Cheapest SR-22 insurance in Wisconsin

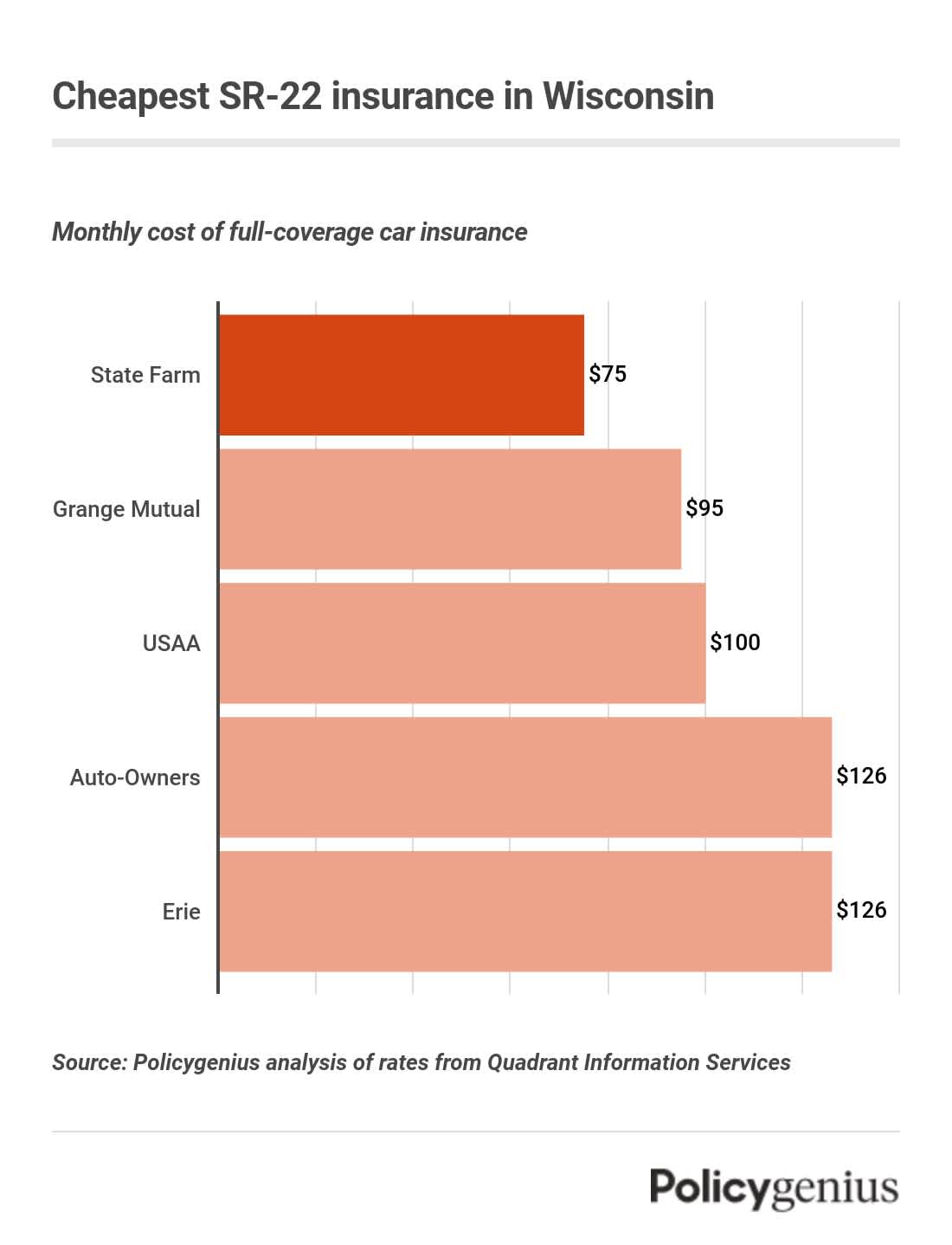

We found that State Farm has the cheapest SR-22 car insurance in Wisconsin. On average, State Farm costs just $75 per month or $896 a year. That’s 59% cheaper than the statewide average in Wisconsin.

There are other affordable companies in Wisconsin that can file an SR-22 for you, including Grange Mutual and USAA. The cost of car insurance depends largely on the driver, so compare quotes from more than one company before buying.

Company | Average monthly cost of SR-22 insurance | Average yearly cost of SR-22 insurance |

|---|---|---|

State Farm | $75 | $896 |

Grange Mutual | $95 | $1,136 |

USAA | $100 | $1,197 |

Auto-Owners | $126 | $1,510 |

Erie | $126 | $1,511 |

GEICO | $142 | $1,707 |

American Family | $147 | $1,764 |

SECURA | $156 | $1,871 |

West Bend Mutual | $161 | $1,931 |

What is SR-22 insurance in Wisconsin?

An SR-22 isn’t actually a type of car insurance. An SR-22 is just a form that your insurance company files for you that proves to the state that you have insurance. In Wisconsin, you must have at least the following amount of insurance:

Bodily injury liability (BIL): $25,000 per person, $50,000 per accident

Property damage liability (PDL): $10,000 per accident

An SR-22 is usually required for drivers whose license has been suspended or revoked, or after a serious moving violation, like an OWI or driving without car insurance.

Wisconsin state laws require that you have to carry your SR-22 for at least three years after you reinstate your license. If you don’t want to get an SR-22 and would rather give up your driving privileges instead, Wisconsin lets you surrender your license to the Department of Motor Vehicles and cancel your policy.

How to get SR-22 insurance in Wisconsin

When you find out you need SR-22 insurance in Wisconsin, there are a few steps to follow to get covered. The first is to check and see if your current company will file an SR-22 on your behalf, but if that won’t work, you should:

Find a company that offers coverage: Not every company in Wisconsin offers SR-22 insurance. If you're someone with a history of high-risk driving behavior, you may need to spend some extra time shopping for a policy.

Wait for your company to file your SR-22, or do it yourself: While most companies in Wisconsin will file your insurance for you in one or two days, you may have to fax or email your SR-22 yourself.

Reinstate your license online or in person: To complete the SR-22 process, Wisconsin lets you reinstate your license at a DMV location or online. If you reinstate your license online, you’ll have to pay an additional convenience fee.

How to file your SR-22 yourself

If you have to file your SR-22 yourself, Wisconsin requires you to submit the actual SR-22 certificate, not just a summary. You can email or fax the SR-22 form, which has to include:

Your name

Your insurance policy number

Your policy and SR-22’s start date

When you submit your SR-22, you also have to make sure that you indicate whether or not you own the vehicles, your state (which must be Wisconsin), and the name of your insurance company.

Non-owner SR-22 insurance in Wisconsin

If you’re licensed but don’t own a car, you may still need to get SR-22 insurance after a license suspension or a driving violation. Non-owners insurance, which is special, limited coverage for people who don’t own a car, can let you regain your license without a standard car insurance policy.

You can get non-owners car insurance from the same car insurance companies that sell regular car insurance, but it usually just includes basic liability coverage, which means it’s cheaper than a standard policy.

Like with regular car insurance, your insurance company can file an SR-22 with your non-owners policy. That said, non-owners insurance is less commonly offered than a regular policy, so plan on spending more time looking for coverage.