Whether you want a larger vehicle for your growing family or you are looking for a car that has better highway safety ratings than the compact car you’re driving, buying an SUV could be a good choice for you.

But what about auto insurance rates for your new SUV? Average car insurance costs for SUVs are, on average, lower than rates for sedans and trucks, but how much you pay for insurance varies based on a number of factors, including the make and model of your SUV.

How much does it cost to insure an SUV?

Car insurance rates for SUVs are sometimes lower than other types of cars, but rates can vary significantly from one SUV to another. Different insurance rates based on the make and model of your SUV are just one of the reasons why it is so important to do your research before buying a vehicle.

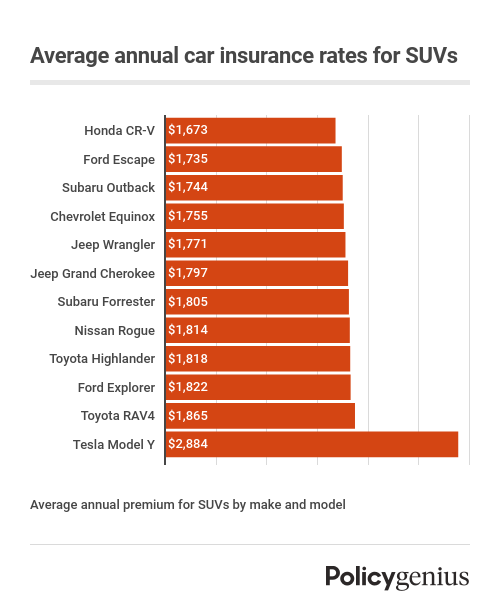

SUV insurance rates by make and model

Insurance costs vary based on the make and model of your vehicle (and the insurance company you choose). Because each company sets their own rates, the best insurance company for one person may not be the best choice for someone else.

And some types of SUVs are significantly more expensive to insure than others — our analysis found that a driver who chooses GEICO insurance will pay an average of $2,078 per year to insure a Tesla Model Y, but if they had a Subaru Outback instead they would only pay an average of $1,061 per year.

Company | Chevrolet Equinox | Ford Escape | Ford Explorer | Honda CR-V | Jeep Grand Cherokee | Jeep Wrangler | Nissan Rogue | Subaru Forester | Subaru Outback | Toyota Highlander | Toyota RAV4 | Tesla Model Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

AIG | $3,428 | $3,439 | $3,573 | $3,061 | $3,826 | $3,825 | $3,651 | $3,222 | $3,027 | $3,283 | $3,683 | $4,708 |

Allstate | $2,164 | $2,214 | $2,300 | $2,085 | $2,138 | $2,652 | $2,122 | $2,203 | $2,327 | $2,271 | $2,343 | $4,531 |

Chubb | $2,377 | $2,386 | $2,477 | $2,102 | $2,591 | $2,429 | $2,590 | $2,331 | $2,127 | $2,332 | $2,649 | $3,548 |

Erie | $1,210 | $1,179 | $1,267 | $1,124 | $1,336 | $1,394 | $1,272 | $1,090 | $1,045 | $1,244 | $1,309 | $2,013 |

Farmers | $2,133 | $1,977 | $1,920 | $1,948 | $2,101 | $1,736 | $2,192 | $2,253 | $1,937 | $2,164 | $2,050 | $2,951 |

GEICO | $1,161 | $1,219 | $1,324 | $1,052 | $1,294 | $1,126 | $1,149 | $1,039 | $1,061 | $1,179 | $1,154 | $2,078 |

MetLife | $2,660 | $2,499 | $2,588 | $2,624 | $2,534 | $2,166 | $2,727 | $3,000 | $2,807 | $3,160 | $2,851 | $4,583 |

Nationwide | $1,377 | $1,320 | $1,408 | $1,257 | $1,432 | $1,634 | $1,482 | $1,285 | $1,123 | $1,365 | $1,465 | $1,842 |

Progressive | $1,724 | $1,595 | $1,806 | $1,595 | $1,798 | $1,667 | $1,731 | $1,955 | $1,945 | $1,746 | $1,686 | $2,997 |

State Farm | $1,229 | $1,234 | $1,247 | $1,128 | $1,249 | $1,404 | $1,231 | $1,260 | $1,316 | $1,331 | $1,424 | $1,913 |

The Hartford | $2,162 | $2,078 | $2,279 | $2,085 | $2,253 | $2,223 | $2,204 | $2,173 | $2,176 | $2,272 | $2,295 | $3,242 |

Travelers | $1,567 | $1,394 | $1,657 | $1,295 | $1,533 | $1,404 | $1,607 | $1,339 | $1,321 | $1,508 | $1,575 | $2,954 |

USAA | $1,124 | $1,126 | $1,309 | $1,144 | $1,246 | $1,062 | $1,207 | $1,123 | $1,118 | $1,166 | $1,158 | $1,828 |

Insurance companies all use their own unique systems to set rates, so one company may quote you a very different rate than another, even for the exact same vehicle.

This is why it is so important to compare car insurance quotes from multiple companies before you buy a policy to make sure you are getting the best possible rate.

What’s the cheapest SUV to insure?

Out of the most popular SUVs in the country, the Honda CR-V is the cheapest to insure at $1,673 per year. The Honda CR-V is a compact SUV, which means it is smaller than other models of SUV. Small, lower-cost SUVs are generally cheaper to insure than their larger counterparts.

What's the most expensive SUV to insure?

Among the most popular SUVs sold in the U.S., the Tesla Model Y is the most expensive to insure at $2,884 per year. The Tesla Model Y is larger and more expensive than other SUVs, and not all repair shops can fix a Tesla, which contributes to the higher insurance rates.

Drivers who are considering purchasing a Tesla may find that they get lower insurance rates from Tesla's own car insurance, which is available in Arizona, California, Illinois, Ohio and Texas.

Is car insurance cheaper for an SUV, a truck, or a sedan?

It may seem a little surprising but, on average, SUVs are a little cheaper to insure than trucks and sedans. There are three big reasons for this:

Safety: According to the National Highway Traffic Safety Administration, the average number of prorated fatal crashes per billion miles is largest for people driving smaller vehicles and lowest for people in larger vehicles. [1] What does all that jargon mean? You are less likely to be fatally injured in an accident if you’re driving a larger, heavier vehicle.

Theft rates: Insurance rates take into account the likelihood that your car will be stolen, which means vehicles that are high on the National Insurance Crime Bureau’s list of most stolen vehicles will cost more to insure. The five most frequently stolen vehicles are Ford pickups, Chevrolet pickups, Honda Civics, Honda Accords, and Toyota Camrys. [2]

Repair costs: The more an SUV costs to repair or replace after a loss, the more you’ll pay to add comprehensive insurance and collision insurance to your policy.

That said, there is no one type of vehicle that is universally cheaper or better than another when it comes to car insurance. Insurance rates are based on a number of factors, including your age, location, and driving history, which means rates will vary from one person to the next, even for the exact same vehicle.