Russia’s invasion of Ukraine has raised the specter of a greater global conflict. Whether or not the war remains localized, the citizens and organizations caught in the middle could sustain catastrophic losses.

If you’re wondering whether you need insurance coverage to protect against losses caused by war, you should know that most common insurance policies specifically exclude war as something they cover. While there is such a thing as war risk insurance, it’s generally only suitable for very specific business purposes.

Does your insurance policy cover losses caused by war?

War can cause untold losses to human life and property — the types of losses that are typically covered by policies like homeowners, renters, auto, and life insurance. But most of these policies contain war exclusion clauses that say the insurer is not required to pay for losses caused by war-related events.

According to the Insurance Information Institute, war is considered fundamentally uninsurable because it is nearly impossible for insurers to accurately calculate risk and charge a fair premium for such an unpredictable event. In addition, the volume of claims that could be filed for wartime losses would make it financially impossible for insurers to stay in business. [1]

Workers compensation, which covers employees who are injured or killed while on the job, is the only traditional insurance policy that does not contain war exclusions.

What is war risk insurance?

War risk insurance is a type of policy that does cover losses caused by war, but it’s mainly geared toward businesses and individuals who work in or travel to high-risk areas of the world. General war risk insurance policies may cover war-related losses including damaged business assets like office buildings and property or lost income if operations are shut down.

“Companies operating in politically unstable parts of the world are more exposed to risk of loss from acts of war. War risk insurance may cover kidnappings and ransom, sabotage, emergency evacuation, worker injury, and loss or damage to property, cargo, supply chain,” says Janet Ruiz, a spokeswoman for the Insurance Information Institute.

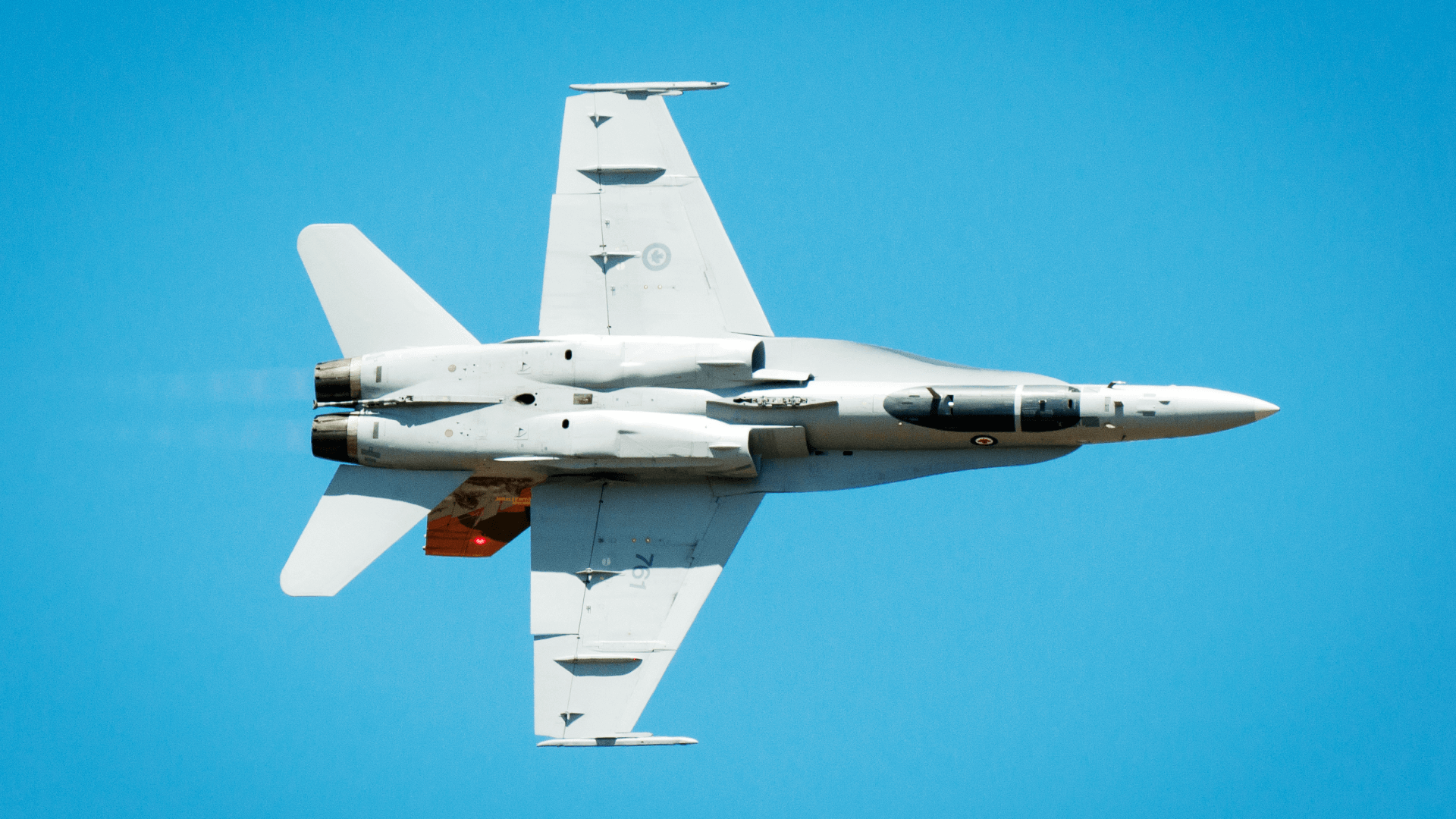

There are also war risk insurance policies created specifically for businesses in the aviation and maritime industries. For example, a shipping company may wish to purchase war risk liability insurance, which covers the people and property on a shipping vessel, and war risk hull insurance, which covers damage or losses to the vessel itself. Covered losses may include damage to property, loss of life, and business losses in the event the ship is damaged, sunk, seized, or detained.

“Aviation and maritime industries tend to have more specific war insurance options available to them,” says Ruiz. Some countries require airlines to secure war risk coverage before they enter their airspace or use their airports.

High-risk travel insurance can provide coverage when you or your employees travel to war zones or high-risk countries as part of the job. These travel policies may cover losses like accidental death and dismemberment, kidnap and ransom, and more. The basic travel insurance provided by your credit card probably won’t cover these types of scenarios.

Do you need war risk insurance?

With the exception of worker’s comp, the average person who has insurance for their life, car, or home probably won’t be covered in the event of war, says Ruiz. “Acts of war are usually excluded under homeowner/renter/auto personal insurance policies and considered uninsurable due to the expensive nature of such coverage.”

If you own a business or work for a business where war is a realistic threat, it’s worth looking into war risk insurance policies. Shipping companies, airlines, and businesses that operate or travel to high-risk countries may be eligible to purchase war risk insurance.

What about terrorism coverage? It’s important to note that acts of terrorism are categorized differently than acts of war, and may be covered by your existing insurance policies as there aren’t usually specific exclusions like there are for war. Check with your insurer to find out what unexpected events you’re covered for in the event of a disaster.

Image: Yiming Cheng / Getty Images