What is term life insurance?

Term life insurance is a policy that lasts a set term — usually between 10 and 30 years — and then it expires.

You make premium payments in exchange for coverage. If you die during your policy’s term, the insurer will pay your beneficiaries a tax-free sum of money called the death benefit.

At the end of the term, your coverage will expire (unless you renew your policy).

Term life is the most affordable way to provide a financial safety net for your loved ones.

It’s easy to manage and provides coverage during the period of your life when you have the biggest expenses, such as a mortgage to pay off, or young children to support.

How does term life insurance work?

To activate a term life insurance policy, you’ll have to complete application paperwork, and oftentimes, take a medical exam. After that, the insurance company will review your application materials before approval.

Once you’re approved, you’ll sign your policy paperwork and pay your first premium to activate your coverage.

You’ll have financial protection as long as you continue paying your premiums — until the end of the term.

In most term life policies, your premium payments and your death benefit remain the same for the length of your policy. This makes it easy to plan your budget

Unlike whole life insurance, term life insurance doesn’t have a cash value feature, so it can’t be used as an alternative savings or investment vehicle.

What are the different types of term life insurance policies?

The main differences between the different types of term life policies on the market have to do with the length of the term and the coverage amount they offer.

Level term life insurance comes with both level premiums and a level death benefit, which means they stay the same throughout the duration of the policy. This is the most common and popular type of term life insurance.

Annual renewable life insurance is also known as yearly renewable term, and has a term of only one year. It can be renewed on a yearly basis, but premiums will increase every time you renew the policy.

Increasing term life insurance, also known as an incremental term life insurance plan, is a policy that comes with a death benefit that increases over time. It’s usually more complex and expensive than level term.

Decreasing term life insurance comes with a payout that decreases over time. It’s commonly used to cover loans, like a mortgage. The most popular type of decreasing term policy is mortgage protection insurance (MPI).

Return-of-premium life insurance refunds all or part of your premium payments if you outlive the policy’s term. It’s usually two to three times more expensive than level term.

Convertible term life insurance allows you to convert your policy to permanent life insurance at the end of your initial term. Many policies include this option by default.

What are the main pros & cons of term life insurance?

Pros

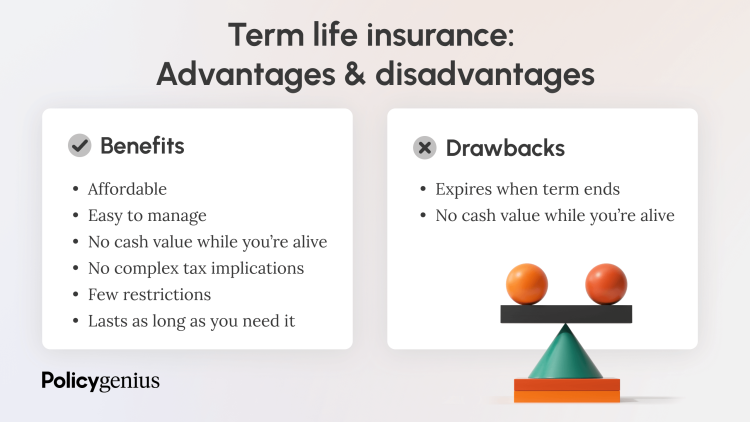

Term life insurance is affordable. Even though 50% of non-life insurance owners cite cost as a reason they don’t have coverage, [1] term life is one of the cheapest kinds of life insurance. You can often get the coverage you need at a manageable price.

Term life is easy to manage and understand. Unlike permanent options like whole life insurance or universal life insurance, term life policies don’t have any complex tax implications or restrictions.

It provides coverage when you most need it. Term life offers financial protection during the period of your life when you have major financial obligations to meet, like paying a mortgage or funding your children’s education.

Cons

Term life insurance has an expiration date. At the end of the term, you’ll need to buy a new policy, renew it at a higher premium, or convert it into permanent life insurance if you still want coverage.

Term life doesn’t have a cash value savings component. Unlike permanent life policies, term life policies only offer a guaranteed lump-sum death benefit.

Who should consider a term life insurance policy?

Anyone looking for an affordable, easy way to offer their loved ones a financial safety net for a set period of time in the event of their death should consider buying term life insurance.

Newlyweds, married couples, and people who share expenses with a partner. Term life can provide your spouse with support if they had to live without your income or contributions to the household.

Parents, guardians, and people planning on having children. Term life is an affordable way to provide a financial safety net when raising children. According to LIMRA’s 2023 life insurance barometer study, only 49% of people with dependents who don’t have life insurance feel secure about their finances if one partner were to pass away, compared to 69% of respondents with dependents who do own life insurance. [2]

Homeowners with a mortgage, or people with other significant debt. A term life policy can help your dependents cover any outstanding debts they might be responsible for in your absence.

Term life insurance can provide financial solutions for a wide demographic of people — total term life premiums in the U.S. are forecasted to grow up to 3% throughout 2024 and 2025. [3]

How much does term life insurance cost?

A 30-year-old non-smoking female in good health can expect to pay $22 per month ($264 per year) for a 20-year term life insurance policy with a $500,000 payout. A 30-year-old with a similar health profile can expect to pay $29 per month ($336 per year) for a policy with the same coverage.

Average monthly term life insurance rates

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15.01 | $22.65 | $33.63 |

Male | $19.18 | $30.20 | $47.51 | |

30 | Female | $15.17 | $22.98 | $36.90 |

Male | $18.19 | $29.32 | $48.89 | |

40 | Female | $21.66 | $35.27 | $60.65 |

Male | $25.39 | $42.94 | $75.24 | |

50 | Female | $43.92 | $78.29 | $139.50 |

Male | $56.69 | $102.50 | $188.29 | |

60 | Female | $107.83 | $194.16 | $354.51 |

Male | $149.38 | $268.04 | $499.98 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Is term life insurance better than whole life insurance?

Term life is a good fit if you’re looking for an affordable life insurance policy that only lasts for a set period of time. If you need permanent coverage or are considering life insurance as an investment alternative, whole life might be a better option for you.

The main differences between term life and whole life are:

The length of your coverage: Term life lasts for a set period of time and then expires. Whole life insurance never expires. If you have long-term financial obligations or coverage needs, like dependents who require lifelong care, whole life might be a better fit.

The cash value: Whole life policies offer a separate cash value account, which you can borrow from while you’re still alive. Term life only offers a lump-sum payout called the death benefit.

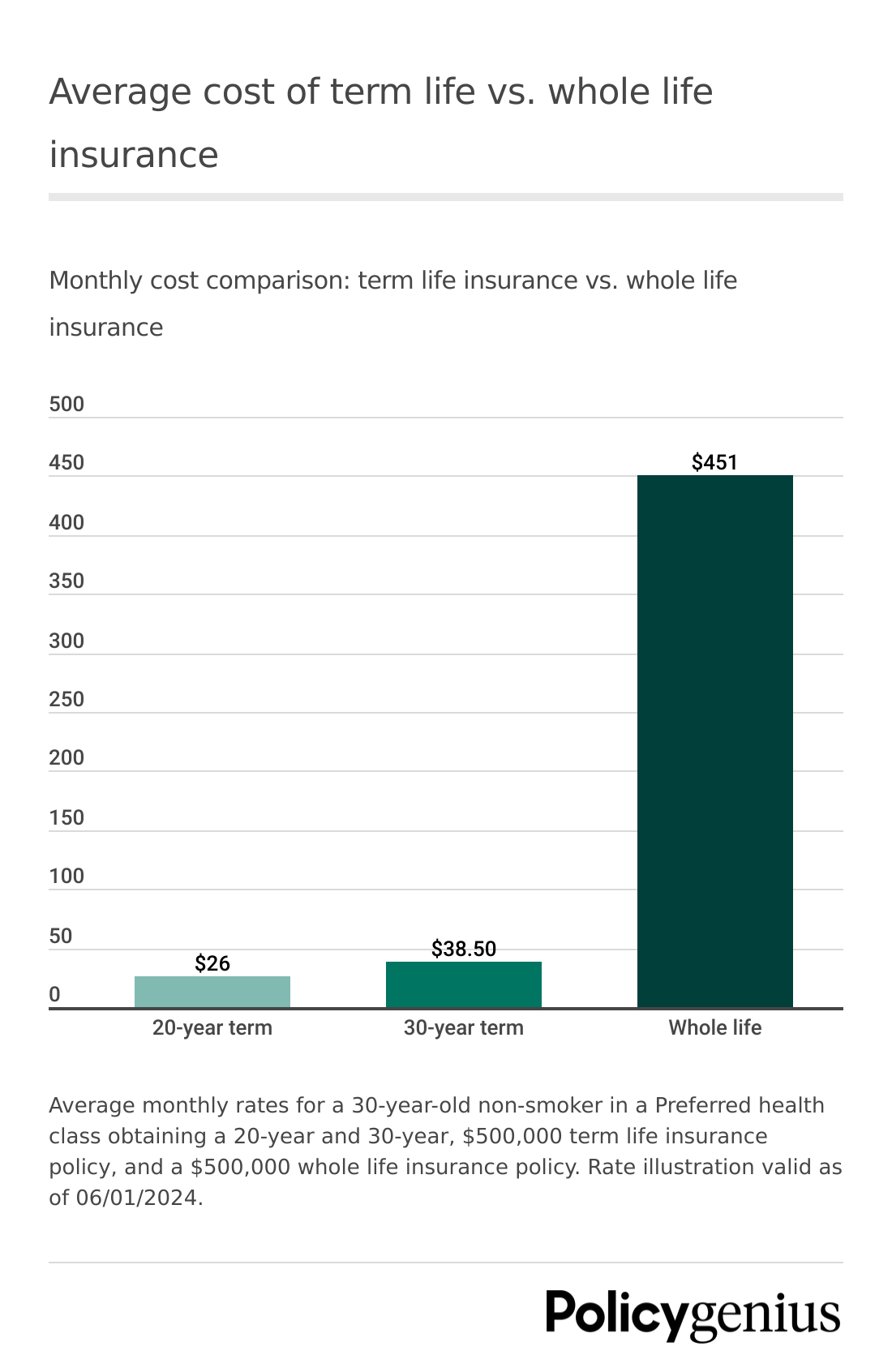

The cost: Whole life is significantly more expensive than term life.

Comparing term life vs. whole life

Features | Term life insurance | Whole life insurance |

|---|---|---|

Permanent coverage | No — maximum of 40 years | Yes |

Cost* ($500,000 coverage amount) | $26/month for a 20-year term | $451/month |

Guaranteed death benefit payout | Yes | Yes |

Guaranteed cash value | No | Yes |

Premium cost stays fixed | Yes, in most cases | Yes, in most cases |

Pays annual dividends | No | Yes, in some cases |

*Methodology: Average monthly term life insurance rate is for male and female non-smokers with a Preferred health classification obtaining a 20-year, $500,000 policy. Term life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Average monthly whole life insurance rate is calculated for non-smokers in a Preferred health classification, obtaining a whole life insurance policy paid up at age 100 offered by Policygenius from MassMutual. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/01/2024.

Read more about the differences between term life and whole life insurance

How & where can you buy term life insurance?

You can buy life insurance from an independent broker that works with multiple companies, or directly from an individual insurance company. At Policygenius, our agents can help you compare quotes from different term life insurance companies to find the right coverage at a price that works for you.