A decade ago, the Affordable Care Act introduced the federal health insurance marketplace at HealthCare.gov, added new consumer protections, and made many preventive services available for free. [1]

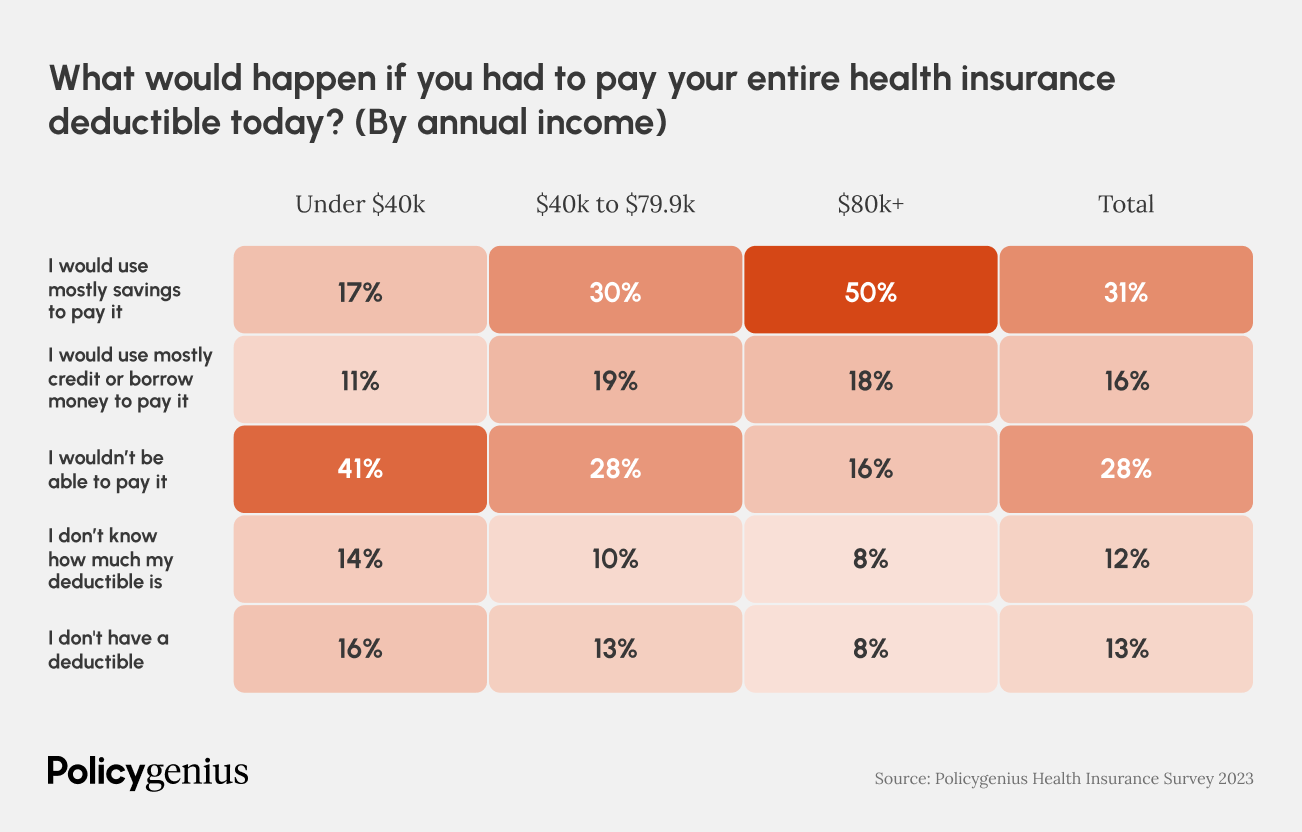

But for many Americans, health care is still unaffordable — even with health insurance. In fact, 28% of Americans with health insurance said they wouldn’t be able to pay their deductible immediately, while 16% said they would have to borrow money or use mostly credit, according to the Policygenius 2023 Health Insurance Survey.

A choice between debt and avoiding medical care

Over the last decade, insured families have incurred an increase of 67% in health care costs, including premiums and out-of-pocket spending like deductibles — the amount of money you pay for health care out-of-pocket before health insurance starts covering the bill. [2]

During that time, the average deductible amount for people covered by employer-sponsored health insurance with single coverage has increased by a staggering 61%. [3] For high-deductible health plans, a type of coverage with a higher-than-usual annual deductible, deductibles can be as high as $7,500 a year for single coverage and $15,000 a year for family coverage in 2023. [4]

According to our survey, 28% of insured Americans wouldn’t be able to pay their entire deductible in the event of a medical emergency. Even 16% of those earning $80,000 a year or more are now “underinsured” because they wouldn’t be able to pay their deductibles out-of-pocket.

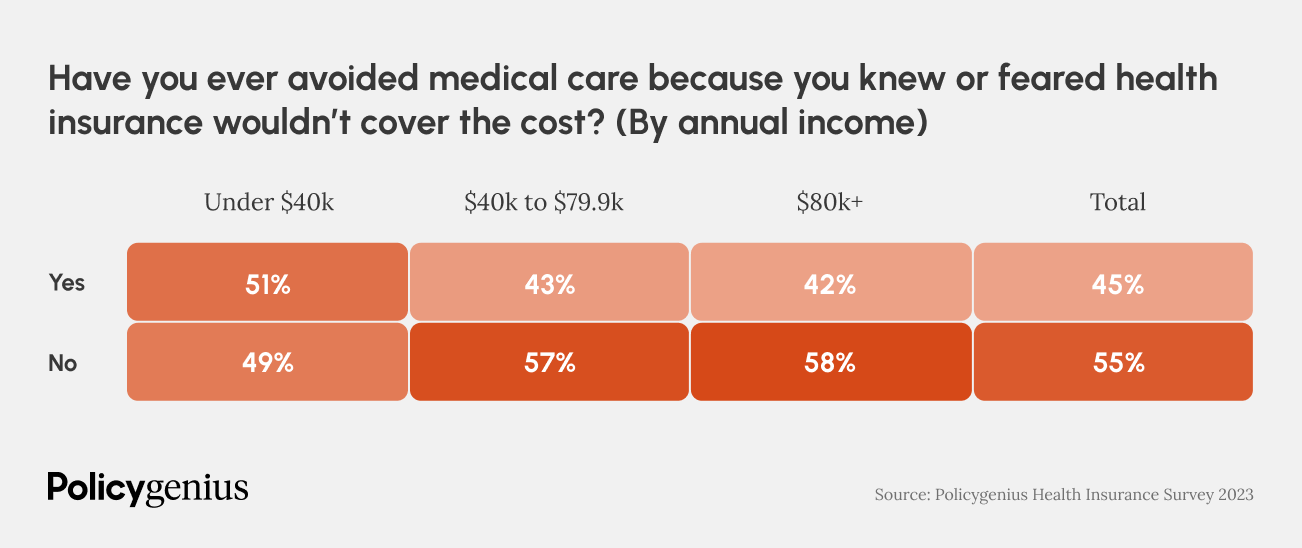

It’s not surprising that 45% of insured Americans say they’ve avoided medical care because they knew or feared health insurance wouldn’t cover the cost. With a high enough deductible, those fears are well founded.

Millions of Americans are losing Medicaid coverage this year. What will they do?

As part of the COVID-19 public health emergency, Medicaid enrollment grew by more than 20 million people from February 2020 through March 2023 thanks to a temporary “continuous coverage” measure enacted by Congress. [5] But after the end of continuous coverage in March 2023, millions of people are in the process of losing their Medicaid health insurance coverage.

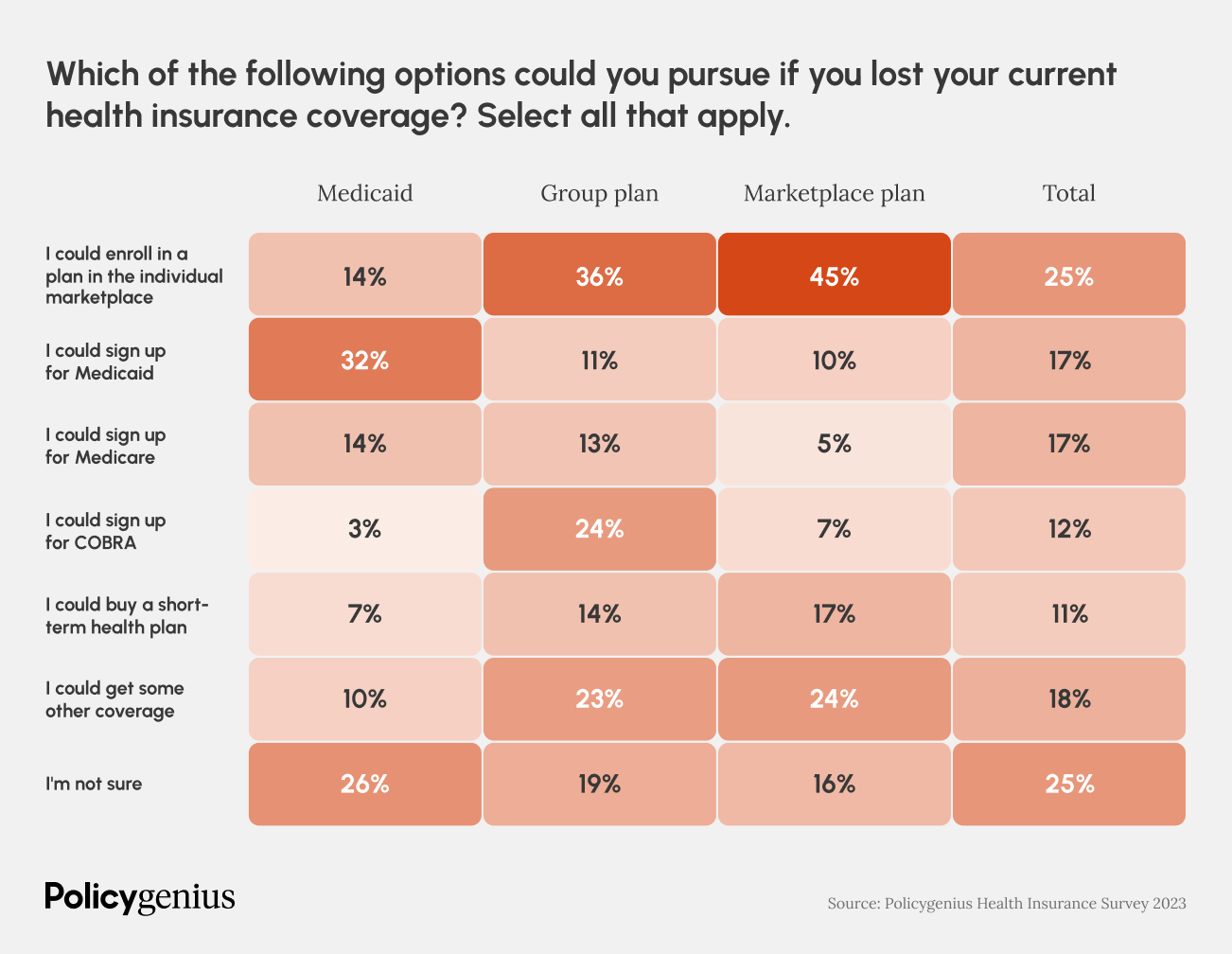

In our survey, almost a third of people on Medicaid (32%) said they expect to be able to re-enroll in the program, but 17% said they would have to go without health insurance. When asked what they would do if they lost their current health insurance, a plan on the federal marketplace was the most popular choice for insured Americans, especially among those with employer-provided coverage and those who already have marketplace plans.

Still, the number of people who selected a state or federal marketplace is relatively low, especially among people covered by Medicaid. Only 14% said they would enroll in a marketplace plan, almost as many as the number of people who said they would go without health insurance coverage altogether. One reason may be a lack of information about these plans.

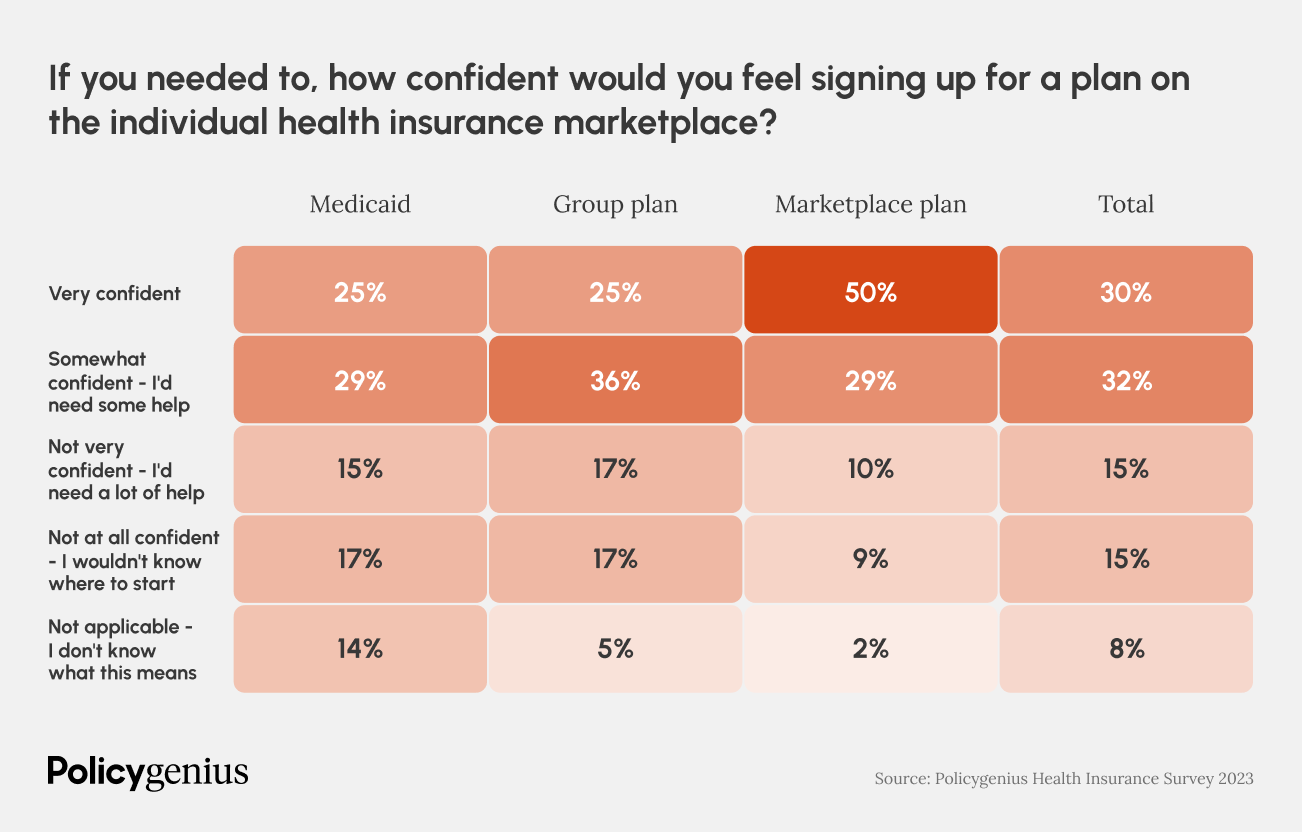

Only 30% of insured Americans said they would feel “very confident” signing up for a plan on the health insurance marketplace. Most (63%) said they would need at least some help, including 15% who said they felt “not at all confident — I wouldn’t know where to start.”

The Biden administration has increased funding for navigator organizations, which help people sign up for health insurance coverage. [6] Healthcare.gov has a search tool that lets users look up certified agents, brokers, and navigators who can provide application help in your area.

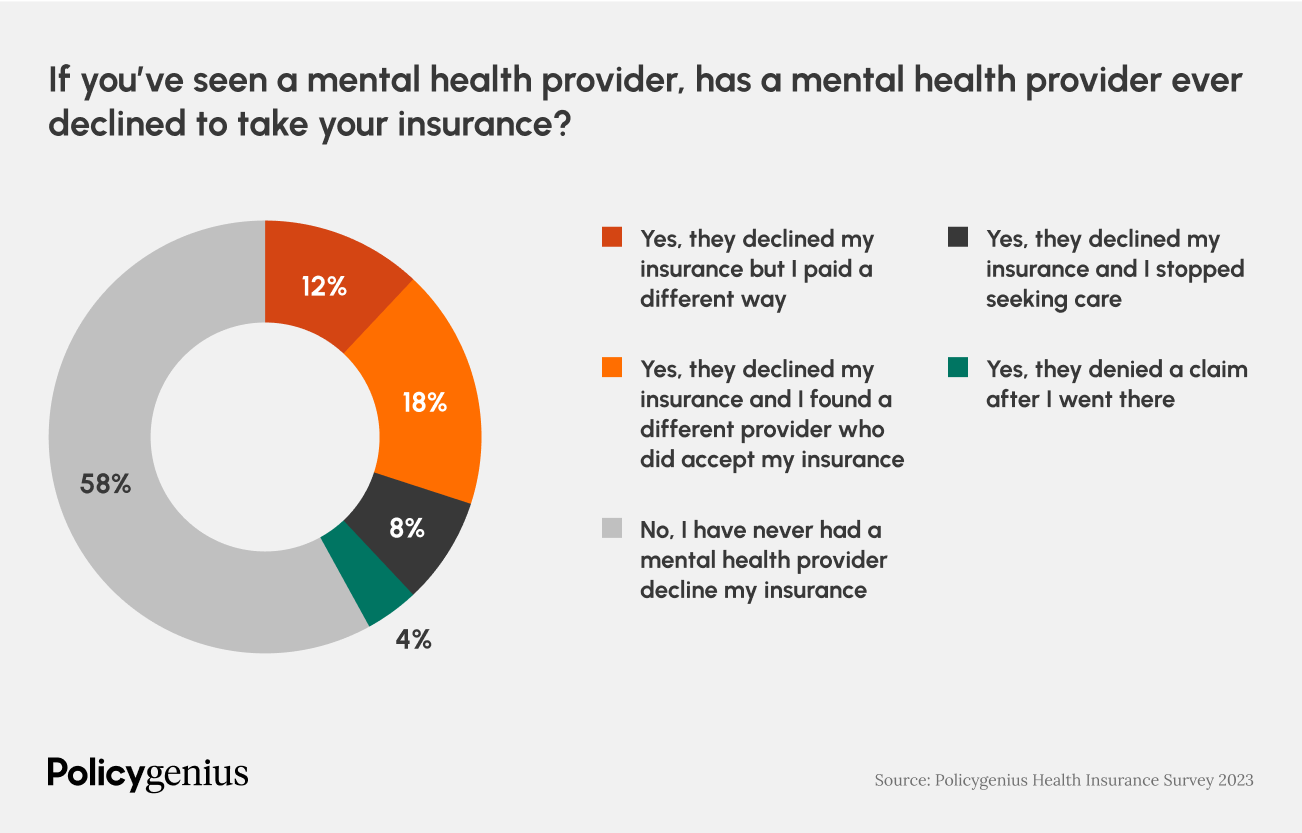

Many mental health care providers are still declining insurance

An increasing number of U.S. adults are seeking mental health care in the wake of the COVID-19 pandemic, but health insurance coverage has not always been adequate to meet the mental health crisis. In our survey, 29% of insured Americans said they weren’t sure whether their plans covered mental health care, and among insured Americans who have seen a mental health provider, 42% have had a provider decline their insurance.

The Biden administration proposed a rule that aims to require health insurance companies to report more data on their mental health coverage, but insurance isn’t the only issue with mental health care. Many providers opt out of insurance networks entirely because they can earn more from patients who pay out of pocket.

Methodology

Policygenius commissioned YouGov to poll 2,051 Americans 18 or older who confirmed having health insurance at the time of the survey. The survey was carried out online from Aug. 24 through Aug. 31, 2023. The results have been weighted to be representative of all U.S. adults. The average margin of error was +/- 2%.

Infographics by Anna Konson