According to our Policygenius experts, disability insurance costs an average of around $2,200 a year, though rates depend mostly on your income (as well as your health and other personal details).

Think of disability insurance as income protection insurance, so the higher your salary, the more you’ll pay to protect it. But the upside is massive — having the right long-term disability coverage means that you’ll be covered if you’re hurt or sick and can’t work, whether it’s for years or even decades.

How much is long-term disability insurance?

A long-term disability insurance policy generally costs 1% to 3% of your annual salary. Since disability insurance rates are so tied to income, the more money you make, the more it will cost to insure it.

Annual salary | Cost of long-term disability insurance |

|---|---|

$75,000 | $63 to $188 per month |

$100,000 | $83 to $250 per month |

$125,000 | $104 to $313 per month |

$150,000 | $125 to $375 per month |

$175,000 | $146 to $438 per month |

$200,000 | $167 to $500 per month |

$225,000 | $188 to $563 per month |

$250,000 | $208 to $625 per month |

$275,000 | $229 to $688 per month |

$300,000 | $250 to $750 per month |

How much should you pay for disability insurance?

You might know that the cost of disability insurance is usually equal to a small percentage of your income, but how do you know if you’re paying too much for coverage?

The best way to tell is by getting disability insurance quotes from multiple companies and comparing rates before you buy. Your quotes may all be different, but you’ll have a good idea of what a “normal” range is before you pick a policy.

Estimate what your disability insurance rates with our calculator

Who pays for long-term disability insurance?

The answer is most often you. Long-term disability insurance is usually a private or individual policy, meaning you went and got it on your own like with your auto or life insurance.

You might get disability insurance through work as an employee benefit, but group policies are usually short-term disability coverage, meaning that you’ll only be covered for absences of up to a year at the most.

If your disability coverage through work is partially or fully covered (meaning your employer pays for some or all of it), it’s definitely worth opting-in to, but you may still need to pay out of pocket for your own long-term disability policy to be fully protected.

What affects long-term disability insurance costs?

While your income (basically the amount of coverage you want) is important when it comes to disability rates, there are lots of factors that affect the cost of a long-term disability insurance policy, like:

Age: Older age groups see higher disability insurance rates.

Benefit period: Your benefit period (which means how long you can receive disability insurance payments) can be two, five, or 10 years, up to age 65, or for life. The longer the benefit period, the higher your rates.

Coverage amount: You’ll pay more for disability insurance if you’re a higher earner, since you’re protecting more money than someone with a lower income.

Health: If you’re a smoker, or have asthma, diabetes, hypertension, or another condition that makes you more likely to become disabled later on, you’ll probably pay more for disability insurance.

Hobbies: Risky hobbies, like skydiving, mountain climbing, or extreme sports, will lead to higher rates that reflect the increased risk.

Occupation: Your disability insurance rates can depend on your job — if you have a dangerous job your rates will be higher, or you may have limited coverage options.

Waiting period: Your policy’s waiting, or elimination period, is the time between when you’re first injured or get sick and when you start receiving benefits. A shorter waiting period means higher premiums.

Since these factors are different for everyone, we recommend comparing disability insurance quotes to get a better idea of what you want in a policy and how much it will cost you.

Do taxes affect what you pay for disability insurance?

If you get disability insurance through work and pay for it through pre-tax dollars (meaning the money for the policy is deducted from your paycheck), you’ll have to pay taxes on your disability benefits if you ever actually file a claim.

If you use after-tax income to buy a personal policy, or your employer-sponsored policy gives you the option to pay with after-tax dollars, you won’t have to worry about paying more taxes on any benefits in the future.

Riders and disability insurance rates

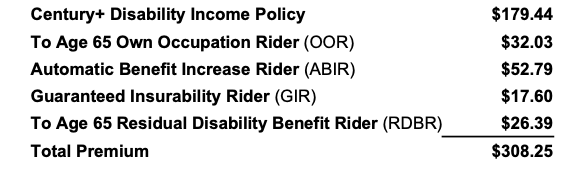

The cost of a long-term disability insurance policy also depends on any riders you’ve added (riders are additional coverage options that modify or add to an insurance policy). Adding more riders means your disability insurance will be more expensive.

Some of the most popular disability insurance riders include:

Cost of living adjustment: This increases your benefit amount as inflation goes up.

Future increase option: If your income goes up in the future, this lets you increase your benefits without taking another medical exam.

Own-occupation rider: Allows you to keep getting benefits even if you can still work, like if a hand injury means you can’t continue being a surgeon but you can still hold a teaching position.

Sample disability insurance policy

Let’s take a look at a sample disability insurance policy for a 31-year-old for a white-collar worker, and how adding different riders affects their monthly rate.

Long-term vs. short-term disability insurance costs

An individual short-term disability insurance policy usually costs about the same as a long-term policy, but you get much less protection than long-term disability insurance since it only replaces your income for months rather than years.

Lots of people get short-term disability insurance through work, often for free. But if you don’t already have it as an employer benefit, getting an individual short-term disability policy might not be worth the cost.

Is long-term disability insurance worth the cost?

Yes — long-term disability insurance can cost thousands of dollars a year, especially for high-earners, but we think it’s worth it, especially if you’re among the 61% of high-earning adults with six months or less in savings.

One reason disability insurance is worth the cost is because it allows you to insure potentially millions of dollars in future earnings for a fraction of that amount. And even if you never have to use your coverage, the total amount of money that you spend on disability insurance will be much less than your lifetime earnings.

Becoming seriously disabled is more likely than you may think. According to the Social Security Administration, more than 1 in 4 20-year-olds will become disabled before they retire. [1]

How to lower disability insurance rates

Here are some general rules for making sure you get the cheapest long-term disability insurance rates:

Avoid risky activities: People without risky habits or hobbies, like smoking or skydiving, will be able to find cheaper long-term disability insurance.

Buy disability insurance early in life: Buying a non-cancellable long-term disability insurance policy early in life, when rates are lower and you can take advantage of graded premiums, is cheaper than buying one later in life when you’re at a greater risk of becoming disabled.

Choose a longer elimination period: Disability insurance costs go down if you choose a longer waiting period between the time you become disabled and when you start to get benefits.

Compare rates: Compare disability insurance quotes from multiple companies so you can be sure you get the best rates for your coverage needs (Policygenius can help with this).