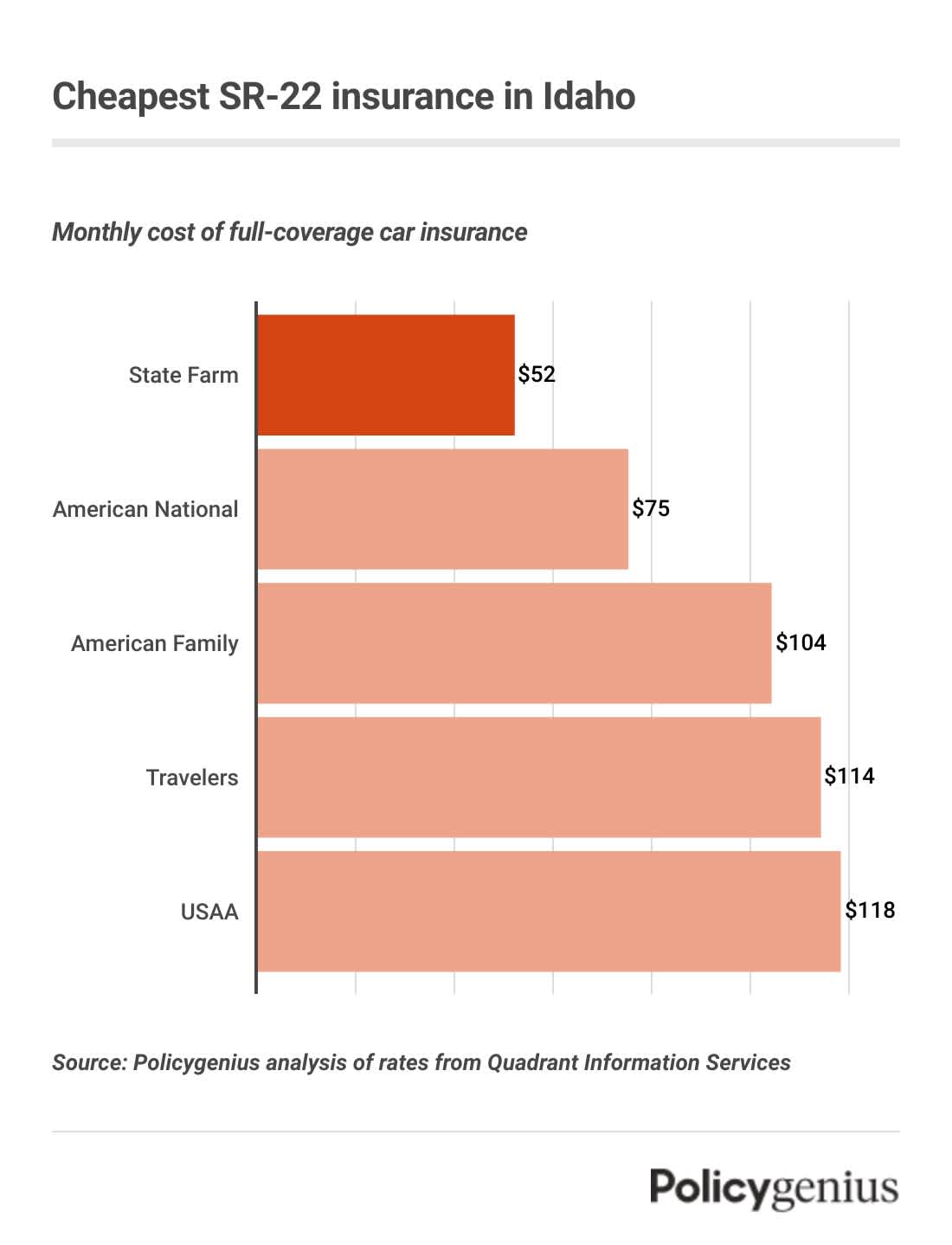

Cheapest SR-22 insurance in Idaho

Our expert analysis found that State Farm has the cheapest SR-22 insurance in Idaho. On average, SR-22 insurance from State Farm costs drivers in Idaho just $52 per month or $618 a year. That’s $1,250 cheaper than the state average for car insurance with an SR-22.

Idaho has some of the cheapest car insurance rates in the country, so it’s relatively easy to find cheap SR-22 insurance too. American National, American Family, and other companies also have affordable coverage for drivers who need an SR-22, but it’s always a good idea to compare rates before you buy.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $52 | $618 |

American National | $75 | $902 |

American Family | $104 | $1,251 |

Travelers | $114 | $1,362 |

USAA | $118 | $1,411 |

Auto-Owners | $127 | $1,526 |

GEICO | $135 | $1,616 |

Oregon Mutual | $141 | $1,687 |

What is SR-22 insurance in Idaho?

Despite what you might assume, SR-22 insurance isn’t actually a kind of insurance. It’s a form your car insurance company files for you to prove that you’re insured with at least the state minimum requirements. In Idaho, you need at least the following amounts of car insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $15,000 per accident

Idaho may require you to file an SR-22 after you commit a serious driving violation (like driving under the influence, reckless driving, eluding the police) or if you’re caught without driving without insurance.

In addition to the cost of car insurance with an SR-22, you’ll have to pay a fine to reinstate your license. You may pay anywhere from $25 to $285 depending on why you had to get an SR-22. You’ll have to pay another fine of $25 if you let your SR-22 lapse.

How to get SR-22 insurance in Idaho

Once you know you have to get SR-22 insurance, follow these steps to get covered:

Find a company that offers coverage: High-risk drivers may have a hard time finding coverage, since not every company offers SR-22 insurance. Plan to spend time checking with more than one company.

Expect to pay a fine: Idaho has separate fines for the violations that would cause you to have to get an SR-22. You’ll have to pay these fines on top of your policy’s premium.

Wait for your coverage to start: After you buy a policy, your insurance company will file your SR-22 to be approved by the state. Make sure not to drive before you’re notified that your SR-22 was approved.

Non-owner SR-22 insurance in Idaho

Non-owner insurance is a policy that offers basic coverage to drivers who don’t own their own cars. If you commit a driving violation and you have to get an SR-22 even though you don’t own a car, you may need a non-owner SR-22.

With non-owner SR-22 insurance, you get enough coverage to be able to drive legally in Idaho. Non-owner insurance with an SR-22 is cheaper than a standard policy since non-owners insurance doesn’t include the types of car insurance that cover the vehicle itself, like comprehensive and collision coverage.

It can be hard to find a company that will file non-owner insurance, and even harder if you need an SR-22. You’ll have to call around (companies don’t offer this coverage online) to find a company with non-owner insurance that will file a SR-22 for you.