Home break-in rates in the U.S. have been falling steadily since 1991, with a significant decrease in the annual number of burglaries happening every year since 2011. [1] While this is great news, home break-ins are still a very real issue. Over 1.7 million homes were subject to property crimes in 2020, according to the FBI. [2]

Because burglary is still a serious concern for most people, it is important to have homeowners insurance coverage to protect your home and belongings in case you end up on the wrong side of these statistics.

Home break-ins by the numbers

Home burglary statistics change from one year to the next. While we have seen a noticeable decrease in your overall chances of home invasion, the threat is still very real. Some common home burglary statistics are listed below:

522,426 burglaries occurred in the U.S. in 2020 [3]

62% of those burglaries were home break-ins [4]

24% of all burglaries were committed by people who knew their victim in 2020 [5]

$2,661 was the average loss per burglary in 2019 [6]

290,909 home burglaries took place during the daytime in 2019 [7]

56% of burglaries involved forcible entry in 2019 [8]

38% of burglars walked into an unlocked home in 2019 [9]

1.4 million firearms were stolen during home burglaries and other property crimes from 2005 to 2010 [10]

50% of burglars live within 2 miles of the house they steal from [11]

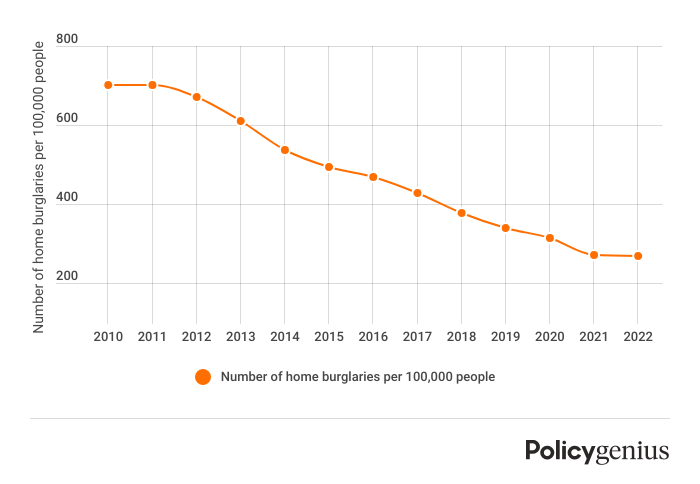

Home break-ins per year

Home burglaries decreased 60% over the past 10 years, according to our analysis of FBI data.

Here’s a look at how the numbers shake out.

Source: FBI Crime Data Explorer

Does homeowners insurance cover home break-ins?

Yes, homeowners insurance protects your home and personal property in the event of a break-in. This includes replacing items that were stolen, as well as covering damage to your home caused by the break-in.

But how much you’ll get from a stolen property claim depends on what type of coverage you have. There are two main types of personal property coverage: replacement cost and actual cash value (ACV).

Replacement cost: Your insurer pays for you to replace your stolen goods with new items, no matter how long you owned it. For example, if your stolen TV was ten years old you’ll be given enough to buy a new TV, not the amount your insurance company thinks a ten-year-old TV was actually worth.

Actual cash value: Your insurer pays you what your items were actually worth after years of use and regular wear and tear. If your stolen TV was ten years old you’ll be given the value of a ten-year-old TV, which may only be a few dollars. If your policy offers ACV coverage and all of your belongings are a few years old, you could receive a small payout that only covers a fraction of the cost to replace your belongings after a burglary.

Most standard homeowners insurance policies come with ACV coverage for personal property. However, you can add on replacement cost coverage for an additional expense. While replacement cost policies are more expensive, it may be worth it to ensure your belongings are fully protected.

Learn more more about actual cash value vs. replacement cost insurance policies

How to protect your home from break-ins and save on homeowners insurance

Security equipment like burglary alarms and smart cameras can help protect your home from break-ins and, as a bonus, it may even earn you a discount on your homeowners insurance. Many insurers offer discounts if you make your home safer, because that means you’re less likely to file a claim.

The table below compares the average annual cost of homeowners insurance vs. the average cost when you install safety features like deadbolts, smoke alarms, and burglary alarms.

Average cost of homeowners insurance | Average cost with a deadbolt | Percentage difference | Average cost with a smoke alarm | Percentage difference | Average cost with a burglar alarm | Percentage difference |

|---|---|---|---|---|---|---|

$1,754 | $1,897 | -0.09% | $1,892 | -0.37% | $1,846 | -2.97% |