Cheapest SR-22 insurance in Utah

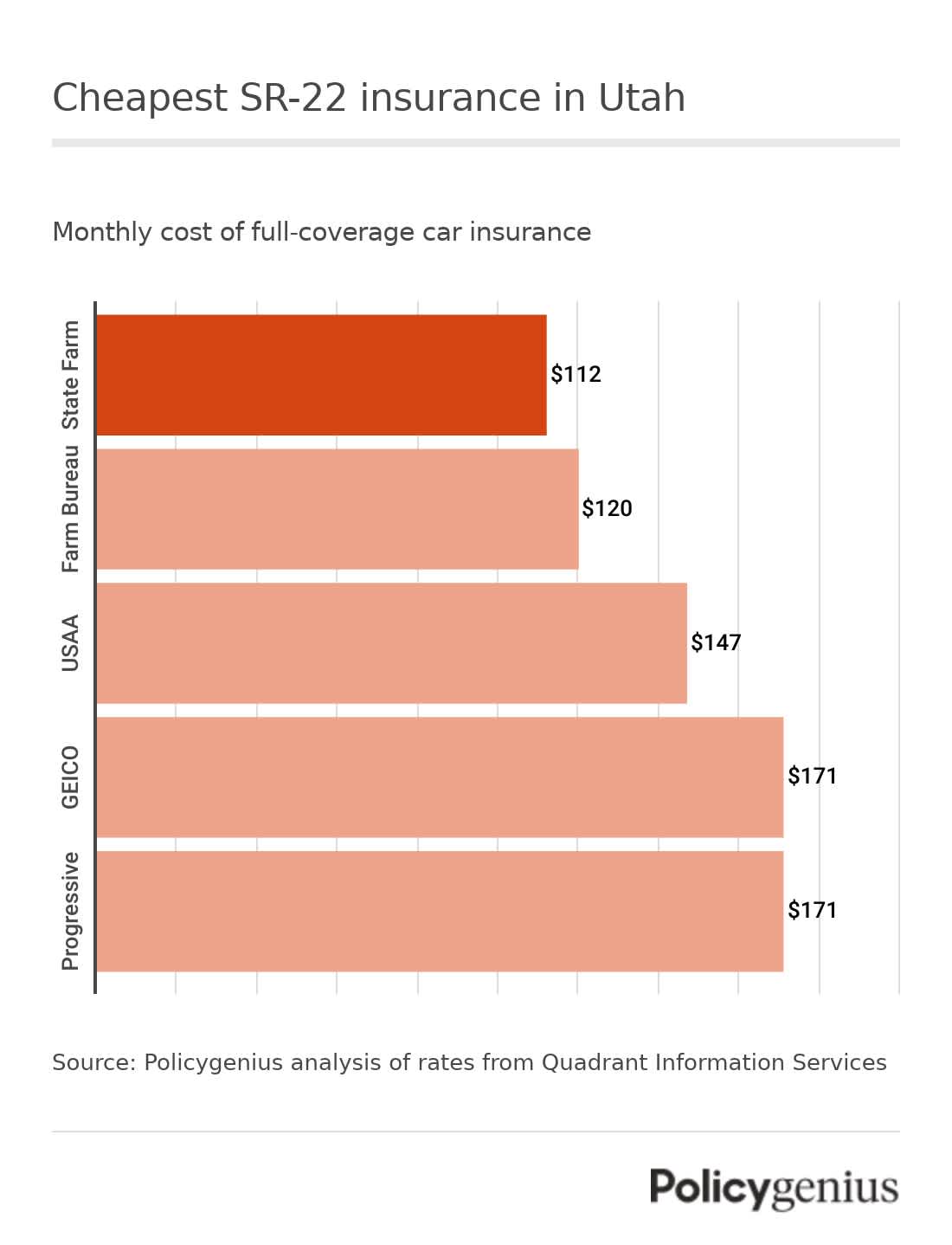

We found that State Farm has the cheapest SR-22 insurance in Utah. On average, SR-22 coverage from State Farm is $112 per month or $1,342 a year. That’s 51% cheaper than the average cost of SR-22 car insurance in Utah.

You can also find cheap SR-22 insurance in Utah from Farm Bureau, USAA, and a few other companies we researched. Remember to compare rates before you buy, since insurance costs can vary so much by company, especially for high-risk drivers.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $112 | $1,342 |

Farm Bureau | $120 | $1,446 |

USAA | $147 | $1,761 |

GEICO | $171 | $2,048 |

Progressive | $171 | $2,050 |

UAIC | $183 | $2,197 |

Allstate | $189 | $2,268 |

American Family | $207 | $2,481 |

What is SR-22 insurance in Utah?

An SR-22 is a form that your car insurance company files with the state that proves you’re covered, it’s not actually a type of car insurance. In Utah, when you have an SR-22 on your policy you must have at least the following amounts of coverage:

Bodily injury liability (BIL): $30,000 per person, $65,000 per accident

Property damage liability (PDL): $25,000 per accident

Personal injury protection (PIP): $3,000

Having an SR-22 raises the cost of your car insurance because it means you were caught driving without insurance or committed a serious roadway violation, like driving under the influence or reckless driving. You’ll pay the increased rates for at least as long as the SR-22 is required (you’ll also have to pay a small filing fee with an SR-22).

In Utah, drivers have to maintain an SR-22 for three years. It could be longer if you let your coverage lapse. And if your SR-22 coverage lapses, you’ll also have to pay fines that get larger with each offense.

How to get SR-22 insurance in Utah

Utah drivers can follow these steps to get an SR-22 and start driving again:

Find a company that offers coverage: Not every company in Utah will insure high-risk drivers, and that can include your current car insurance company. You may have to search for a SR-22 coverage from a few companies before finding a policy.

Pay any additional fines: Utah requires a $100 license reinstatement fee. Depending on the reason for the suspension and your past history, your fines could be even higher.

Wait for your SR-22 to process: When your SR-22 processes, you’ll get notified by Utah’s Department of Motor Vehicles. Don’t drive before that, because you risk more penalties.

Non-owner SR-22 insurance in Utah

Even drivers who don’t own a car can be required by the state to get SR-22 insurance. If your license was suspended or you committed a serious violation, you may need something called non-owner SR-22 insurance.

Non-owners insurance is coverage for drivers who don’t own a car. A non-owners policy comes with enough coverage for you to drive legally, but it doesn’t come with comprehensive or collision coverage. This usually makes it cheaper than a regular policy.

But just like a regular policy, you can have your non-owner insurance company attach an SR-22 form to fulfill your requirement.

That said, it can also be hard to find a company that offers non-owner SR-22 insurance, so plan to spend more time shopping. You will also have to call companies to ask about this coverage, as it’s not offered online.