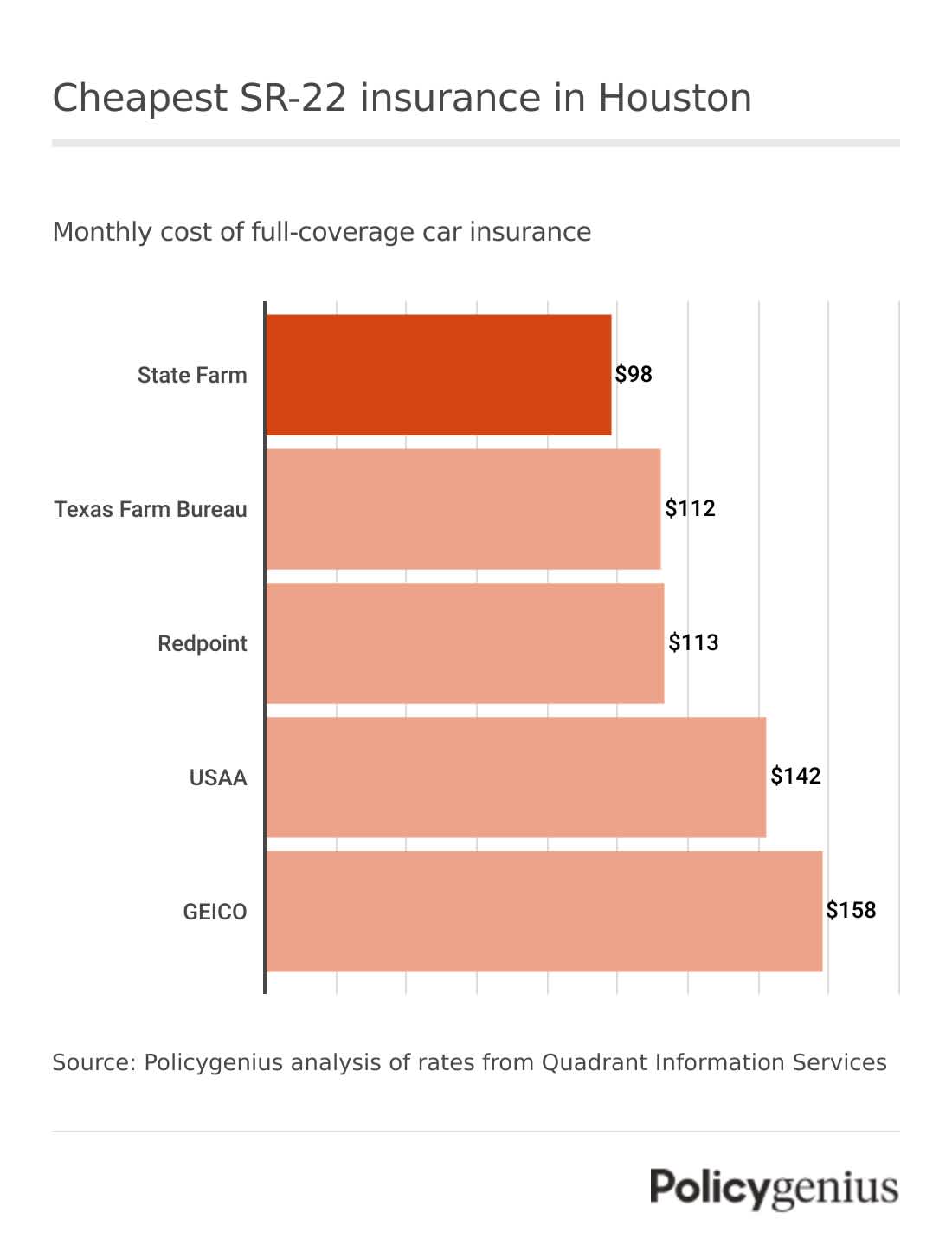

Cheapest SR-22 insurance in Houston

State Farm has the cheapest SR-22 car insurance in Houston. Car insurance with an SR-22 costs an average of $98 per month or $1,173 a year at State Farm — 55% cheaper than the average cost of SR-22 insurance in Houston.

Texas Farm Bureau and Redpoint also have cheap car insurance for drivers who need an SR-22. Since costs vary by company, you should compare rates from more than one company to get the best rate.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $98 | $1,173 |

Texas Farm Bureau | $112 | $1,340 |

Redpoint | $113 | $1,356 |

USAA | $142 | $1,702 |

GEICO | $158 | $1,900 |

Dairyland | $159 | $1,907 |

Germania | $159 | $1,912 |

Nationwide | $187 | $2,247 |

AAA | $199 | $2,388 |

What is SR-22 insurance in Houston?

SR-22 insurance isn’t actually a type of car insurance. An SR-22 is just a form that proves you have car insurance. You typically need your car insurance company to file an SR-22 for you.

According to the law in Texas, your SR-22 must show you have at least this much car insurance:

Bodily injury liability (BIL): $30,000 per person, $60,000 per accident

Property damage liability (PDL): $25,000 per accident

In Houston, you may have to get an SR-22 after you’re caught driving under the influence of alcohol or drugs, driving without a valid license, or driving without insurance.

Your license will probably be suspended after any of these violations, and you may need to show proof of car insurance through an SR-22 in order to reinstate it.

In Houston, you typically have to carry an SR-22 for two years from the date of your violation. [1] If you don’t keep up with your car insurance payments and your policy lapses, you’ll need an SR-22 for longer (and face more fines).

How to get SR-22 insurance in Houston

Getting SR-22 insurance in Houston can be straightforward. If you need coverage and your current car insurance company won’t add an SR-22 to your policy, follow these steps to find coverage:

Find a company offering coverage: Not every car insurance company in Houston will file an SR-22 for you, especially if you’re a repeat offender, so plan to shop around before finding coverage.

Wait for your SR-22 to process: It can take up to 21 business days for your SR-22 to process. Don’t try and drive right away or you’ll face higher fines and more legal penalties.

Pay a fine and any additional fees for your violation: You must pay a $100 fine when you have SR-22 insurance before you can get your license reinstated.

Non-owner SR-22 insurance in Houston

You may still be required to file an SR-22 and prove you have car insurance even if you don’t own a car. In this case, you may want to look into non-owner insurance.

Non-owner insurance is a special kind of bare bones, secondary car insurance policy for people who don’t own a vehicle. Just like with regular car insurance, the insurance company can file an SR-22 with your non-owners policy.

Even though non-owner insurance is cheaper than a regular policy, it’s hard to find companies that offer coverage. It’s even harder to find companies that offer non-owner insurance and will file an SR-22. You’ll have to call a few companies or work with an independent agent to find coverage, since you can’t get quotes online.