Top 5 cheapest homeowners insurance companies of 2024

Erie, Auto-Owners Insurance, USAA, Homesite, and Travelers are the cheapest homeowners insurance companies, according to our analysis of average premiums of top home insurance companies by market share. But with home insurance premiums up 21% from May 2022 to May 2023 according to the Policygenius Home Insurance Pricing Report, it’s more important than ever to compare home insurance companies to find the best policy at the cheapest price.

Erie: $1,284

Auto-Owners: $1,406

USAA: $1,479

Homesite: $1,487

Travelers: $1,568

Company | Average annual cost | % difference from national average | Policygenius rating | |

|---|---|---|---|---|

$1,284 | 31% cheaper | 4.5 out of 5 | ||

$1,406 | 22% cheaper | 5 out of 5 | ||

$1,479 | 17% cheaper | 4.9 out of 5 | ||

$1,487 | 16% cheaper | 4.3 out of 5 | ||

$1,568 | 11% cheaper | 4.4 out of 5 |

Best and most affordable home insurance: Pros and cons

Here's a more in-depth look at some of the most affordable home insurance companies in the U.S., including discount opportunities, state availability, policy perks, and just how cheap their rates are compared to the national average.

How Erie compares to other home insurance companies

Coverage options: Erie offers a comprehensive base policy that rivals competitors, which includes coverages like guaranteed replacement cost, all-risk protection, and never before seen coverages like gift card reimbursements. Erie customers can also take advantage of its three comprehensive policy packages that include additional protection for things like underground service lines and appliance breakdown.

Customer satisfaction ratings: Erie earned above-average scores in J.D. Power’s 2022 customer and claims satisfaction surveys, ranking at or near the top for both studies. However, it received a below-average score in J.D. Power’s 2022 digital experience study, which looks at ease of navigation, quality of information and content, visual appeal, and other factors related to a company’s web and app experience. It also received about 68% fewer customer complaints from 2019 to 2021 compared to other companies of its size, according to the National Association of Insurance Commissioners National Complaint Index Report.

Awards: Founded around 200 years ago in 1800, Erie has the longest history in the insurance industry than any other company on this list. While it's not one of the 10 largest home insurance companies in the U.S. by market share, it did earn the title of "Best for comprehensive dwelling coverage" on our list of the best home insurance companies of 2024 thanks to its base policy that comes with coverages that typically cost extra with other insurers, such as guaranteed replacement cost and lost or misplaced items coverage.

How Auto-Owners compares to other home insurance companies

Coverage options: Auto-Owners offers more coverage add-ons and supplemental policies than any other company on this list (up to 24, in fact), including guaranteed replacement cost, professional liability protection, and a Homeowners Plus package that rolls several policy endorsements into one.

Customer satisfaction ratings: Auto-Owners earned the highest score of any insurer in J.D. Power’s 2022 customer and claims satisfaction study, and had the second-highest score in its 2022 digital experience study.

Awards: Founded around 100 years ago in 1916, Auto-Owners has a longstanding history in the insurance space. While it's not one of the 10 largest home insurance companies in the U.S. by market share, it did earn the top spot "Best overall company" on our list of the best home insurance companies of 2024 thanks to its mix of extensive policy and coverage options, high marks for financial strength and customer experience ratings, and affordable premiums.

How USAA compares to other home insurance companies

Coverage options: USAA outshines several competitors on this list of low-cost home insurance companies when it comes to coverage options available. It offers 15 optional policy add-ons, including extended dwelling coverage, protection for military uniforms, computers coverage, and standalone NFIP flood insurance and CEA earthquake insurance.

Customer satisfaction ratings: USAA earned the highest score of any insurer in J.D. Power’s 2022 customer and claims satisfaction study, and had the second-highest score in its 2022 digital experience study.

Awards: Founded over 100 years ago, USAA is one of the oldest home insurance companies on this list. With its extensive history in the business, it's no surprise USAA takes the No. 3 spot on our list of the largest home insurance companies of 2024, with $8 billion in written premiums in 2022 and holds a 6.67% market share in the U.S. It also tops our best home insurance companies of 2024 list, thanks to its numerous policy perks available to veterans and members of the military.

How Homesite compares to other home insurance companies

Coverage options: As another one of our best-priced homeowners insurance companies, Homesite rivals competitors in the coverage add-ons it offers. These include extended replacement cost coverage for your home, replacement value coverage for your personal belongings, and water backup coverage. This low-cost home insurance company also offers flood and earthquake insurance, as well as complimentary wildfire protection and mitigation services to homeowners in select states at high risk of wildfire damage.

Customer satisfaction ratings: While Homesite earned a top 10 spot in J.D. Power’s 2022 digital experience study, it scored below average in its claims satisfaction survey. But the company as a whole garnered 60% fewer complaints on average in 2021 compared to similar-sized insurers, according to the National Association of Insurance Commissioners (NAIC) Complaint Index Report.

Awards: Founded around 25 years ago in 1997, Homesite is still relatively new compared to competitors who've been in business for over 100 years. Homesite doesn't make our list of the best home insurance companies of 2024, nor is it one of the 10 largest home insurance companies of the year.

How Travelers compares to other home insurance companies

Coverage options: In addition to offering all of the standard home insurance coverages, Travelers has up to 12 optional coverages, including extended dwelling coverage, water backup coverage, and standalone flood insurance through the NFIP. This is on par with other home insurance companies on this list.

Customer satisfaction ratings: Of the companies included in J.D. Power’s 2022 customer satisfaction, claims satisfaction, and digital experience surveys, Travelers scored below the industry average. However, Travelers made up for the lower-than-average J.D. Power ratings by scoring favorably in the National Association of Insurance Commissioners (NAIC) National Complaint Index Report. From 2019 to 2021, Travelers received about half as many complaints as expected for a company of its size.

Awards: In business for a staggering 170 years, Travelers is one of the oldest home insurance companies in the country. With its extensive history in the business, it's no surprise Travelers takes the No. 6 spot on our list of the largest home insurance companies of 2024, with $5.6 billion in written premiums in 2022 and holds a 4.64% market share in the U.S. It also tops our best home insurance companies of 2024 list, thanks to its friendliness toward homeowners with poor credit.

Cheapest home insurance rates by state

Home insurance typically costs more in states prone to natural disasters, which is why home insurance rates tend to be higher in Florida, Texas, Oklahoma, Nebraska, and other places with frequent hurricanes or tornadoes.

But even in states where rates skew higher, you can often find affordable homeowners insurance rates. According to our analysis of rates in each state, Allstate and State Auto offer the cheapest home insurance in the most states.

State | Cheapest company | Average annual cost |

|---|---|---|

USAA | $1,035 | |

Western National | $1,040 | |

Armed Forces Insurance | $714 | |

State Auto | $1,608 | |

Allstate | $868 | |

State Auto | $308 | |

Vermont Mutual | $692 | |

Cumberland Mutual | $544 | |

Chubb | $890 | |

Security First Insurance | $713 | |

Cincinnati Insurance | $1,270 | |

DB Insurance | $286 | |

American National | $508 | |

Auto-Owners Insurance | $1,011 | |

Allstate | $856 | |

West Bend Mutual | $1,014 | |

Armed Forces Insurance | $1,132 | |

State Auto | $1,273 | |

Armed Forces Insurance | $1,037 | |

Vermont Mutual | $517 | |

Brethern Mutual | $656 | |

Quincy Mutual | $836 | |

Auto-Owners Insurance | $236 | |

Auto-Owners Insurance | $1,158 | |

Allstate | $1,372 | |

Armed Forces Insurance | $1,363 | |

Chubb | $1,226 | |

American Family | $1,919 | |

Universal Group | $769 | |

NGM Insurance | $581 | |

Cumberland Mutual | $481 | |

Farmers | $1,581 | |

NYCM Insurance | $659 | |

Kemper | $708 | |

North Star Mutual | $1,382 | |

Westfield Insurance | $813 | |

Allstate | $3,086 | |

Mutual of Enumclaw Insurance | $430 | |

Cumberland Mutual | $480 | |

Narragansett Bay | $770 | |

USAA | $726 | |

State Auto | $312 | |

State Auto | $1,048 | |

Farmers | $478 | |

American Family | $617 | |

Auto-Owners Insurance | $515 | |

Cincinnati Insurance | $828 | |

Allstate | $586 | |

USAA | $1,072 | |

West Bend Mutual | $817 | |

USAA | $711 |

Cheapest home insurance rates by city

Your city and even your specific ZIP code can also impact your home insurance premiums. Cities or ZIPs with a high rate of burglary or arson often see higher rates and more restricted coverage than cities with less regional risk.

According to our analysis of the 20 biggest cities in the U.S., Farmers, CSAA, and Allstate offer the most affordable homeowners insurance premiums in more major cities than any other company.

City | Cheapest company | Average annual cost |

|---|---|---|

Farmers | $475 | |

Kemper | $798 | |

Allstate | $1,171 | |

American Select Insurance | $820 | |

Farmers | $556 | |

State Auto | $336 | |

Farmers | $400 | |

Farmers | $497 | |

Farmers | $519 | |

Allstate | $992 | |

Universal North America | $869 | |

Allstate | $818 | |

NYCM | $1,091 | |

American Select Insurance | $936 | |

Armed Forces Insurance | $725 | |

Farmers | $518 | |

USAA | $810 | |

CSAA | $800 | |

CSAA | $724 | |

Allstate | $586 |

Cheapest homeowners insurance by dwelling coverage amount

Your insurance premiums are primarily based on how much dwelling coverage you need to repair or rebuild your house in the event of a disaster. Your dwelling limit is based on things like your home’s square footage and the current price of labor and construction materials in your area — not the home’s market value or your remaining mortgage balance.

Below are the most affordable home insurance companies for various levels of dwelling coverage. Narragansett Bay has the lowest average annual premium for a policy with $100,000 in coverage, while USAA is the cheapest company for policies with $200,000 to $500,000 in coverage.

Company | $100k dwelling | $200k dwelling | $300k dwelling | $400k dwelling | $500k dwelling |

|---|---|---|---|---|---|

$743 | $1,105 | $1,432 | $1,725 | $2,009 | |

$727 | $1,115 | $1,491 | $1,855 | $2,220 | |

$634 | $1,078 | $1,558 | $2,011 | $2,472 | |

$809 | $1,177 | $1,596 | $2,035 | $2,509 |

Cheapest homeowners insurance for bundling

Below are five of the cheapest home insurance for multi-policy discount deals. If you need both home and auto insurance and you’re interested in bundling, you might want to consider State Farm first.

Company | Average annual rate with discount | Average savings |

|---|---|---|

$1,487 | 30% | |

California Casualty | $1,493 | 18% |

$1,496 | 20% | |

$1,581 | 17% | |

$1,610 | 6% |

Cheapest homeowners insurance if you have bad credit

One of the factors that impacts your home insurance premium is your credit score. Homeowners who have a history of bad credit are generally more prone to file claims than homeowners with good credit scores — leading to higher rates. However, there are a few low-cost homeowners insurance companies that are friendlier toward homeowners with less-than-stellar credit than others.

Here are the cheapest home insurance companies if you have bad credit:

Company | Average annual cost |

|---|---|

$1,121 | |

$1,306 | |

$1,592 | |

$1,702 | |

$1,824 |

Cheapest homeowners insurance if you have a history of claims

Some insurance companies will increase your rates after a single claim, while others may outright deny you coverage if you have multiple claims on your record. Below are the five cheapest home insurance companies for a homeowner with three claims over a five-year period, with Auto-Owners’ average annual rate of $1,365 being the lowest.

Company | Average annual cost |

|---|---|

$1,365 | |

$1,608 | |

$1,926 | |

$2,005 | |

$2,023 |

Cheapest homeowners insurance for older homes

Some insurers also consider older homes to be high risk due to the increased chance of structural damage and water damage due to plumbing leaks. Older homes are also generally built with more obsolete materials that can be expensive to replace.

With an average annual premium of $1,159, Auto-Owners’ average older home premium is nearly $800 lower than the next cheapest company.

Company | Average annual cost |

|---|---|

$1,159 | |

$1,930 | |

$2,047 | |

$2,085 | |

$2,579 |

Cheapest homeowners insurance if you have a dangerous dog breed

Home insurance companies often consider so-called aggressive dog breeds, like Rottweilers and pit bulls, to be a liability concern due to the chance of bites or attacks. If you own one of these breeds, your insurer could charge you higher premiums to offset the heightened risk.

With an average annual rate of $1,191, Cincinnati Insurance offers the best price on home insurance for homeowners with an aggressive dog breed.

Company | Average annual cost |

|---|---|

$1,191 | |

$1,429 | |

$1,473 | |

$1,505 | |

$1,507 |

Cheapest homeowners insurance for high-deductible policies

Many insurance companies offer discount options and cheaper rates if you choose a high out-of-pocket deductible, but be careful about increasing it to an amount that you won’t be able to afford in the event of a claim.

Below are the companies that offer the most affordable rates for high-deductible policies. While Auto-Owners Insurance provides the cheapest average rates, State Farm and Hippo offer the biggest average savings.

Company | Average annual rate with discount | Average savings |

|---|---|---|

$713 | 18% | |

$1,020 | 3% | |

$1,071 | 49% | |

$1,131 | 15% | |

$1,170 | 13% |

Cheapest homeowners insurance for new homeowners

Most insurance companies also offer discounts to policyholders with new homes — or homes that are anywhere from 0 to 10 years old. According to our research, Auto-Owners Insurance and AAA top our list of the cheapest rates for new homeowners.

Company | Average annual rate with discount | Average savings |

|---|---|---|

$712 | 19% | |

$1,295 | 31% | |

$1,324 | 16% | |

$1,479 | 41% |

Cheapest homeowners insurance for low-income families

While insurance companies can't use your annual income to determine your home insurance premiums, in most U.S. states they are allowed to factor in your credit score. Generally speaking, this tends to adversely impact low-income families more than others.

However, there's a number of ways for low-income homeowners to find low-cost home insurance, such as bundling home and car insurance, looking into various discounts, and shopping around for cheaper rates.

Based on our analysis, Hippo, Allstate, Narragansett Bay, Cincinnati Insurance, and Travelers offer the most affordable home insurance coverage for homeowners with a poor credit score.

Company | Average annual cost |

|---|---|

$1,559 | |

$1,613 | |

$1,765 | |

$1,766 | |

$1,789 |

Cheapest homeowners insurance for seniors

Many home insurance companies offer discounts to seniors, retirees, or homeowners who live in a retirement community. Retirees likely spend more time at home, which means there’s less risk of break-ins and for sustained damage from covered losses like a pipe leak or fire.

Of the companies that offer discounts specifically to older adults or retirees, NYCM Insurance and Pacific Specialty top our list of the cheapest rates for seniors.

Company | Average annual rate |

|---|---|

$676 | |

$1,102 | |

$1,487 | |

$2,058 | |

$2,495 |

Cheapest homeowners insurance from smaller companies

While major home insurance providers tend to offer the most convenience, nationwide availability, and multi-policy bundling perks, you can often find cheaper and better coverage with small or regional insurers.

If you’re looking for personalized customer service and claims handling from a local agent, consider one of the following cheap regional home insurance companies.

Company | Average annual rate |

|---|---|

$437 | |

$659 | |

$661 | |

Texas Farm Bureau | $700 |

PEMCO | $736 |

$776 | |

$857 | |

$954 | |

$1,002 | |

$1,081 | |

$1,128 | |

$1,287 | |

$1,373 | |

California Casualty | $1,484 |

How to get cheap home insurance quotes

When getting homeowners insurance quotes, there are several things you can do to ensure you’re not overpaying for coverage. Below are the best ways to find a low-cost homeowners insurance company.

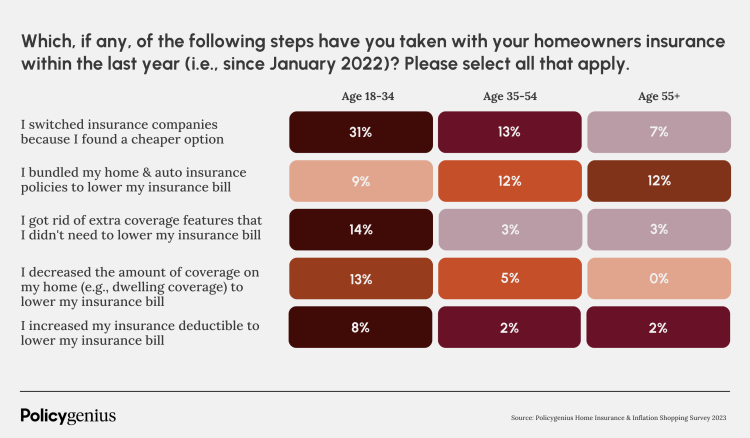

How real customers lowered their home insurance bill

With the increase in insurance rates nationwide over the last year, Policygenius ran a survey to see what homeowners were doing to offset these high costs and lower their insurance bill.

According to our Policygenius Home Insurance & Inflation Shopping Survey, 51% of homeowners lowered their home insurance costs last year by switching companies for a cheaper option, followed by 33% who bundled their home and auto insurance policies to get a cheaper rate.

Bottom line: Is cheap homeowners insurance best for me?

When deciding on a policy, you may be tempted to go with the cheapest homeowners insurance quote or a policy with comparably worse coverage but more affordable premiums than others.

Before doing this, consider the fact that while you may save on premiums in the short term, you could find yourself in a tough spot should you have to file a claim — potentially costing you more in the long run.

In other words, you’ll likely see cheaper rates if you lower your dwelling coverage limit or switch to a less comprehensive type of home insurance (like an HO-1 or HO-2). But doing this could also leave you underinsured and unable to rebuild after a disaster, or your policy may simply not be broad enough to cover the type of damage or loss you’re claiming.

In both cases, you’re potentially having to pay tens of thousands of dollars out of pocket to get your home back to its original condition. That’s why it’s important to pick a company that offers a mix of affordable rates, financial stability, dependable customer service and claims handling, and high-quality coverage options that work for your home.

Find the best cheap homeowners insurance near you

Below are the most highly-rated insurers in each state, according to our analysis of the best home insurance companies in the U.S. Click on your state for our guide to the best-priced homeowners insurance companies where you live.

State | Top-rated company | Average annual cost |

|---|---|---|

USAA | $1,035 | |

USAA | $1,712 | |

USAA | $856 | |

USAA | $2,476 | |

USAA | $994 | |

USAA | $2,286 | |

USAA | $1,233 | |

Allstate | $1,102 | |

USAA | $990 | |

State Farm | $2,128 | |

USAA | $1,639 | |

Allstate | $471 | |

USAA | $1,143 | |

USAA | $1,387 | |

USAA | $1,340 | |

USAA | $1,796 | |

Auto-Owners Insurance | $2,172 | |

Auto-Owners Insurance | $2,489 | |

USAA | $2,504 | |

Auto-Owners Insurance | $704 | |

USAA | $1,351 | |

USAA | $1,257 | |

USAA | $1,352 | |

Auto-Owners Insurance | $1,158 | |

USAA | $2,032 | |

USAA | $1,791 | |

USAA | $1,642 | |

USAA | $2,989 | |

USAA | $955 | |

USAA | $1,089 | |

USAA | $1,100 | |

State Farm | $1,796 | |

Allstate | $1,522 | |

USAA | $1,939 | |

Auto-Owners Insurance | $2,155 | |

USAA | $1,187 | |

USAA | $3,957 | |

USAA | $1,080 | |

USAA | $880 | |

Allstate | $1,403 | |

USAA | $726 | |

USAA | $2,312 | |

USAA | $1,646 | |

USAA | $2,609 | |

USAA | $1,197 | |

USAA | $881 | |

Auto-Owners Insurance | $1,240 | |

USAA | $1,023 | |

USAA | $1,072 | |

USAA | $1,135 | |

USAA | $711 |