Unlike with other types of insurance, your location doesn’t actually affect what you pay for life insurance. What really affects your life insurance quotes is the amount of coverage you get, along with personal details like your health and age.

That’s why our picks for best life insurance companies in Illinois aren’t all that different from our best overall picks. But laws for grace periods, contestability, and product and company availability — these can vary by state, so it’s important to know what’s unique about buying life insurance in Illinois.

Policygenius rating | Best for … | AM Best score | Number of complaints | Cost | ||

|---|---|---|---|---|---|---|

4.9/5 ★ | Overall, cheapest, term life, young adults, smokers | A+ | Lower than average | $ | ||

4.9/5 ★ | Whole life | A++ | Much lower than average | $$$ | ||

4.1/5 ★ | Seniors | A+ | Lower than average | $$ | ||

4.8/5★ | Guaranteed universal | A+ | Much lower than average | $ |

Best overall life insurance company in Illinois

The best overall life insurance company in Illinois is Legal & General America, which also does business as Banner Life and William Penn in other states. Legal & General America offers a range of term lengths and affordable rates — even for applicants with diabetes, bipolar disorder, or another pre-existing condition that makes it hard to find cheap coverage.

Legal & General America also offers no-medical-exam life insurance to qualifying applicants, which can make getting life insurance a lot quicker.

Cheapest life insurance company in Illinois: Legal & General America

Legal & General America is our pick for cheapest life insurance in Illinois. But it’s worth remembering that your life insurance rates have nothing to do with where you live, so Legal & General is also our choice for the overall cheapest company, regardless of state.

The best way to find cheap life insurance is by comparing quotes from different companies before picking a policy. You’ll also save money if you buy coverage while you’re still relatively young, since the older you are when you apply for coverage, the more you’ll pay.

Best term life insurance in Illinois: Legal & General America

Legal & General America is also our pick for the best term life insurance company in Illinois. Term options range from 10 to 40 years — a wider range than most companies in the industry. Applicants between 20 and 75 years old may be able to qualify for up to $65 million in term life coverage.

A term life insurance policy is the best choice for most people. It’s pretty straightforward — you choose the “term,” or the length of the policy, and then if you die while the policy is active, your loved ones will receive a payment. Life insurance policies with longer terms mean more protection, but they also cost more.

Best whole life insurance in Illinois: MassMutual

The best whole life insurance company in Illinois is MassMutual. MassMutual has strong financial strength ratings (an A++ from AM Best), which is important for permanent life insurance policies.

A whole life policy — besides providing a payout to your family when you die — also includes a cash value portion that gains interest over time. You can take out money from this part of your policy while you’re still alive, and even use it to pay part of your premiums.

Best guaranteed universal life insurance in Illinois: Pacific Life

Pacific Life is the best life insurance company in Illinois if you’re looking for guaranteed universal life insurance. Pacific Life is our top choice in Illinois because of its affordable rates — even if you’re a smoker. Pacific Life also has an A+ rating from AM Best, which is important for universal life insurance.

A guaranteed universal life policy is guaranteed to pay out when you die. It can gain some cash value, but not as much as other types of permanent life insurance, though coverage tends to be cheaper than with whole life.

Best life insurance for seniors in Illinois: Prudential

The best life insurance company in Illinois if you’re a senior over age 60 or 65 is Prudential. That’s because you may still be able to find affordable rates with Prudential when you’re 60 or older — even if you have a health condition that’s related to your age, like osteoporosis or arthritis.

Best life insurance for young adults in Illinois: Legal & General America

The best life insurance for young adults in Illinois is Legal & General America. Legal & General is our top life insurance company for young adults because of its affordable rates. Legal & Generals also offers certain applicants between the ages of 25 and 50 a no-medical-exam option worth up to $3 million in coverage.

No-medical-exam life insurance lets you skip the medical exam part of the application process, making getting a policy much faster.

Best life insurance for marijuana users in Illinois: Lincoln Financial

We found that Lincoln Financial is the best life insurance for marijuana users in Illinois. That’s because Lincoln Financial treats marijuana users differently than tobacco users, which means better rates.

If you use marijuana, which is legal in Illinois, be sure to tell your life insurance company when you sign up for coverage. Otherwise your insurance company may deny a future claim.

Best life insurance for smokers in Illinois: Legal & General America

The best life insurance company for smokers is Legal & General America, which may offer lower rates than average for smokers. Smoking is always going to make life insurance more expensive, but a year after you quit, you can re-apply for cheaper rates with Legal & General America — other life insurance companies may only let you re-apply after two years tobacco-free.

How is life insurance different in Illinois?

Living in Illinois won’t affect the cost of your life insurance, but it does affect certain life insurance laws and regulations. [1] Here’s what you need to know if you’re shopping for life insurance in Illinois:

Contestable period: The contestable period in Illinois is two years. If your insurance company finds out you misrepresented yourself when you applied for coverage during the contestable period, your policy can be canceled and any claims denied.

Free look period: The free look period in Illinois is 10 days from when you buy a life insurance policy. This is the time during which you can cancel your policy and get a full refund.

Grace period for missed payments: You have 30 days to settle a missed payment before your life insurance company can cancel your policy for nonpayment.

Guaranty fund protection: The state of Illinois covers up to $300,000 in death benefits and $100,000 in cash settlement value if your life insurance company goes out of business.

Time to settle a claim: Life insurance companies have two months after receiving proof of death to settle a claim, according to Illinois law.

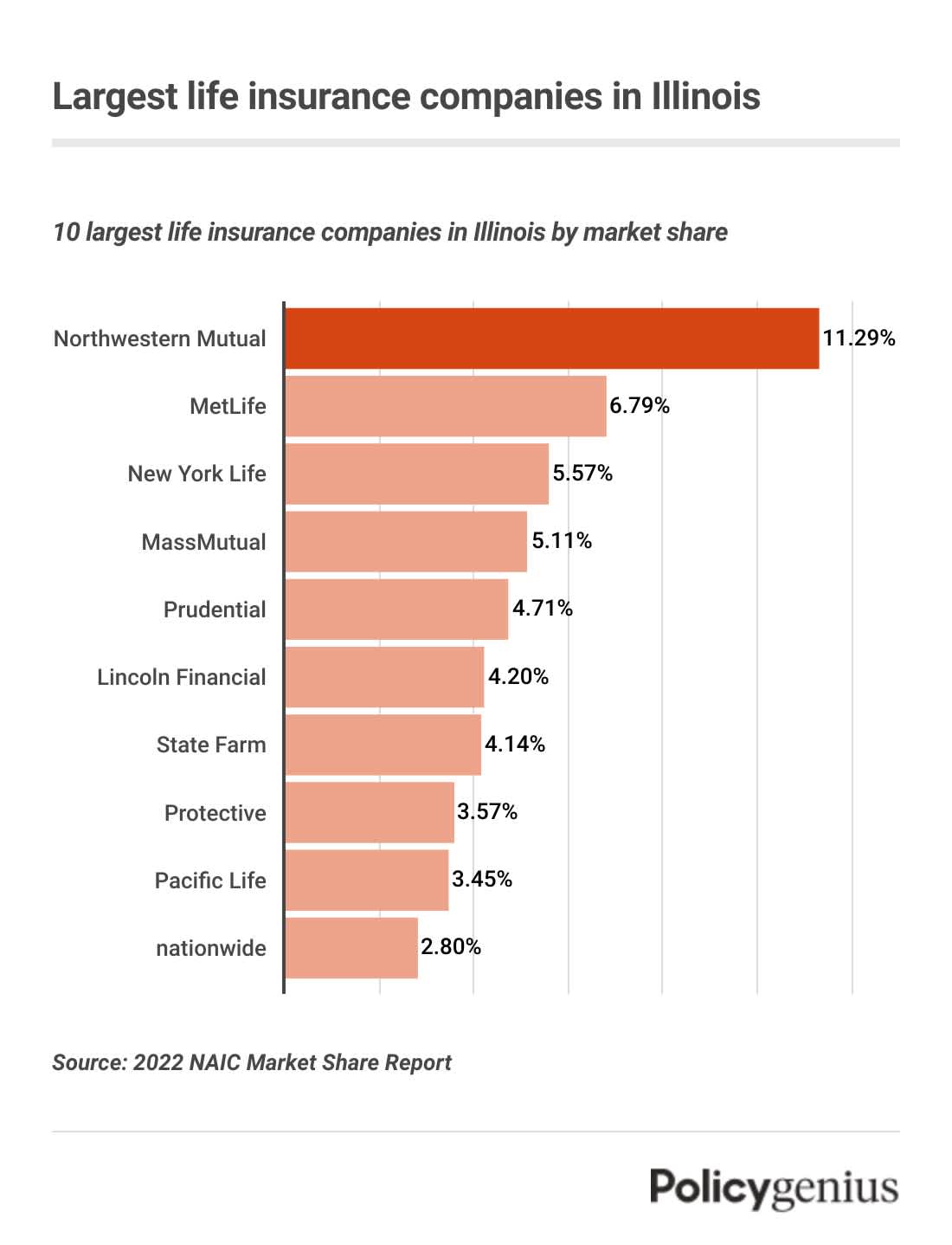

Largest life insurance companies in Illinois

Many of the largest life insurance companies in the country operate in Illinois. [2] Here are the 10 largest life insurance companies in Illinois by market share:

Company | Market share in Illinois |

|---|---|

Northwestern Mutual | 11.29% |

MetLife | 6.79% |

New York Life | 5.57% |

MassMutual | 5.11% |

Prudential | 4.71% |

Lincoln Financial | 4.20% |

State Farm | 4.14% |

Protective | 3.57% |

Pacific Life | 3.45% |

Nationwide | 2.80% |

What happens if a life insurance company goes bankrupt in Illinois

Your life insurance company probably won’t go bankrupt, but if it does, the Illinois Life and Health Insurance Guaranty Association can step in and cover part of your benefits.

The Illinois Life and Health Insurance Guarantee Association protects up to $300,000 of your life insurance benefits after a bankruptcy. You’re also protected for up to $100,000 of your life insurance cash settlement or withdrawal amount.

How to find a lost life insurance policy in Illinois

The Illinois Department of Insurance can help you or your family locate the life insurance policies or annuity contracts held by someone who died.

If you submit a request to the Department of Insurance, it will forward that request to all the life insurance companies in the state, which must respond if they have a policy in the name of the person who’s deceased.

Average life insurance rates in Illinois

According to Policygenius data from 2023, the average cost of life insurance for a healthy 35-year-old in Illinois looking for a $500,000, 20-year term life insurance policy is $27 per month ($307 per year) for women and $32 per month ($373 per year) for men.

But remember: while the cost of life insurance depends on many factors, where you live isn’t one of them.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15 | $23 | $34 |

Male | $19 | $29 | $48 | |

30 | Female | $15 | $23 | $37 |

Male | $18 | $29 | $49 | |

40 | Female | $22 | $35 | $61 |

Male | $25 | $43 | $75 | |

50 | Female | $44 | $78 | $139 |

Male | $57 | $102 | $188 | |

60 | Female | $108 | $194 | $355 |

Male | $149 | $268 | $500 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 09/01/2024.