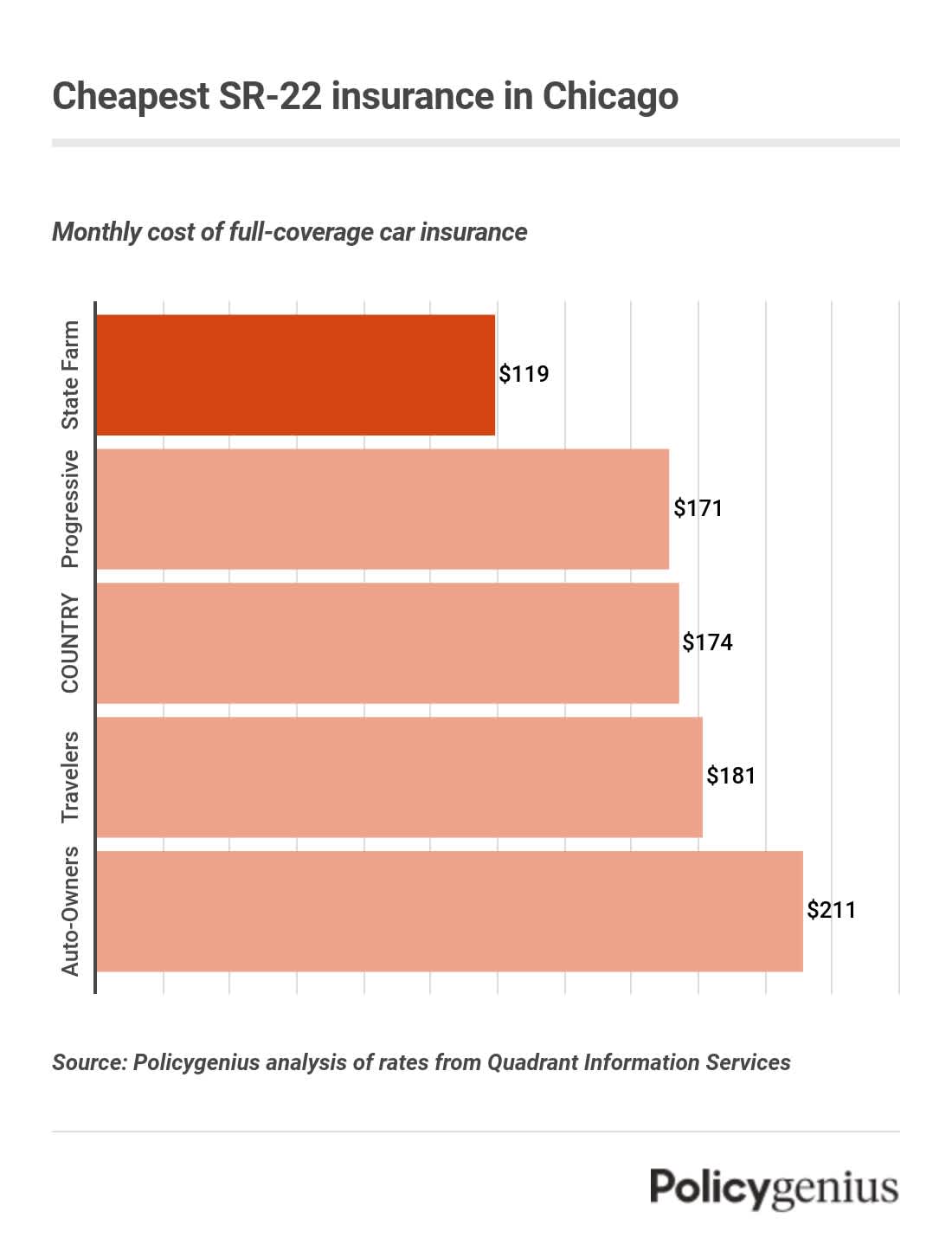

Cheapest SR-22 insurance in Chicago

The cheapest company for SR-22 insurance in Chicago is State Farm, which offers coverage to high-risk drivers for $119 per month or $1,430 a year. That’s 60% cheaper than the average cost of SR-22 insurance in the Windy City.

You may also find cheap SR-22 insurance in Chicago from Progressive and COUNTRY. The average cost of SR-22 insurance in Chicago is very expensive ($3,560 per year), but may be able to find lower rates by comparing quotes from multiple companies.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $119 | $1,430 |

Progressive | $171 | $2,051 |

COUNTRY | $174 | $2,086 |

Travelers | $181 | $2,170 |

Auto-Owners | $211 | $2,533 |

American Family | $217 | $2,609 |

Erie | $227 | $2,720 |

USAA | $254 | $3,044 |

What is SR-22 insurance in Chicago?

SR-22 insurance is not actually a form of insurance (in Chicago or anywhere else). An SR-22 is a form that your insurance company files for you with Illinois’s Secrety of State that shows you have at least the following amount of insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $20,000 per accident

You may need SR-22 insurance in Chicago if your license has been suspended or you have a violation on your record. In Illinois, your license may be suspended for serious violations (like drinking and driving), failure to appear in court, and failure to make child support payments.

In Chicago, you typically need SR-22 insurance for at least three years. You can also deposit at least $70,000 with the state and file for a bond instead of getting SR-22 insurance.

How to get SR-22 insurance in Chicago

After your license is suspended in Chicago, you’ll have to follow a few steps to get an SR-22:

Find an insurance company that will file an SR-22 for you: Your insurance company will need to file an SR-22 on your behalf, but not all insurance companies in Chicago offer coverage to high-risk drivers, so start with your current insurer but be prepared to shop around.

Wait for your SR-22 to process: It can take as many as 30 days for your SR-22 to process, but once it does you’ll receive a confirmation from both your insurance company and the Illinois Secretary of State.

Renew your SR-22 on time: You have to renew your SR-22 every year in Chicago. State law requires you renew your SR-22 45 days in advance.

Non-owner SR-22 insurance in Chicago

You’ll have to get non-owner SR-22 insurance if your license is suspended but you don’t own a car. A non-owner policy has less protection than a regular car insurance policy, but if you need to get an SR-22 it will still allow you to reinstate your license and avoid more legal penalties.

The good news is that a non-owner SR-22 policy is usually cheaper than regular car insurance for someone who owns a car. Not every company offers non-owner policies, though, so you’ll probably have to call different insurance companies to find coverage.