Final expense insurance, also called burial insurance or funeral insurance, is a type of permanent life insurance policy that is designed to cover end-of-life expenses.

Final expense insurance has more expensive rates and lower available coverage amounts than term life insurance, which is meant to replace income and lasts for a specific length of time.

Burial insurance is best for people who don’t qualify for traditional coverage due to serious health issues or older adults who only need a small amount of coverage.

Best overall: Mutual of Omaha

Cheapest: Mutual of Omaha

Best for seniors: Mutual of Omaha

Best for fast approval: Corebridge Financial

Best for additional benefits: Corebridge Financial

Best overall final expense insurance

Mutual of Omaha offers a variety of products for final expense, including simplified issue and guaranteed issue life insurance options, so people with a wide array of health conditions can get coverage that’s best suited for them.

The typical turnaround time for an application is one to five days, depending on the specific policy. You can apply for up to $40,000 in coverage for the simplified issue product, and up to $25,000 for the guaranteed issue product.

Cheapest final expense insurance

Mutual of Omaha

Mutual of Omaha’s product offerings are cheaper than some of its competitors. The company also offers coverage amounts as low as $2,000, which can help keep premiums low.

Best final expense for seniors

Mutual of Omaha

Mutual of Omaha’s variety of policy options makes them ideal for seniors in varying degrees of health.

To be eligible for their simplified issue final expense life insurance, you have to be under the age of 80. To be eligible for their guaranteed issue life insurance policy, you have to be under the age of 85.

Best final expense for fast approval

Corebridge Financial’s turnaround time for their guaranteed issue whole life policy is typically one to three days. You can even get approved on your initial phone call for up to $25,000 in coverage.

Mutual of Omaha

Mutual of Omaha’s guaranteed issue whole life option also allows you to get approved on the initial phone call. Turnaround time is similar to Corebridge Financial (formerly AIG Life & Retirement) — one to three days.

Best final expense insurance for additional benefits

Corebridge Financial

Corebridge Financial’s guaranteed issue whole life option comes with two additional benefits at no extra cost.

The chronic illness accelerated benefit allows you to request a refund of all of your premiums paid in a lump sum if you become chronically ill or can’t complete two out of six activities of daily living.

The terminal illness benefit can provide you with 50% of your death benefit if you are diagnosed with a terminal illness

How much does final expense insurance cost?

Burial insurance is generally more expensive than other types of life insurance, like term, because it’s a type of whole life insurance.

This means it’s a permanent policy and doesn’t expire. You can still apply for affordable final expense coverage — you might just have a lower death benefit, but it’ll last your whole life.

Some types of final expense insurance, like guaranteed issue in particular, are more expensive because they don’t exclude people based on their health. Generally speaking with life insurance, the more health conditions you have, the higher you’ll pay in premiums.

Average monthly simplified issue final expense insurance rates by age and gender

Age | Gender | $10,000 coverage amount | $20,000 coverage amount | $40,000 coverage amount |

45 | Female | $22.61 | $42.01 | $80.81 |

Male | $27.11 | $51.01 | $98.83 | |

55 | Female | $27.71 | $52.21 | $101.21 |

Male | $35.95 | $68.69 | $134.18 | |

65 | Female | $41.01 | $78.82 | $154.43 |

Male | $56.48 | $109.75 | $216.31 | |

75 | Female | $72.41 | $141.62 | $280.03 |

Male | $99.97 | $196.74 | $390.28 |

Methodology: Monthly rates are calculated for male and female non-smokers obtaining a simplified issue, final expense whole life policy through Mutual of Omaha. Rates may vary by age and health class. Not all policies available in all states. Rate illustration valid as of 01/01/2024.

Average monthly guaranteed issue final expense insurance rates by age and gender

Age | Gender | $5,000 coverage amount | $10,000 coverage amount | $20,000 coverage amount |

55 | Female | $19.24 | $37.49 | $73.97 |

Male | $23.19 | $45.38 | $89.76 | |

65 | Female | $25.49 | $49.98 | $98.96 |

Male | $34.74 | $68.47 | $135.95 | |

75 | Female | $44.73 | $88.46 | $175.93 |

Male | $57.13 | $113.25 | $225.51 |

Methodology: Average monthly rates are calculated using male and female rates for sample guaranteed issue whole life policy options from Mutual of Omaha. Rates may vary by insurer, coverage amount, and state. Rate illustration valid as of 01/01/2024.

Average monthly cost of final expense instance vs. term insurance

Below is a comparison of final expense policies and 10-year term policies. When you’re younger, term policies for higher coverage amounts are often cheaper than burial policies, but as you get older, the difference in cost becomes more pronounced.

Age | Gender | $20,000 simplified issue policy | $20,000 guaranteed issue policy | $250,000, 10-year term policy |

45 | Female | $42.01 | $54.78 | $31.80 |

Male | $51.01 | $71.77 | $38.60 | |

55 | Female | $52.21 | $73.97 | $62.78 |

Male | $68.69 | $89.76 | $86.76 | |

65 | Female | $78.82 | $98.96 | $144.58 |

Male | $109.75 | $135.95 | $201.05 | |

75 | Female | $141.62 | $175.93 | $460.37 |

Male | $196.74 | $225.51 | $678.53 |

Methodology: Average monthly rates are calculated for male and female non-smokers obtaining a $20,000 guaranteed issue whole life policy through Mutual of Omaha, a $20,000 simplified issue whole life policy through Mutual of Omaha, or a $250,000 10-year term policy based on an average of carrier rates offered through the Policygenius marketplace at a standard health rating. Rates may vary by individual policy, health, age, and gender. Not all policies available in all states. Rate illustration valid as of 01/01/2024.

What is final expense life insurance?

Burial insurance is a type of whole life insurance policy intended to cover final expenses, like funeral, burial, or medical bills. Final expense insurance is also commonly referred to as burial insurance for this reason.

Final expense insurance policies typically have a maximum coverage amount of $20,000 to $40,000, depending on the insurance company. They also have fewer underwriting requirements than traditional term or whole life, so you don’t have to take a medical exam to apply.

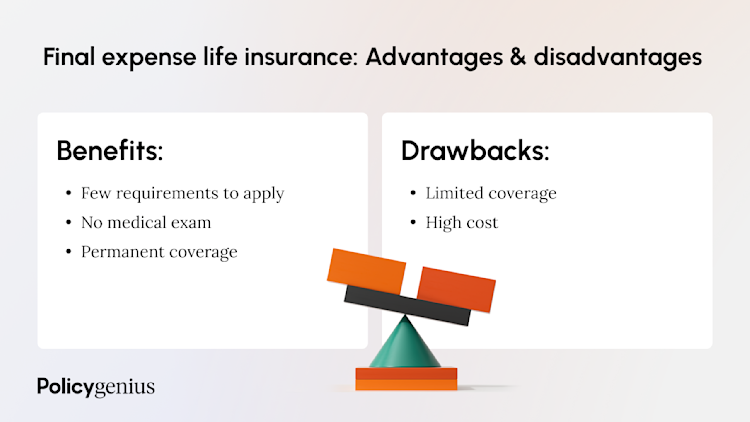

Benefits of final expense insurance

Stays active your whole life, as long as you pay the premiums

Few health requirements to apply

Shorter waiting period than other types of life insurance

Drawbacks of final expense insurance

More expensive than other types of life insurance

Limited coverage amounts

How does final expense insurance work?

Final expense insurance works much like other life insurance products. You pay a premium to the insurance company — usually monthly or annually — and in exchange, the insurance company will pay out a death benefit to your beneficiary when you die.

Burial insurance is permanent — it’s a type of whole life insurance with a cash value — so you can guarantee your beneficiary will be able to file a claim when you’re gone.

For some final expense insurance policies, the first two years the policy is active are subject to something called a graded death benefit.

If you die of natural causes within the first two years of the policy, your beneficiary will receive 110% of the premiums you’d paid instead of the full coverage amount.

If you die by suicide during that period, your policy will pay the beneficiaries 100% the premiums you have paid.

If you die from an accident during that period, your beneficiaries will get 100% of the policy’s death benefit.

Final expense insurance vs. funeral insurance vs. burial insurance: What’s the difference?

Final expense life insurance, funeral insurance, and burial insurance all refer to the same product. When people use these terms, they typically mean a small whole life policy that is designed to cover end-of-life expenses like funeral or medical bills.

Funeral insurance can also sometimes refer to a pre-paid funeral plan, also called pre-need insurance, which delivers the death benefit straight to the funeral provider for a pre-planned funeral.

Pre-need funeral service can be risky as it doesn’t protect against the fact that ownership of the funeral provider might change.

What does a final expense insurance policy cover?

Final expense insurance policies will pay out the death benefit to your beneficiary when you die.

Some final expense policies have a two-year exclusion graded benefit period, during which if you die by suicide or of natural causes, your beneficiary will receive either 100% or 110% of the premiums paid in, respectively. The death benefit is meant to cover end-of-life expenses, such as funeral costs, which can include body preparation fees, ceremony fees, a casket, or cremation.

Types of final expense insurance

Simplified issue life insurance

Simplified issue life insurance is a type of life insurance policy that can be obtained quickly by answering a few health questions. You don’t need to take a medical exam for this type of policy.

Final expense whole life policies are a type of simplified issue life insurance. These kinds of simplified issue policies usually offer a maximum coverage of $40,000 to $50,000, depending on the insurer.

You can typically get simplified issue whole life insurance if you’re between the ages of 45 and 85.

Guaranteed issue life insurance

Guaranteed issue life insurance is a type of whole life policy that offers near-certain approval. This type of policy is best for people who cannot qualify for traditional life insurance or simplified issue policies.

For this type of policy, there’s no medical exam and the health questions are minimal — you’ll just need to discuss with the agent working on your application so they can match you to the right policy. The turnaround time for approval is typically one to three days.

Pre-need insurance

Pre-need policies are final expense policies set up with a specific funeral service or provider. You purchase the policy through the funeral provider, and the funeral provider is the beneficiary.

There’s a risk with pre-need policies that they may not transfer if the funeral home changes ownership. If you can qualify for other final expense policies, they are often better options because they offer more flexibility.

Final expense insurance vs. term life insurance

Final expense or burial insurance is a type of whole life policy, which is permanent and lasts your entire life. Term life insurance only lasts for a set term — 10-year, 20-year, and 30-year are the most common term life insurance policies.

Burial insurance is a policy that is intended for final expenses, so these policies offer lower coverage amounts. On the other hand, term life insurance is primarily intended as income replacement, so it’s common to buy hundreds of thousands of dollars, or even millions, in coverage.

Term insurance is meant to serve as a financial safety net so that your loved ones wouldn’t struggle financially if you were to pass away during your peak earning years.

Simplified issue vs. guaranteed issue vs. pre-need life insurance at a glance

Policy type | Premiums | Permanent? | Beneficiary | Coverage amount maximum |

Simplified issue (whole life) | Monthly or annually | Yes | Executor of estate/family member | $40,000 |

Guaranteed issue | Monthly or annually | Yes | Executor of estate/family member | $25,000 |

Pre-need | One lump sum payment | Yes | Funeral provider | Directly tied to funeral provider’s pricing |

Do you need final expense insurance?

If you know your loved ones would struggle financially to pay for funeral or burial services, a burial or final expense insurance policy may be worth it.

However, if you can qualify for a term life policy, the premiums will be lower and the available coverage higher. If you still have dependents or significant debt, like a mortgage, term life insurance is likely a better fit.

Final expense policies are best for people who cannot qualify for more affordable coverage, or people who want a small amount of permanent coverage.

How much final expense insurance do you need?

The average cost of a funeral and viewing in 2021 was about $7,800, according to the National Funeral Directors Association. [1]

Some common coverage amounts for final expense insurance are $5,000, $10,000, and $20,000 — although it depends on your specific needs.

If you have other outstanding bills that your loved ones would have to pay, you may want to look at higher coverage if you can. If, on the other hand, you have enough to self-insure for the cost of a funeral already, you may not need coverage.

Tips for buying final expense insurance

First, you’ll want to think through your needs for coverage. You can ask yourself questions such as:

Do I have any outstanding bills that my loved ones would have to pay in my absence?

Would my loved ones struggle to pay for my funeral?

Do I have health conditions that would make it difficult for me to qualify for a traditional policy?

If you think you need coverage but you’re not sure which type you can qualify for, speaking with an independent broker can help you understand your options.

At Policygenius, our experts are licensed in 50 states and can provide you with transparent, unbiased advice.

Alternatives to final expense insurance

Other than term life insurance, there are several other insurance products that can help pay for final expenses, including:

Pre-need insurance. Also called pre-need funeral insurance or pre-need burial insurance, this type of policy is offered by funeral homes and directors.

Pre-need funeral trust. This type of trust serves the same purpose as a pre-need funeral policy, but you contribute to a trust that earns interest over time instead.

Self-funded burial. If you’re financially comfortable in retirement, you may have the money you need to cover end-of-life expenses already.

Pre-need trusts and policies can be risky because the funeral home or service provider you’ve committed your money to could go out of business or change hands before you pass away.

Self-funding is usually the best alternative if you decide not to go with a final expense insurance policy.

That being said, speaking with a licensed expert can help if you need financial protection and you’re not certain about your options due to your age or health.

Learn more about other types of life insurance:

If you or someone you know is in crisis, you can call the National Suicide Prevention Lifeline at 1-800-273-8255, or text the Crisis Text Line (text HELLO to 741741). Both services are free and available 24 hours a day, seven days a week. The deaf and hard of hearing can contact the Lifeline via TTY at 1-800-799-4889. All calls are confidential.