Buying a car at certain times of the month or the year can save you a lot of money, but car insurance doesn’t work the same way.

Car insurance doesn’t go on sale the way other products and services do, but you can still save money on car insurance by buying it at the right time, like after your birthday or when a violation has “fallen off” your driving record.

When should you shop for car insurance?

Car insurance rates are regulated by states, and insurance companies are required by law to offer everyone rates based on the same factors (like age, ZIP code, and the make and model of your car) so insurance doesn’t ever go on sale, and brokers can’t get you a special deal on cheap car insurance.

But there are still certain times you should be shopping (and re-shopping) for car insurance so you can get the best rates, like when something big changes in your life or whenever your policy is up for renewal. Here are the best times to buy car insurance:

1. When you have a birthday

Age is a major factor in your insurance rates and young drivers can see their rates drop significantly as they get older.

Age | Average annual premium |

16 | $6,779 |

18 | $4,931 |

21 | $2,708 |

25 | $1,929 |

30 | $1,705 |

35 | $1,654 |

45 | $1,582 |

55 | $1,462 |

60 | $1,449 |

65 | $1,494 |

70 | $1,585 |

If you are turning 21 and your birthday falls in the middle of your policy period, shopping around the day after your birthday could get you a lower rate, possibly saving you hundreds of dollars over the length of your policy.

2. When you move

Location is also a big factor in your car insurance rates, even moving a few miles can mean higher or lower car insurance rates. For example, the rates in the chart below show the average rates for car insurance across several cities in North Carolina.

City | Average annual premium |

Newport | $893 |

Powells Point | $911 |

Raleigh | $1,019 |

Princeton | $1,024 |

Godwin | $1,046 |

Potecasi | $1,105 |

Lowell | $1,114 |

Monroe | $1,163 |

Fayetteville | $1,209 |

Hope Mills | $1,220 |

As you can see, moving from one city to another could potentially cause your rates to go up (or down) based on your new location. Also, moving from one state to another could save (or cost) you hundreds or even thousands of dollars on your car insurance.

For instance, the average insurance rate for a full-coverage policy in Louisiana is $2,906 per year, while the average rate in Texas is $1,840 per year.

A resident in Louisiana moving to Texas could potentially save $1,066 per year, while someone moving from Texas to Louisiana would likely see a $1,066 per year increase in their rates.

3. When you get married

One of the less-talked-about benefits of getting married is that it usually comes with a slightly lower car insurance rate.

Marital status | Average annual premium |

Divorced | $1,723 |

Married | $1,591 |

Single | $1,721 |

Insurance companies have found that married people file fewer claims than single people and take that into consideration when setting your rates.

If you’ve tied the knot since your last car insurance renewal you should let your insurance company know and take this opportunity to shop around for quotes for a new policy.

4. When your teen gets their license

Teenage drivers have the highest insurance rates, often paying several thousand dollars more per year than an adult driver.

Because the rates for teen drivers are so high, it is important to shop around to find the lowest possible rate when you are adding a newly licensed 16-year-old to your policy.

Comparing quotes from multiple insurance companies before adding a teen to your policy can save you thousands of dollars each year on your car insurance.

5. When your driving record changes

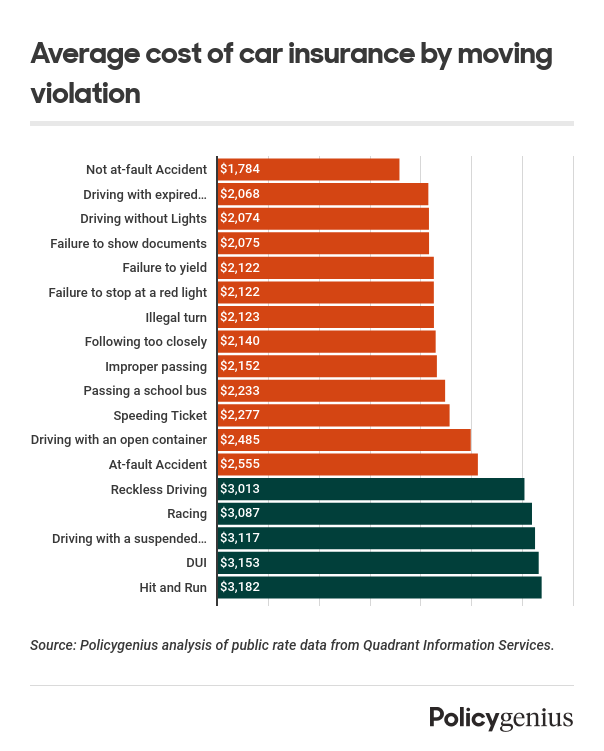

Because car insurance companies charge higher rates to drivers with a recent accident or a moving violation in their driving history, having a clean driving record is one of the most effective ways of keeping your insurance costs low.

Something like a new speeding ticket or an at-fault accident could raise your rates by hundreds of dollars or more each year, which also means having a violation “fall off” your record after enough time has passed could significantly lower your rates.

If you have an accident or moving violation that comes off your driving record mid-way through your policy, either because you took a defensive driving course or because it has been five years since the accident, shopping around could allow you to start a new policy without any blemishes on your record.

→ Learn more about car insurance for high-risk drivers

6. Whenever your policy is up for renewal

Your insurance policy will renew every six months or every year, giving your car insurance company the opportunity to adjust your rate based on a variety of factors.

Many people find that their car insurance rate either stays the same or goes up over time when they stay with the same insurance company, even if they haven't filed any claims.

Comparing quotes from multiple companies a few weeks before your policy renews is a great way to make sure you are paying the lowest possible rate.

You can work with your insurance agent or use an online marketplace like Policygenius to help you get quotes from different companies so you know whether you should stay with your current insurance policy or if you will save money by getting insurance with another company.

→ Learn more about how to compare car insurance quotes

7. When you can’t afford your premiums

Whether your premiums have gone up or your income has gone down, sometimes your car insurance is just too expensive.

If you are looking at your car insurance bill and you know you just can’t afford it, shopping for a new policy is the best way to find cheap car insurance. This is especially true for drivers who have a car loan and can’t necessarily drop comprehensive and collision coverage to save money.

While someone with no car loan might choose to buy liability only coverage, drivers who are financing their vehicles are required by the terms of their loan to purchase a full coverage policy, which makes shopping around for new insurance the fastest and easiest way to save money on your car insurance.

Do I need to wait for my policy to expire to shop for auto insurance?

Nope! You can always buy a new car insurance policy and cancel your old policy for any reason. If you find you can get a lower rate or better coverage through another insurance company, feel free to switch insurance companies at any time.

However, some states allow insurance companies to charge a cancellation fee for car insurance policies, so make sure you know the terms of your contract and the laws in your state so you aren’t surprised by an unexpected cancellation fee.

→ Learn more about how to switch car insurance companies

Methodology

Policygenius has analyzed car insurance rates provided by Quadrant Information Services for every ZIP code in all 50 states, plus Washington, D.C.

For full coverage policies, the following coverage limits were used:

Bodily injury liability: 50/100

Property damage liability: $50,000

Uninsured/underinsured motorist: 50/100

Comprehensive: $500 deductible

Collision: $500 deductible

In some cases, additional coverages were added where required by the state or insurer.

Rates for overall average rate, rates by ZIP code, and cheapest companies determined using averages for single drivers age 30, 35, and 45. Our sample vehicle was a 2017 Toyota Camry LE driven 10,000 miles per year.

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of insurance costs. Your actual quotes may differ.