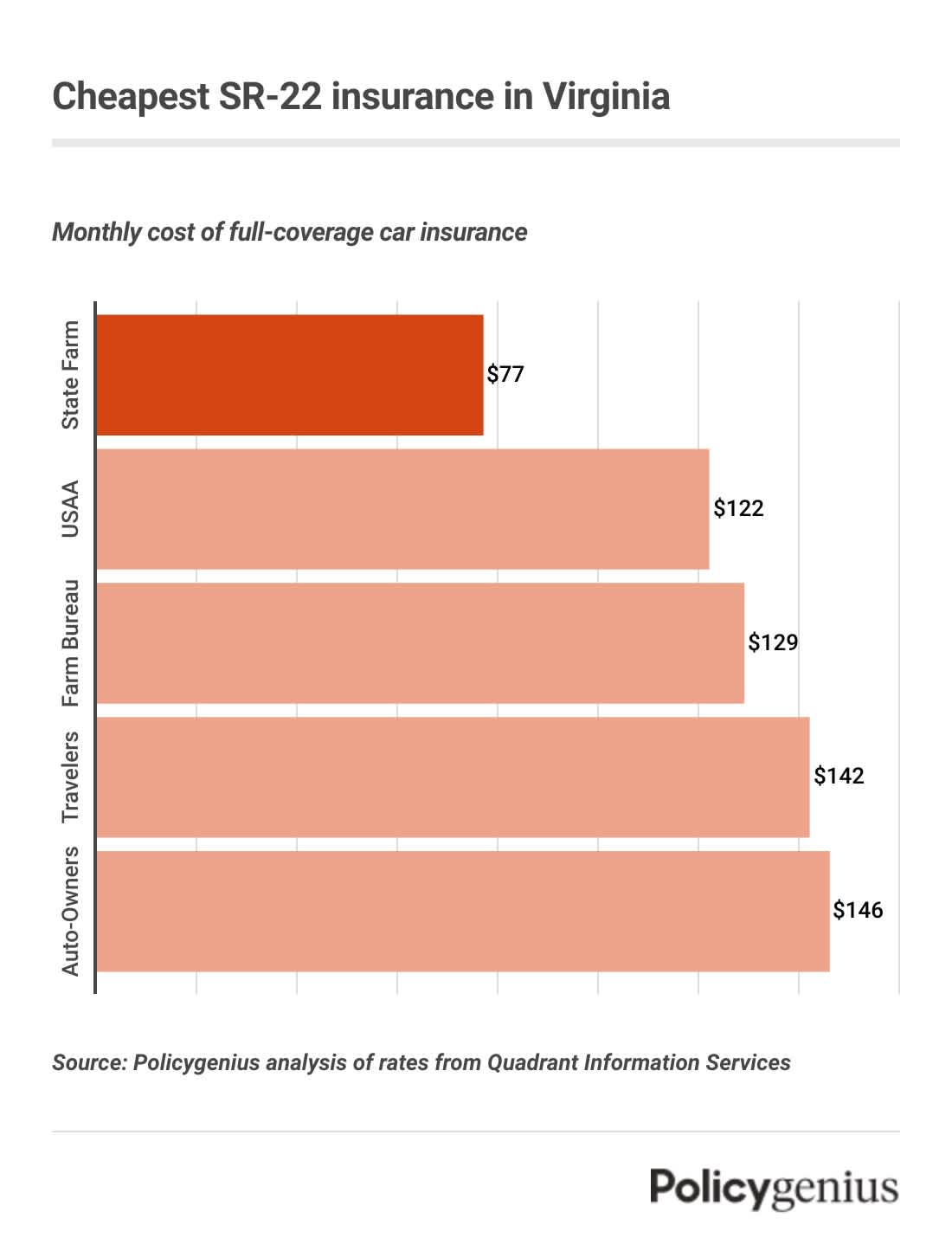

Cheapest SR-22 insurance in Virginia

We found that State Farm has the cheapest SR-22 insurance in Virginia. On average, coverage from State Farm costs $77 per month or $927 a year. That’s $1,977 cheaper than the statewide average in Virginia.

Farm Bureau, USAA, and others also have cheaper-than-average rates for drivers with an SR-22. Since the cost of insurance varies so much from driver to driver, it’s a good idea to compare quotes before you get covered.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $77 | $927 |

USAA | $122 | $1,459 |

Farm Bureau | $129 | $1,551 |

Travelers | $142 | $1,708 |

Auto-Owners | $146 | $1,751 |

Erie | $155 | $1,859 |

Nationwide | $177 | $2,127 |

Progressive | $200 | $2,405 |

American Family | $204 | $2,450 |

GEICO | $215 | $2,582 |

Allstate | $239 | $2,862 |

What is SR-22 insurance in Virginia?

An SR-22 is not actually a type of insurance, but a form that your insurance company files for you to prove you’re covered. Virginia is one of two states where you don’t have to be insured, but you must pay a $500 fee if you don’t get a policy with at least:

Bodily injury liability (BIL): $30,000 per person, $60,000 per accident

Property damage liability (PDL): $20,000 per accident

Not all drivers in Virginia have to get SR-22 insurance, just high-risk drivers. You’ll be required to get SR-22 insurance after:

You fail to pay a judgment after an accident

You’re caught driving without insurance and didn’t pay the uninsured fee

You lie about having insurance

You’re convicted of a serious driving violation

You lie when applying for a license

You’re commit a felony involving a car

In Virginia, you’re required to carry an SR-22 for three years and pay a reinstatement fee. Your fee is $600 if you didn’t buy a policy or pay Virginia’s Uninsured Motor Vehicle fee, but it depends on your violation. [1]

What is the difference between an SR-22 and FR-44 in Virginia?

Virginia is one of the two states (the other is Florida) that requires some drivers to get an FR-44 instead of an SR-22. You will have to get an FR-44 if you’re caught driving under the influence of alcohol or drugs, or after seriously injuring someone while driving.

Just like with an SR-22, your insurance company will file an FR-44 for you once you’re covered. If you’re required to get FR-44 insurance, you need at least:

Bodily injury liability (BIL): $60,000 per person, $120,000 per accident

Property damage liability (PDL): $40,000 per accident

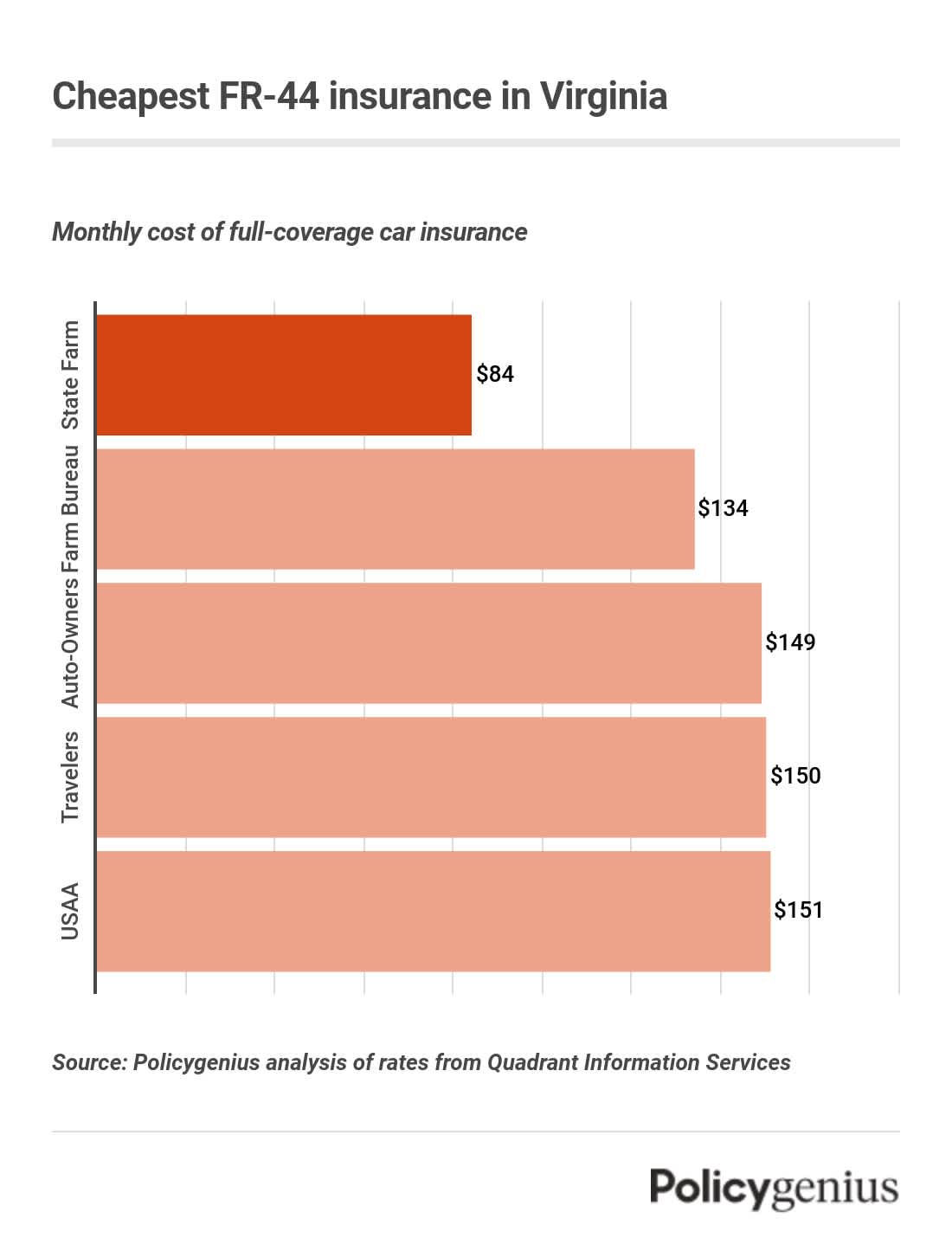

Cheapest FR-44 insurance in Virginia

According to our analysis, State Farm has the cheapest FR-44 insurance in Virginia. On average, the cost of F-44 insurance from State Farm costs $84 per month or $1,005 a year — $1,728 cheaper than the statewide average in Virginia.

Besides State Farm, Farm Bureau and Auto-Owners are the cheapest car insurance companies in Virginia for drivers who need an FR-44.

Company | Average monthly cost of FR-44 insurance | Average yearly cost of FR-44 insurance |

|---|---|---|

State Farm | $84 | $1,005 |

Farm Bureau | $134 | $1,602 |

Auto-Owners | $149 | $1,790 |

Travelers | $150 | $1,795 |

USAA | $151 | $1,817 |

Erie | $165 | $1,978 |

Nationwide | $186 | $2,232 |

Progressive | $190 | $2,275 |

GEICO | $207 | $2,483 |

American Family | $214 | $2,566 |

How to get SR-22 or FR-44 insurance in Virginia

After you’re labeled a high-risk driver and have to get SR-22 or FR-44 insurance, follow these steps to get covered:

Find a company that offers coverage: You might have to spend some more time shopping for SR-22 or FR-44 coverage, since not all companies in Virginia will file proof of insurance for you.

Pay all of your fines: When your license is suspended, you may have to pay more than one fine: one to reinstate your license and another that changes based on your violation.

Don’t let your SR-22 or FR-44 lapse: In Virginia, you must have proof of insurance for three years, provided you don’t let your policy lapse. If you do, you would face more fines and an even longer suspension.

Non-owner SR-22 or FR-44 insurance in Virginia

If you don’t own a car but you’re licensed, you may have to get non-owners insurance after a driving violation. Like a standard policy, when you have non-owners insurance your company will file SR-22 or FR-44 for you.

Non-owners insurance works almost exactly like a regular policy, but they’re cheaper since neither includes comprehensive or collision coverage. One difference is that it’s often harder to find non-owner insurance, especially for high-risk drivers.