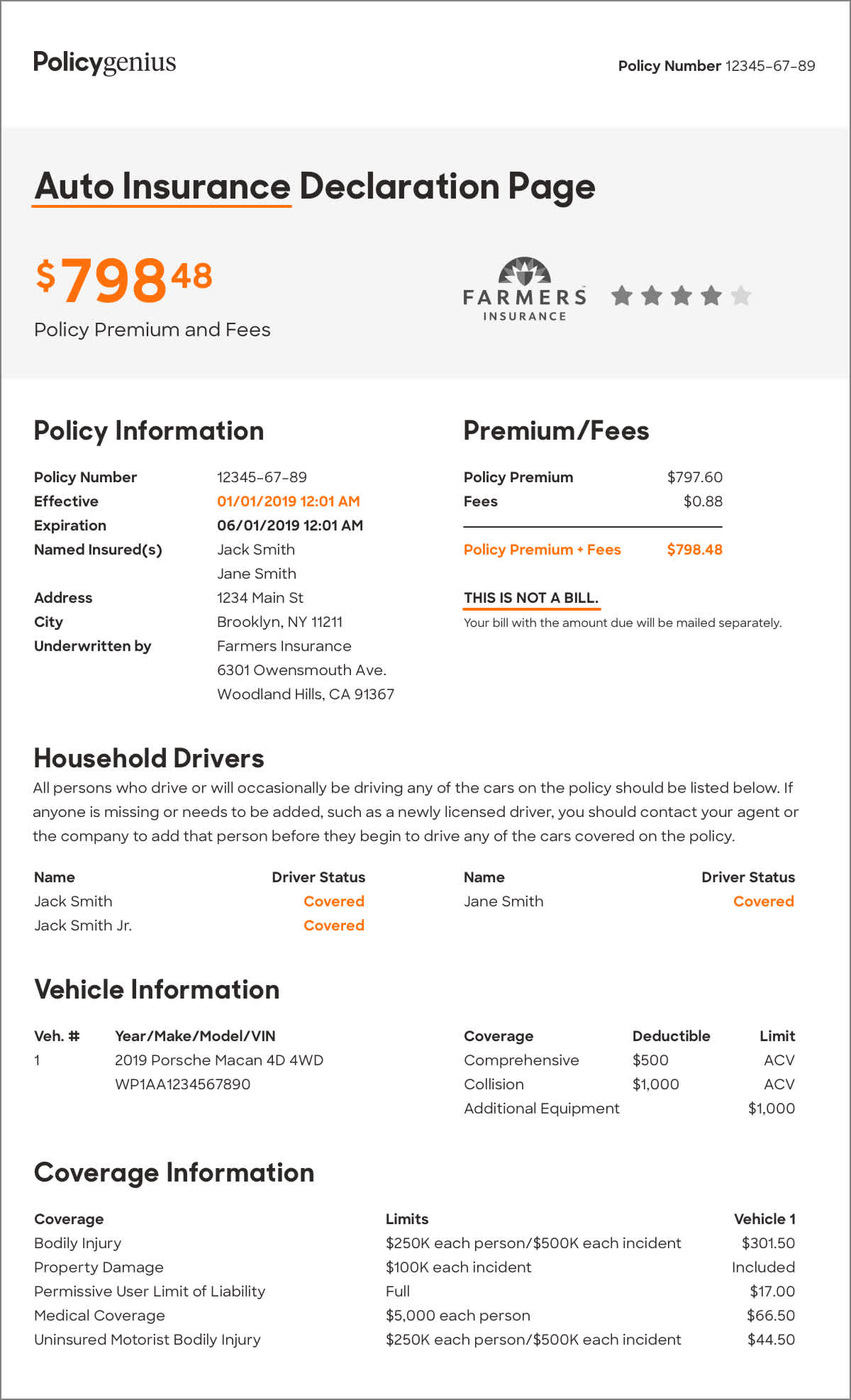

Sample car insurance declarations page

Your car insurance declarations page will have important information about your auto insurance policy, such as cost and coverage types and amounts. Popular insurance companies like GEICO, Progressive, and Allstate will provide a declarations page when your policy begins:

How to get your insurance declarations page

You can usually find the declarations page attached to the front of your car insurance policy.

If you don’t have your declarations page, you can call your car insurance company to request a copy. You may also be able to access it online through your insurance company’s website or app. When you make a change to your coverage or renew your policy, your insurer should send you a new declarations page.

Basic information on the car insurance declarations page

A dec page will list all the basic information about your car insurance policy and read like a summary (meaning it won’t go into exhaustive detail). At the top of the dec sheet, you’ll find the policy number, which will need to be referenced when filing a claim. Some dec sheets will also list your previous policy number; since you may have to get a new policy every six months to a year, this could change often.

Below are additional types of details you’ll find on a car insurance declarations page:

Policy term information

A dec page will contain information about your policy, like your car insurance policy period, a span of months beginning from one date, the effective date, and ending on the other, the end date. These dates will each be written as a precise day, month, and year. Some policies even include a start time, usually one minute after midnight on the start date of the policy.

The names of relevant parties

The auto insurance declarations page will describe all the relevant parties to the policy. These people will be:

The named insured. Usually, that’s you, the person buying the policy to insure your car. It may also be anyone else who drives the car, such as your children or spouse. The names, ages, and corresponding addresses of each person who’s covered by the policy will be listed. Sometimes, the dec sheet may also list which drivers are excluded from operating the vehicle.

Excluded drivers. A dec sheet may include the names of any drivers of your household that are explicitly excluded from coverage.

The agent. The company's representative, if applicable, and their phone number.

The insurance company. The policy dec page should include the address of your insurance company and a number to reach them.

The lienholder. The entity who holds your lease, if you lease the car or purchased it with a car loan. This will likely be a bank or credit company, and the dec sheet may contain their address.

Details about the vehicle

The declarations page will also include information about every car insured by the policy. This means:

Year car was manufactured

Make and model (for example, Dodge Avenger, Kia Soul, Tesla Model 3, and so on)

Vehicle Identification Number (VIN), a unique 17-digit code given to every new car

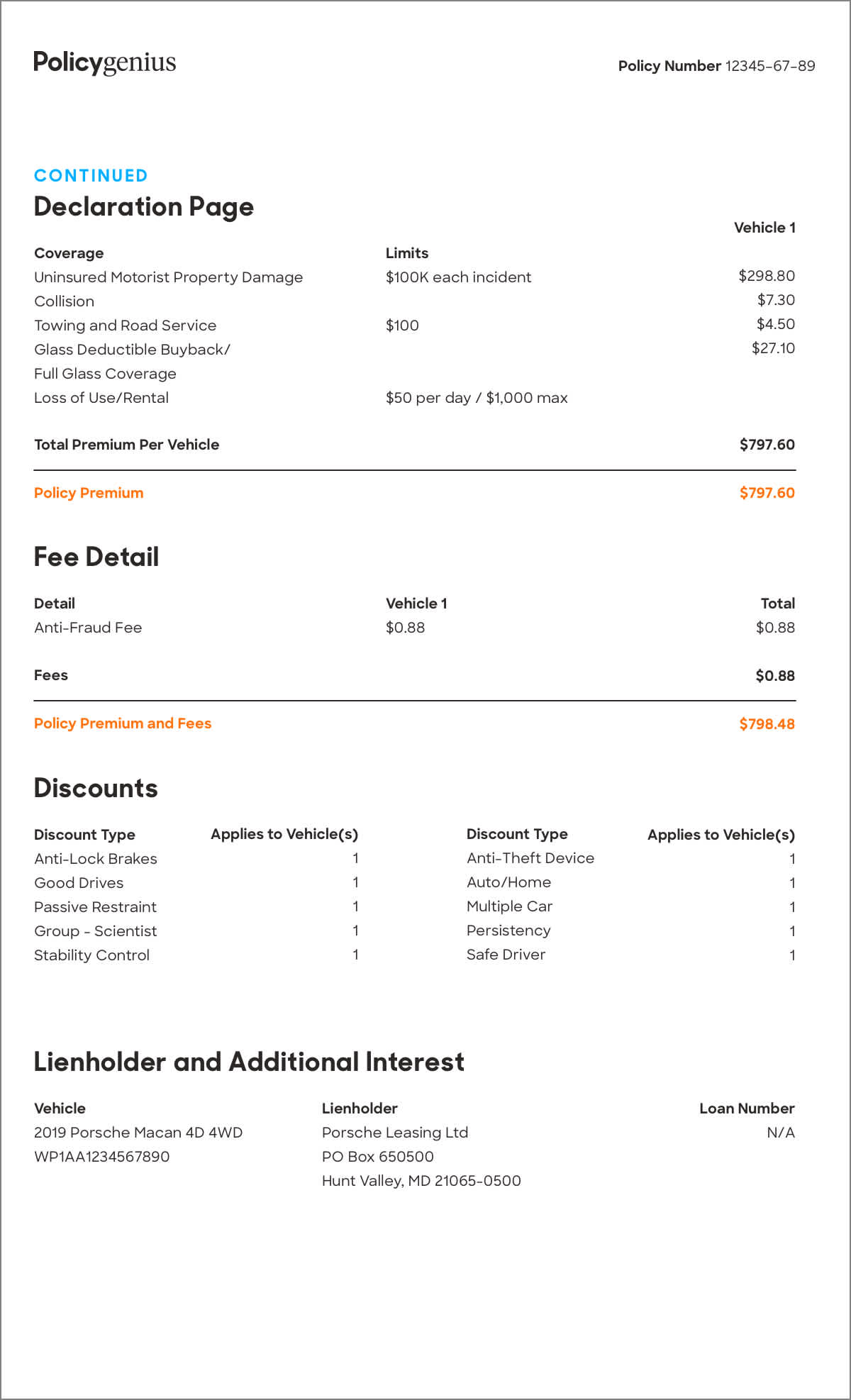

Premiums and deductibles

Your declarations page will list information about your premiums and how you’ll have to pay them (monthly, bi-annually, annually). Your premium is determined by a number of factors, from personal characteristics (age, gender, location) to driving history (whether you’ve gotten a DWI/DUI or accrued other traffic violations) to the type of car you drive and how often you drive it. The most important factor in determining your car insurance premium is how much you’ll need in coverage.

The deductible is the amount you have to pay out of pocket when filing an auto insurance claim before the insurance company pays the rest. A deductible will be listed on your dec page next to the relevant car insurance coverage types, but not every component of car insurance coverage requires you to meet a deductible. Typical deductibles are between $100, $500, and $1,000.

Car insurance coverages

The coverages are what you’re purchasing when you buy a car insurance policy, and your dec page will list all the coverage types that make up your auto policy.In addition to listing each type of coverage you purchase, the dec sheet will list how much you purchased of that coverage. This is called the limits of liability, meaning the car insurance company’s liability to you. If you have $100,000 in coverage for one type of coverage, that’s the maximum amount – the limit – that the car insurance company is obligated to pay.

Your declaration sheet will describe your policy limits in terms of per person limits and per accident limits, sometimes both for the same coverage type. (For example, $100,000 per person and $300,000 per accident.) Once the insurance company has paid out to its limit of liability, you’ll have to pay for any remaining expenses out of pocket.

If you have multiple cars, they will be itemized with each coverage amount stated per vehicle. It’s possible to buy less coverage for one insured car and more for another. You might consider buying less coverage for a car if it’s older and doesn’t cost as much to replace, but you should always make sure you have the coverage you need.

Car insurance coverages include:

Liability insurance. Coverage for bodily injury or property damage you cause while driving to another driver.

Personal injury protection (PIP). Coverage for medical expenses incurred due to injuries you cause to yourself or your passengers.

Collision coverage. Coverage for repair bills you incur when your car is involved in a collision with another car.

Comprehensive coverage. Coverage for repair bills you incur when your car is damaged or destroyed in a non-car-related situation, such as weather or rioting, or if it’s stolen.

Underinsured/uninsured motorist coverage. Coverage for when the other driver is liable for your medical or repair bills but doesn’t have car insurance or doesn’t have enough of it.

Gap insurance. Coverage for when your car is stolen or completely destroyed but the comprehensive reimbursement is less than you still owe on the car’s lease or loan.

Everyone has different coverage needs, and Policygenius makes it easy to find a car insurance policy that satisfies all your coverage needs while still being affordable.

Optional coverages

You can purchase coverage in some optional components of car insurance. These may increase your premium slightly. Depending on the auto insurance company, some of the car insurance types listed above will be considered optional and listed as such on your policy declarations sheet. Note that if you lease a car, the lienholder may require you to purchase collision and comprehensive insurance.

Other types of optional coverages follow. If you don’t see any of these listed on your declarations page but are interested in adding them to your policy, talk to your car insurance company.

Roadside assistance

Towing and labor reimbursement

Rental car reimbursement

Extra equipment attached to the car but not covered by the base policy

Endorsements and riders

Endorsements, or riders, are optional, additional policy terms attached to your base auto insurance policy that enhance some of the coverage. Your declarations page could include any riders you added. When it does, the endorsement may be denoted with a unique code used for reference by the car insurance company and the title of the rider.

Sometimes endorsements are not included on your declarations sheet. For information about how much you’re paying for each endorsement and how it affects your coverage, you’ll have to find the terms of the rider in your policy. Sometimes they’re at the very end of the policy, but other times they’re baked into the policy’s terms throughout.

Car insurance discounts

Every auto insurer offers car insurance discounts. These discounts will be listed on your policy declarations sheet, sometimes (but not always) with the amount by which they reduce your premiums.

Some common car insurance discounts you might see are:

Bundling discount. If you buy your car insurance and your homeowners or renters insurance from the same company, you’ll typically get a discount for bundling your coverage together.

Multiple vehicle discount. Insuring multiple cars under the same policy will yield a discount.

Safe driving discount. For people who have demonstrated safe driving over a span of a certain number of years. This means no accidents, no DWI/DUIs, and no moving violations. Taking a driver’s education course may also qualify.

Premium paid in full. You can get a discount if you pay your premiums all at once instead of monthly.

Security features discount. Installing security features like a car alarm and anti-lock brakes could result in a discount.

Loyalty discount. When your policy is up for renewal after your policy period ends, you may get a discount for being a customer for a certain number of years.

Organization membership discounts. Belonging to some participating organizations could result in a discount. This could mean being a student at or alumni of a university or belonging to a fraternity or sorority. Your employer may also offer car insurance discounts.

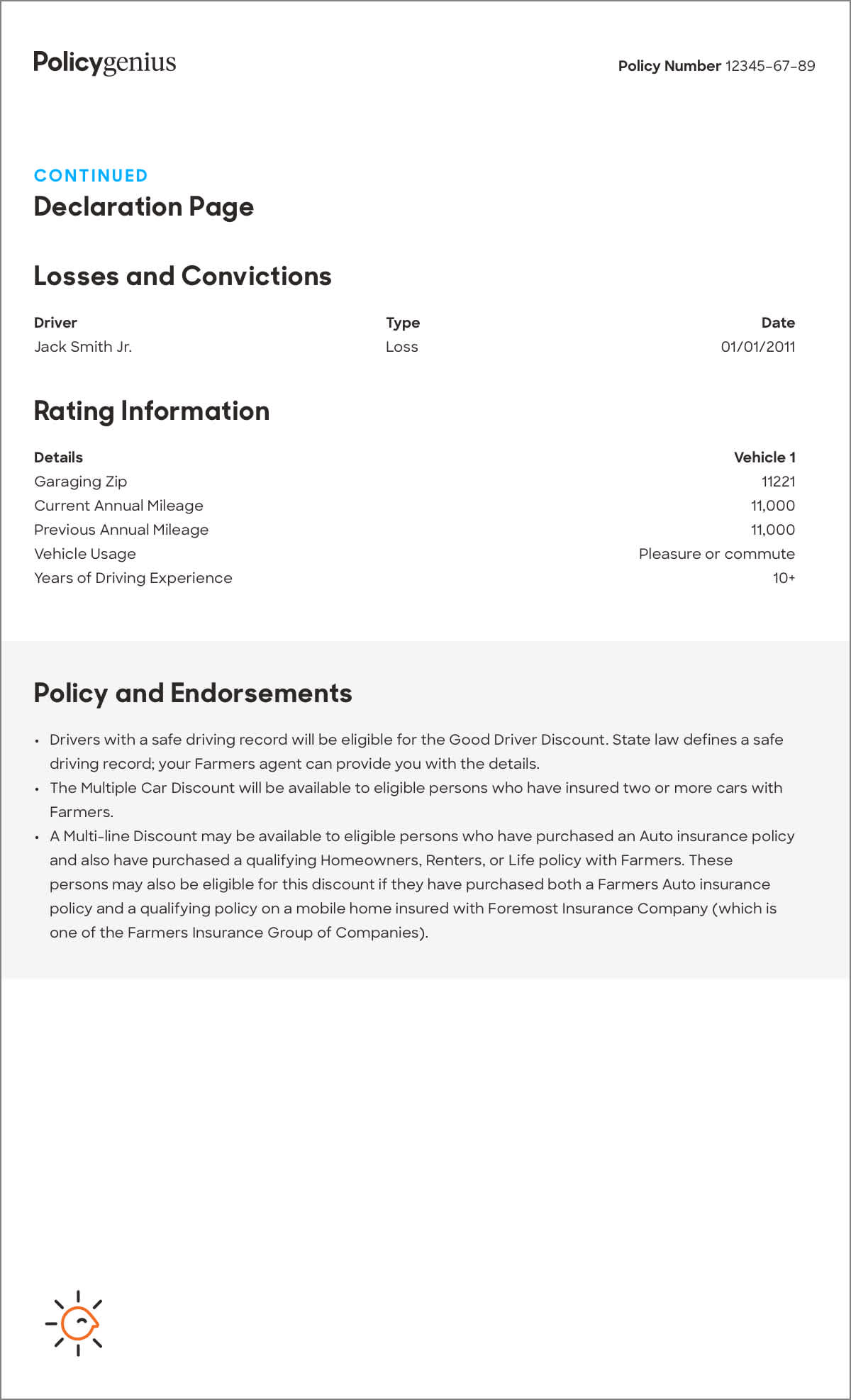

Renewing your car insurance policy

When you renew your car insurance policy, you’ll be issued a new declarations sheet. All the information will be updated to reflect the changes to your policy: new premium and policy period, new discounts (if you’ve been driving safer, for example), new or increased coverage, any new insured cars or drivers, and any new endorsements, and so on.

If your premium has changed, sometimes the declaration sheet will indicate it with the percentage or dollar amount by which it has changed in addition to listing the new premium.

Car insurance policy periods typically last either six months or one year. If you’re looking to get a better rate, you can work with Policygenius to easily compare quotes from different insurers online. Have your declarations sheet handy to quickly compare your coverage.