Navy Federal Credit Union opened in 1933 with a mission to provide banking and financial services to military members and their families. In the years since, they’ve added a number of additional benefits for their credit union members, including discounts on auto insurance.

Does Navy Federal have car insurance?

Navy Federal doesn’t offer car insurance, but they do partner with TruStage Insurance LLC to offer their members a discount on car insurance through Liberty Mutual. TruStage Insurance LLC is an agency that works with many credit unions, including Navy Federal, to provide discounted insurance rates to credit union members. Discounts on coverage vary from state to state, so you’ll need to use their online quote system to find out how much you can save on car insurance through Navy Federal.

However, it is important to remember that Navy Federal’s discounts can change over time. This means that drivers who purchase insurance through Navy Federal may need to switch insurance companies when Navy Federal changes the insurance company they partner with to provide discounts.

Does Navy Federal partner with GEICO?

Yes, though that may be changing soon. Navy Federal has partnered with multiple insurance companies over the years.

MetLife: In 2013, Navy Federal announced a partnership with MetLife to provide discounted insurance rates on home and auto insurance for their customers. As of 2022, the partnership with MetLife was no longer listed as active.

GEICO: Since 2011, Navy Federal partnered with GEICO to offer discounts on auto, home, and motorcycle insurance for military members. GEICO already offered a discounted rate for active military and veterans, but their partnership with Navy Federal added an extra discount for members of the military. The discount through GEICO still appears to be active, but that may change now that they offer discounts through another company.

Liberty Mutual: Navy Federal’s most recent partnership is with TruStage Insurance, offering a discounted rate on auto and homeowner’s insurance policies through Liberty Mutual. Drivers can get a discount on liability, comprehensive, collision, gap insurance, and many other types of car insurance coverage through Navy Federal.

What is the TruStage Auto & Home Insurance Program?

The TruStage Auto & Home Insurance Program provides a discounted rate on Liberty Mutual insurance through Navy Federal as part of their partnership with TruStage Insurance Agency. The amount you can save on your insurance varies from state to state, certain discounts only apply to specific coverages, and not all customers may qualify for a discount.

Which is better, USAA or Navy Federal?

USAA and Navy Federal have some similarities: both offer banking options for active military members, veterans, and their families, as well as offering discounted rates for auto and homeowners insurance. But when it comes to insurance, the two companies are very different.

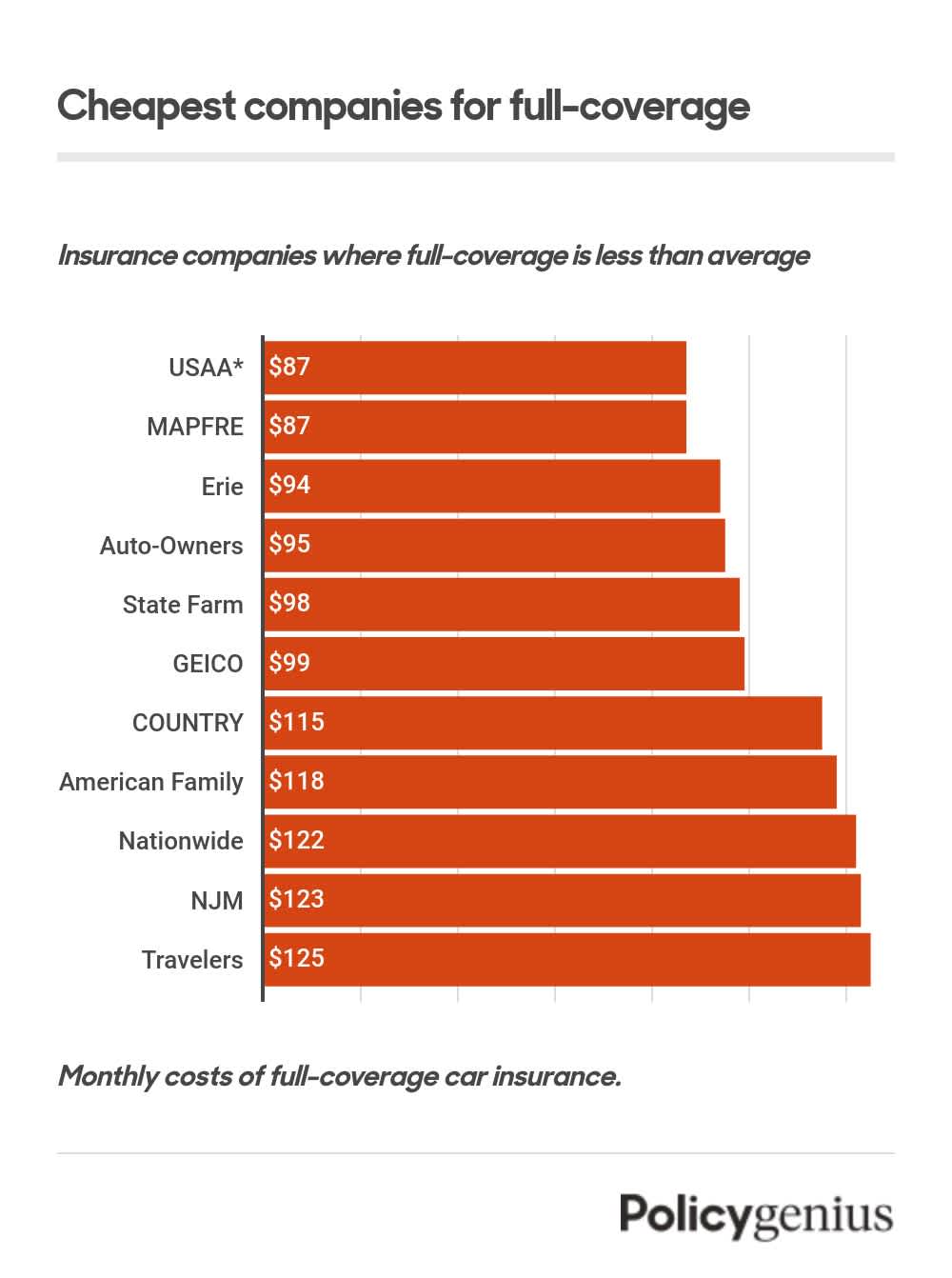

Navy Federal doesn’t write their own insurance policies, instead offering a discount on auto and home insurance through GEICO and Liberty Mutual. In comparison, USAA does offer their own insurance product, often at a very low rate.

Between the two companies, USAA is probably the better option for most people because of their low insurance rates. However, Navy Federal still offers high quality banking and financial products along with a discount on car insurance, which makes them a good choice for people who qualify for membership.