Why comparing car insurance quotes is a good idea

Comparing car insurance quotes helps you find the best deal, since the same driver can get two very different quotes from two different companies. That's why we suggest using a third-party marketplace like Policygenius to see multiple quotes at once instead of going straight to insurance company websites and getting one quote at a time.

If you’re not sure where to start your car insurance comparison, Policygenius can show you quotes from top companies, and help you find options that meet your coverage needs and don’t break the bank.

How to compare car insurance quotes

Auto insurance quotes are free — you don’t pay for anything until you actually get a policy, so it’s always worth it to compare car insurance quotes before you buy. Follow these steps to find the right car insurance policy for you:

1. Figure out how much coverage you need

Most drivers will have to choose liability coverage levels, which is what covers the cost when you’re at fault in an accident.

Not having enough liability coverage can leave you (and your home, savings, and other assets) on the hook for covering any costs that go over your policy limits. It’s a good idea to have at least:

Most drivers should get a full-coverage policy, which means one that includes comprehensive and collision coverage on top of your liability insurance.

With full coverage, you’ll have to choose deductibles (what you agree to pay out of pocket when making a claim). A higher deductible means lower rates, but just remember that you’ll actually have to be able to pay any deductible if you have to make a claim someday.

2. Set a budget

Once you understand how different types of car insurance work and you know how much coverage you need, set a reasonable monthly or annual budget. It can help to look at average car insurance rates in your area to see what drivers near you usually pay.

Remember, factors like where you live, your age, your driving record, and your credit score all affect your car insurance quotes. Knowing what to expect can help you make sense of the rates you get when you compare car insurance quotes.

3. Fill out an application

Because your car insurance rates are based on personal information, you’ll have to share at least a little bit about yourself before you can compare quotes. Before you sit down to shop, gather up the following information:

Names, birthdays and driver’s license numbers for everyone in your home who’s of driving age

Social Security numbers for all drivers in the household

VINs (Vehicle Information Numbers) or make and model years for every car you need to insure

Your address (you’ll have to list both where you live and where the car is garaged, which is usually the same place)

A little bit about your driving history, including recent accidents or violations

Your declarations page from your last or current car insurance policy, if you have it

Personal details, like whether or not you’re married, what your job is, and whether you rent or own your home

It’s important to be honest when you apply for coverage and compare quotes. If you change or omit any of your information, you won’t get accurate rates, and you may wind up having to pay more once you get the actual policy.

Here’s what it looks like when you compare quotes with the Policygenius marketplace:

4. Know what you’re comparing

Once you’ve gotten car insurance quotes from at least a few different companies, go through the options to make sure you’re comparing apples to apples. Are they all for the same term length — and do they all include the same add-ons?

Some insurance companies may show you quotes with multiple coverage tiers, often you’ll see a bare-bones one with low limits, a medium tier, and a premium option with endorsements already added.

5. Choose a policy and get insured

When you’re done comparing rates, sign your policy and set it to start the exact day you need it. Once you pay your first premium (sometimes referred to as a car insurance down payment), you’re good to go.

Your new car insurance company will send you information about your new policy or even an invite to download and set-up a mobile app. You should save any emails or letters you get at the start of your policy so it’s easy to find in case you need to file a claim later.

6. Cancel your old policy (if you have one)

After you use our marketplace to compare rates and buy coverage, you can cancel your old car insurance policy. Canceling a car insurance policy is easy, and you can usually do it either over the phone or online.

You don’t have to wait until the end of your policy term to cancel car insurance, you can do it at any time. When you cancel early, your car insurance company may refund you for any of the months left on your policy’s term.

Sample car insurance quote comparison

Take a look at these two sample car insurance quotes from Allstate and Erie for a better idea of what you’ll see when you do an online auto insurance quotes comparison:

Even though we entered the exact same coverage amounts, the car insurance quotes are different. You can see that both have similar monthly payments, but Allstate offers six-month policies and Erie’s is for an entire year.

The monthly rate for the Allstate policy is cheaper, but a six-month policy means you risk a rate increase halfway through the year, while a 12-month policy means you know what you’ll be paying for longer.

The details of the coverage are different too (so are some of the names of the coverage types). The Allstate quote includes death indemnity coverage (which covers funeral expenses), personal effects coverage for any items that are stolen or damaged while in your car, and custom equipment coverage.

But the Allstate quote doesn't include rental car reimbursement coverage (which is listed on Erie’s as simply “rental” coverage and is bundled with roadside assistance).

Bottom line: The Allstate monthly rate is cheaper, but a shorter policy term could mean more frequent rate hikes. The risk might be worth it for the extra coverage though, especially if you frequently keep your cellphone or laptop in your car, or if you have custom additions to your vehicle.

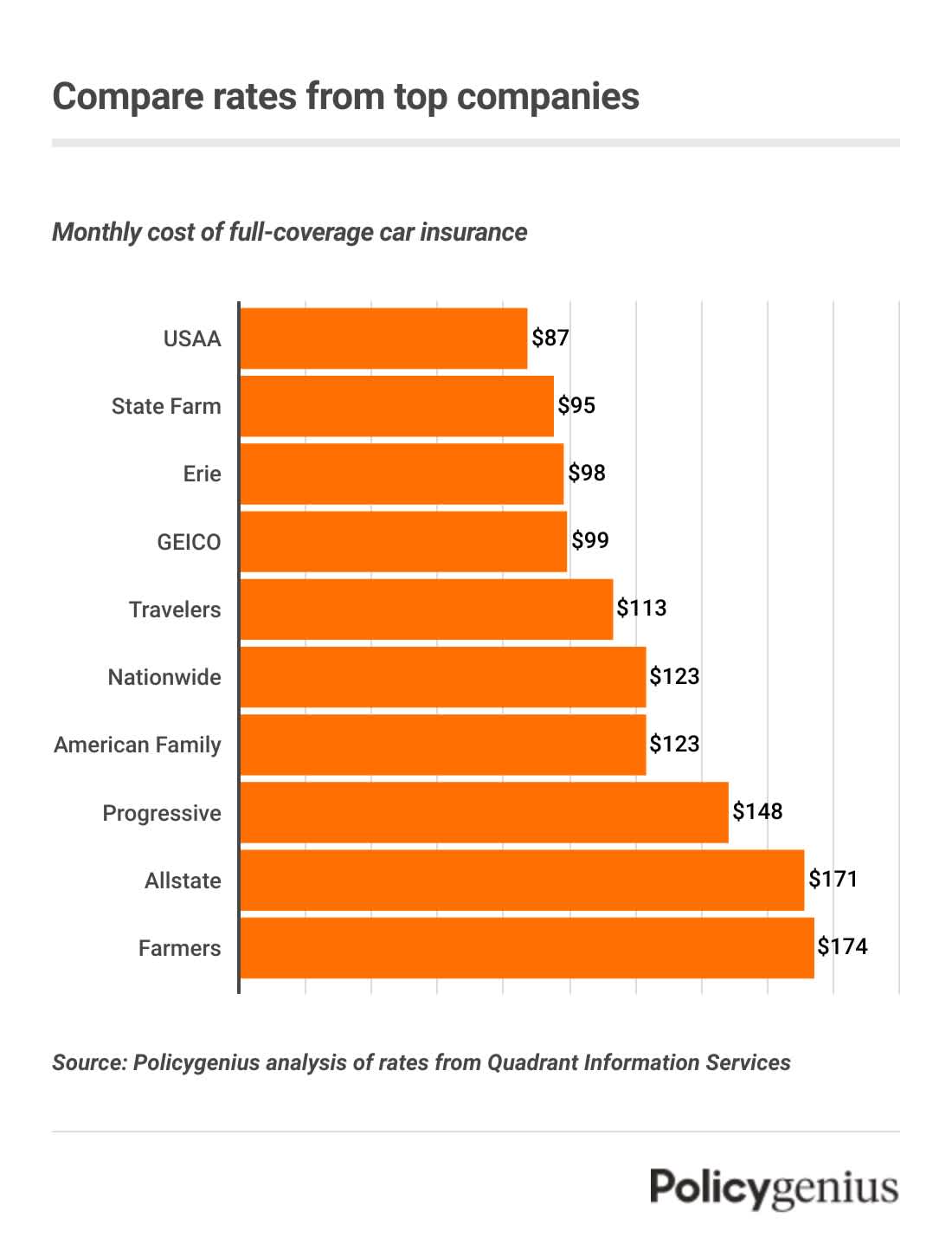

Compare auto insurance quotes from top companies

Think about more than just cost when you compare car insurance quotes with a third-party marketplace.

Pay attention to coverage options, customer service ratings, and financial strength scores. The very best auto insurance companies offer both cheap coverage and top-rated customer service and claims handling.

Policygenius rating | Annual average cost | |

|---|---|---|

5.0 out of 5 | $1,044 | |

4.9 out of 5 | $1,181 | |

4.8 out of 5 | $1,141 | |

4.7 out of 5 | $1,192 | |

4.7 out of 5 | $1,351 | |

4.4 out of 5 | $2,084 | |

4.4 out of 5 | $1,780 | |

4.3 out of 5 | $1,479 | |

4.3 out of 5 | $1,475 | |

4.2 out of 5 | $2,055 |

→ Learn more about our picks for the best car insurance companies

Compare car insurance quotes by age and gender

Comparing insurance quotes is especially important for young and inexperienced drivers, since they usually pay a lot more for coverage than older drivers.

Male drivers also sometimes pay slightly more for car insurance than female drivers, but some states have passed laws banning companies from using gender to determine insurance rates.

Here’s how rates compare across 10 top companies when broken down by age and gender.

16-year-old male | 18-year-old male | 21-year-old male | 25-year-old female | 25-year-old male | 30-year-old female | 30-year-old male | 35-year-old female | 35-year-old male | 45-year-old female | 45-year-old male | 55-year-old female | 55-year-old male | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

USAA | $4,792 | $2,860 | $1,617 | $1,224 | $1,286 | $1,081 | $1,102 | $1,037 | $1,051 | $975 | $988 | $930 | $943 |

State Farm | $4,222 | $3,327 | $2,189 | $1,298 | $1,437 | $1,194 | $1,194 | $1,170 | $1,170 | $1,155 | $1,155 | $1,093 | $1,093 |

Erie | $3,584 | $2,968 | $2,170 | $1,356 | $1,354 | $1,224 | $1,200 | $1,150 | $1,127 | $1,050 | $1,043 | $988 | $1,004 |

GEICO | $4,803 | $3,182 | $1,825 | $1,321 | $1,346 | $1,197 | $1,179 | $1,203 | $1,174 | $1,188 | $1,163 | $1,105 | $1,064 |

Travelers | $8,022 | $4,487 | $2,450 | $1,602 | $1,658 | $1,539 | $1,590 | $1,515 | $1,555 | $1,398 | $1,433 | $1,265 | $1,305 |

Nationwide | $6,111 | $5,328 | $2,557 | $1,670 | $1,784 | $1,511 | $1,530 | $1,492 | $1,497 | $1,401 | $1,410 | $1,274 | $1,294 |

American Family | $4,721 | $3,320 | $2,227 | $1,510 | $1,592 | $1,457 | $1,515 | $1,404 | $1,452 | $1,315 | $1,344 | $1,260 | $1,274 |

Progressive | $10,343 | $7,942 | $3,054 | $1,941 | $1,958 | $1,861 | $1,810 | $1,836 | $1,752 | $1,728 | $1,654 | $1,509 | $1,503 |

Allstate | $8,788 | $5,916 | $3,134 | $2,155 | $2,222 | $2,012 | $1,999 | $1,984 | $1,971 | $1,967 | $1,954 | $1,819 | $1,860 |

Farmers | $10,812 | $8,155 | $2,907 | $2,106 | $2,201 | $1,997 | $1,997 | $1,958 | $1,909 | $1,960 | $1,844 | $1,721 | $1,699 |

→ Learn more about rates by age and gender

Compare car insurance quotes for seniors

Comparing car insurance quotes is also important for senior drivers since car insurance rates can start going up once at 65.

For retirees on a fixed income, comparing car insurance quotes is an easy way to avoid overpaying. Here’s how much drivers 60 and over pay for a full-coverage policy, on average, at 10 major car insurance companies.

60-year-old female | 60-year-old male | 65-year-old female | 65-year-old male | 70-year-old female | 70-year-old male | |

|---|---|---|---|---|---|---|

USAA | $924 | $939 | $945 | $964 | $1,005 | $1,037 |

State Farm | $1,068 | $1,068 | $1,064 | $1,064 | $1,107 | $1,107 |

Erie | $1,013 | $1,032 | $1,057 | $1,086 | $1,123 | $1,153 |

GEICO | $1,098 | $1,067 | $1,093 | $1,073 | $1,157 | $1,143 |

Travelers | $1,270 | $1,321 | $1,321 | $1,388 | $1,401 | $1,500 |

Nationwide | $1,250 | $1,265 | $1,277 | $1,319 | $1,354 | $1,434 |

American Family | $1,259 | $1,266 | $1,293 | $1,292 | $1,383 | $1,372 |

Progressive | $1,508 | $1,507 | $1,550 | $1,583 | $1,666 | $1,705 |

Allstate | $1,815 | $1,856 | $1,892 | $1,935 | $1,916 | $1,959 |

Farmers | $1,662 | $1,685 | $1,800 | $1,875 | $1,909 | $2,057 |

→ Learn more about car insurance for senior drivers

Compare car insurance quotes by state

Car insurance rates vary by state, city, and even ZIP code, but you can find the lowest rates in your area by doing a thorough price comparison.

Even if car insurance is normally expensive in your area, comparing rates can potentially save you thousands of dollars a year.

For example, the difference between the most expensive and cheapest insurance companies in Florida — known for high auto insurance rates — is $2,444 per year. Here’s the average annual car insurance rate at the cheapest company in every state.

Cheapest company | Average cost | |

|---|---|---|

GEICO | $977 | |

USAA | $930 | |

Root | $747 | |

USAA | $962 | |

Wawanesa | $1,110 | |

American National | $811 | |

GEICO | $756 | |

State Farm | $1,152 | |

GEICO | $1,025 | |

GEICO | $1,432 | |

Auto-Owners Insurance | $858 | |

GEICO | $785 | |

American National | $498 | |

FAIA | $712 | |

USAA | $706 | |

State Farm | $719 | |

USAA | $912 | |

GEICO | $1,019 | |

USAA | $1,486 | |

GEICO | $571 | |

USAA | $806 | |

GEICO | $1,067 | |

GEICO | $1,059 | |

Western Agriculture | $964 | |

USAA | $856 | |

USAA | $741 | |

USAA | $856 | |

Auto-Owners Insurance | $1,036 | |

GEICO | $1,043 | |

USAA | $676 | |

GEICO | $1,078 | |

USAA | $907 | |

Main Street America | $1,033 | |

GEICO | $736 | |

USAA | $786 | |

USAA | $711 | |

USAA | $949 | |

State Farm | $843 | |

Erie | $1,018 | |

State Farm | $983 | |

American National | $683 | |

Kemper | $1,128 | |

State Farm | $755 | |

Texas Farm Bureau | $1,036 | |

GEICO | $856 | |

State Farm | $666 | |

USAA | $776 | |

USAA | $1,033 | |

USAA | $869 | |

USAA | $680 | |

American National | $763 |

Some carriers may be represented by affiliates or subsidiaries.

→ Learn more about car insurance costs

Compare car insurance quotes by credit score

If you have average or poor credit, comparing car insurance quotes may save you hundreds or even thousands of dollars a year. While some companies are friendlier to drivers with bad credit than others, it’s usually harder to find affordable insurance with a poor credit score.

There are a few states that don’t allow car insurance companies to set rates based on your credit — but in most places credit still matters. Here's how different credit scores affects your car insurance rates at 10 major car insurance companies.

→ Learn more about how credit scores affect car insurance rates

Compare rates for poor credit

Having poor credit (a score of 524 or lower) means more expensive car insurance rates, which is why comparing quotes to find the best deal is even more important.

Average cost with poor credit | |

|---|---|

USAA | $2,018 |

Nationwide | $2,205 |

American Family | $2,206 |

GEICO | $2,219 |

Erie | $2,836 |

Travelers | $2,880 |

Farmers | $3,086 |

Progressive | $3,220 |

Allstate | $3,335 |

State Farm | $3,338 |

Compare rates for good credit

Insurance rates are about average if you have good credit (a score of 769 to 794), but it’s still important to compare auto insurance quotes to find the best rates.

Average cost with good credit | |

|---|---|

USAA | $1,108 |

GEICO | $1,185 |

Erie | $1,200 |

American Family | $1,321 |

State Farm | $1,395 |

Nationwide | $1,511 |

Travelers | $1,537 |

Progressive | $1,807 |

Farmers | $1,973 |

Allstate | $2,007 |

Compare rates for excellent credit

Having an excellent credit score (823 or higher) means your car insurance rates will probably be cheaper than average — we found that having excellent credit can save you an average of $238 a year.

Average cost with excellent credit | |

|---|---|

GEICO | $940 |

Erie | $955 |

USAA | $966 |

State Farm | $1,095 |

American Family | $1,101 |

Travelers | $1,226 |

Nationwide | $1,331 |

Progressive | $1,380 |

Farmers | $1,620 |

Allstate | $1,706 |

Compare car insurance quotes by driving record

Any drivers with a recent violation on their record, like an at-fault accident or a speeding ticket, should shop around and compare car insurance quotes, but drivers with serious violations — like a DUI or hit-and-run — stand to save the most.

Compare how rates for a full-coverage car insurance policy vary by driving record.

Compare rates after an at-fault accident

Car insurance will be higher than average after an at-fault accident, but comparing quotes can help you find affordable coverage.

Average cost after an accident | |

|---|---|

State Farm | $1,445 |

USAA | $1,533 |

Erie | $1,542 |

GEICO | $2,063 |

American Family | $2,131 |

Travelers | $2,132 |

Nationwide | $2,461 |

Farmers | $2,787 |

Progressive | $2,848 |

Allstate | $3,080 |

Compare rates after a DUI

A DUI is one of the more expensive violations to have on your record, but comparing quotes can help you avoid paying more than you have to.

Average cost after a DUI | |

|---|---|

State Farm | $1,652 |

Erie | $2,032 |

American Family | $2,083 |

USAA | $2,103 |

Progressive | $2,273 |

Travelers | $2,371 |

Farmers | $2,733 |

GEICO | $3,044 |

Allstate | $3,047 |

Nationwide | $3,298 |

Compare rates for driving with a suspended license

Getting caught driving with a suspended license raises your car insurance rates significantly, but some companies are more forgiving than others.

Average cost after driving with a suspended license | |

|---|---|

State Farm | $1,607 |

Erie | $1,901 |

USAA | $1,965 |

GEICO | $2,184 |

American Family | $2,390 |

Travelers | $2,405 |

Progressive | $2,692 |

Allstate | $2,964 |

Farmers | $3,046 |

Nationwide | $3,228 |

Compare rates after a speeding ticket

A speeding ticket won’t affect your car insurance as much as other violations, but your rates will still be higher than with a clean record.

Average cost after a speeding ticket | |

|---|---|

USAA | $1,329 |

Erie | $1,344 |

State Farm | $1,370 |

American Family | $1,888 |

Nationwide | $1,935 |

GEICO | $2,113 |

Travelers | $2,283 |

Progressive | $2,316 |

Allstate | $2,350 |

Farmers | $2,571 |

Compare car insurance quotes by marital status

Your marital status doesn’t affect your car insurance rates by much. Compare how being single, married, or divorced affects your car insurance rates at these top companies.

Single | Married | Divorced | |

|---|---|---|---|

USAA | $1,128 | $1,008 | $1,128 |

State Farm | $1,808 | $1,598 | $1,808 |

Erie | $1,157 | $1,081 | $1,157 |

GEICO | $1,179 | $1,210 | $1,226 |

Travelers | $1,586 | $1,578 | $1,586 |

Nationwide | $1,569 | $1,433 | $1,569 |

American Family | $1,515 | $1,344 | $1,515 |

Progressive | $1,814 | $1,521 | $1,814 |

Allstate | $1,991 | $1,923 | $1,991 |

Farmers | $1,968 | $1,811 | $1,968 |

→ Learn more about car insurance for married couples

Compare car insurance quotes by vehicle

A quotes comparison can help you save money on the cost of your insurance, especially if you drive a newer model car or an electric vehicle.

Compare car insurance rates by vehicle type for some of the most popular types of cars in the U.S.

Ford F-150 | Subaru Forester | Toyota Camry | Tesla Model 3 | |

|---|---|---|---|---|

USAA | $1,086 | $1,123 | $1,245 | $1,544 |

State Farm | $1,202 | $1,260 | $1,309 | $1,764 |

Erie | $1,014 | $1,090 | $1,360 | $1,928 |

GEICO | $1,188 | $1,039 | $1,256 | $2,987 |

Travelers | $1,457 | $1,339 | $1,634 | $1,970 |

Nationwide | $1,276 | $1,285 | $1,561 | $1,961 |

American Family | $1,420 | $1,570 | $1,667 | $2,115 |

Progressive | $1,769 | $1,955 | $2,047 | $3,232 |

Allstate | $1,952 | $2,203 | $2,400 | $4,023 |

Farmers | $1,795 | $2,253 | $2,260 | $3,186 |

→ Learn more about how the kind of car you drive affects insurance

Compare car insurance quotes by coverage amount

Comparing car insurance quotes online helps you save money no matter how much coverage you get.

Whether you’re looking for full-coverage car insurance (meaning a policy that includes comprehensive and collision coverage) or only enough insurance to meet your state’s minimum requirements, you can find the best deal by comparing rates.

State minimum | 50/100/50 liability | 100/300/100 liability | |

|---|---|---|---|

USAA | $369 | $1,128 | $1,191 |

State Farm | $475 | $1,240 | $1,333 |

Erie | $370 | $1,157 | $1,201 |

GEICO | $402 | $1,179 | $1,261 |

Travelers | $683 | $1,586 | $1,690 |

Nationwide | $624 | $1,569 | $1,671 |

American Family | $676 | $1,515 | $1,557 |

Progressive | $737 | $1,814 | $1,967 |

Allstate | $750 | $1,991 | $2,097 |

Farmers | $781 | $1,968 | $2,109 |

→ Learn more about how much car insurance coverage you need

The latest research and surveys from Policygenius

What determines your car insurance rates

Before you start a car insurance quotes comparison, be prepared to enter a few personal details about yourself, your policy, your car, and how you drive. Your rates will be affected by:

Your address: Accident rates, population density, and repair costs in your neighborhood will all go into calculating your premiums.

Your coverage: More types of coverage and higher limits means more protection, but it also means higher premiums.

Your age: Younger, less experienced drivers (under 25) are more likely to get in accidents and file claims, so they often pay the most for car insurance.

Your car: The make and model of car you drive will affect your insurance rates. Luxury cars with expensive parts cost more to insure than a budget daily driver, and cars with certain safety features can get you a lower rate.

Your credit score: Drivers with poor credit scores may have more trouble finding affordable coverage than drivers with higher credit scores.

Your driving history: Recent accidents and driving violations will raise a red flag on your profile, while having a squeaky clean record can earn you extra savings.

Your insurance history: Recent claims on your record or gaps where you were uninsured will mean higher rates.

Average savings on auto insurance: Savings are determined by calculating the average difference between the lowest and second lowest auto insurance policy estimates provided to shoppers with two or more estimates between 06/01/2020 and 05/18/2021. Potential savings are based on a composite of multiple different contracts and insurers. Not all policies in this calculation are available in all states, and availability may be based on eligibility. Savings may vary by policy amount and location.