Costco doesn’t have its own car insurance. But if you’re a Costco member, you can get discounted car insurance through its partnership with CONNECT (formerly known as Ameriprise), an American Family company.

Costco car insurance through CONNECT is worth considering, especially if you’re a Costco Executive Member. Not only do Executive Members get cheaper insurance rates through Costco’s partnership with CONNECT, but they also get free roadside assistance with their auto policy.

How does Costco car insurance work?

Costco car insurance is an affiliate program, so you’re not actually buying your car insurance from Costco, you’re buying from an insurance company that has a partnership with Costco.

Executive and Gold Star Costco members can both get lower rates from CONNECT, the company that Costco partners with. That said, you don’t automatically get an insurance policy just because you’re a Costco member.

Once you buy car insurance, nothing else goes through Costco. You’ll pay your premiums and file any claims with CONNECT, not Costco.

How to get Costco car insurance

There are a couple of ways to get Costco car insurance. You can speak to a representative in the Costco location where you shop, or, if you don’t want to get insurance in person, you can get a quote online through the Costco website.

You can get car a insurance quote faster by being ready with the following information:

Your home address (or the place you keep your car)

Your current policy’s limits

The driving license numbers of everyone in your household

Your car’s vehicle identification number (VIN)

Any past claims

You should also know your Costco membership number. You’ll need it to get the Costco discount from CONNECT.

After you get a quote, you can choose the date you want your policy to start and finalize your coverage by making your first payment.

Costco car insurance coverages

When you buy car insurance through Costco, you’ll be able to get all the basic types of car insurance you need, including:

Bodily injury liability: Covers injuries to others after an at-fault accident.

Property damage liability: Covers other people’s damaged property after an at-fault accident.

Collision coverage: Covers damage to your own car after a crash with another car or object, regardless of fault.

Comprehensive coverage: Covers the cost if your car is damaged by something other than a collision, like animals, vandalism, or extreme weather.

Uninsured/underinsured motorist: Covers damage caused by drivers who aren’t insured (or don’t have enough insurance).

Personal injury protection: Covers your injuries, lost wages, and medical care after an accident, whether or not you were at fault.

Medical payments: Covers your injuries after a crash, but has lower coverage limits than PIP does.

There are a few other coverages and perks that you can get when you buy car insurance through Costco. Roadside assistance comes free for Executive members, but you’ll have to pay extra if you want to add other coverages, like.

Gap insurance coverage: Covers the difference between the rest of your lease or loan and the amount of money comp and collision pay if your car is totaled.

New car replacement coverage: Covers the cost of a new car after your old one is totaled. This is only available to cars that have fewer than 15,000 miles.

Rental car reimbursement coverage: Covers the cost of a rental car or other transportation while your regular car is being repaired after a covered incident.

Roadside assistance coverage: Covers things like towing, winching, battery changes, and fuel deliveries if you’re stranded.

How much is car insurance from Costco?

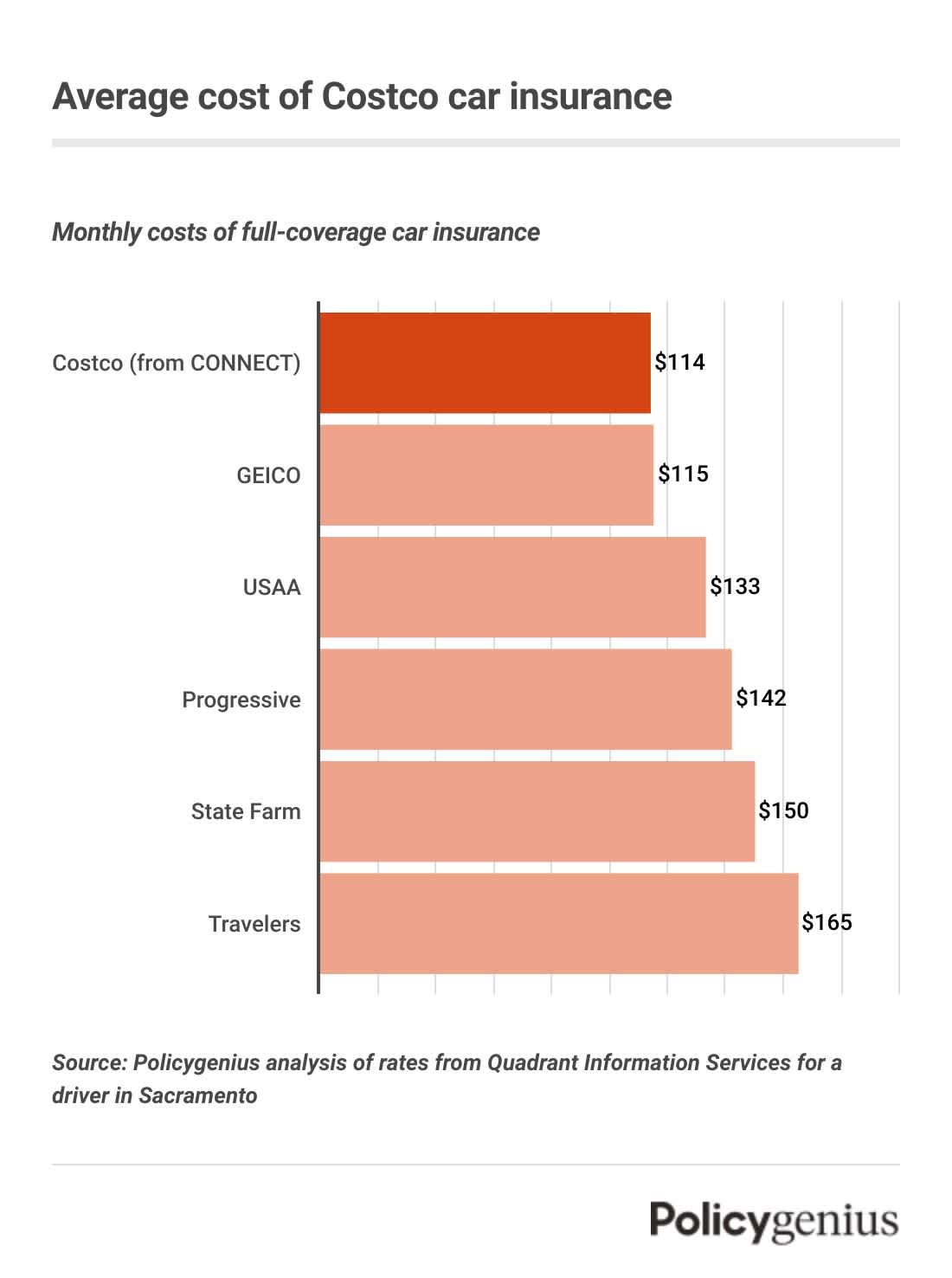

Costco car insurance can be cheaper than average, but it depends on where you live (and your age, credit score, driving history, and other factors). We found that the average cost of car insurance for a sample Costco member in California was $114 per month, or 31% cheaper than average.

If you’re not already a member, consider how much a Costco membership is when you’re thinking about whether you can afford Costco car insurance. Costco has two membership tiers (Executive and Gold Star) that cost $5 or $10 a month, or $60 to $120 per year.

Costco car insurance discounts

You could qualify for a decent number of discounts when you buy car insurance through Costco, another reason why CONNECT could be a good option for Costco members looking for lower rates. Costco car insurance discounts include:

Bundling discount: Bundle your auto insurance through Costco with a homeowners or umbrella policy also from CONNECT and save on both.

Defensive driver discount: Get this discount after you complete a defensive driving class.

Garaging discount: Earn a discount if you keep your car in a locked, secured garage.

Good student discount: Students who get good grades (usually a B average) will save.

Loyalty discount: Earn a discount if you have Costco car insurance through CONNECT for four consecutive years.

Multi-car discount: Get this discount if you insure more than one vehicle.

Safe driver discount: Receive this discount if it’s been at least four years since your last accident or claim.

Student away-from-home discount: Parents of full-time students who live at least 100 miles away from home and don’t have their own car with them can get this discount.

Vehicle safety features discount: Save if your car has safety features like anti-theft devices and crash-avoidance technology.

Costco car insurance customer service

If you get car insurance through Costco, CONNECT (and possibly its parent company, American Family) will handle any of your claims or questions. CONNECT has generally positive reviews for customer service, but your experience could vary.

CONNECT scored above-average in California on J.D. Power’s 2022 year Auto Insurance Study, which looked at how satisfied customers were with price, coverage, transparency, policy information, and claims service by region. CONNECT wasn’t measured at the national level, but American Family was (and it scored better than average).

According to the National Association of Insurance Commissioners, CONNECT receives about the same number of complaints for its claims process and price as is average for the industry.

And you probably can feel safe about the financial stability of CONNECT and American Family if you decide to get Costco car insurance. It has an A rating (Stable) from A.M. Best.

Category | Score | What it means |

|---|---|---|

Claims satisfaction rating | 834/1,000 | Better than average |

Complaint index | 1.27 | About average |

Credit rating | A | Stable |

Methodology

Policygenius analyzed the cost of car insurance from Costco (and CONNECT by American Family) using rates for a 30-year-old driver in Sacramento, California with a clean driving record. Our sample quotes had the following limits:

Bodily injury liability: $50,000 per person, $100,000 per accident

Property damage liability: $50,000

Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

Comprehensive: $500 deductible

Collision: $500 deductible

Our sample vehicle was a 2017 Toyota Camry LE driven 10,000 miles/year. Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.