Unlike home or auto insurance, where you live doesn’t affect what you pay for life insurance. Your life insurance rates depend largely on the kind of policy you buy and how much coverage you get, along with details about your health and medical history.

That’s why our picks for the best life insurance companies in New Hampshire are similar to our picks for the best overall companies. But your location can affect some things about buying life insurance, like company availability and local laws.

Policygenius rating | Best for … | AM Best score | Number of complaints | Cost | |

|---|---|---|---|---|---|

4.9/5 ★ | Overall, cheapest, term life, young adults | A+ | Fewer than average | $ | |

4.9/5 ★ | Whole life | A++ | Fewer than average | $$$ | |

4.8/5 ★ | Marijuana | A | Fewer than average | $ | |

4.8/5★ | Guaranteed universal life, no-medical-exam life | A+ | Fewer than average | $ | |

4.6/5 ★ | Pre-existing conditions, smokers | A | More than average | $ | |

4.1/5 ★ | Seniors | A+ | Fewer than average | $$ |

Best overall life insurance company in New Hampshire: Legal & General America

The best overall life insurance company in New Hampshire is Legal & General America, which also does business as Banner Life and William Penn in some states. We found that Legal & General America has affordable life insurance rates for both healthy applicants and people with certain health conditions.

We also like that Legal & General America receives about 60% fewer complaints from its policyholders than what’s expected in the industry, according to the NAIC.

Cheapest life insurance company in New Hampshire: Legal & General America

Legal & General America has cheap average life insurance rates overall, but remember that where you live doesn’t change what you’ll pay for life insurance. The best ways to find an affordable policy are by comparing life insurance quotes before you buy a policy and getting life insurance while you’re young and premiums are still cheap.

Best term life insurance in New Hampshire: Legal & General America

Legal & General America has the best term life insurance in New Hampshire. While most companies offer policies with terms up to 30 years, Legal & General America offers 40-year terms, and policies worth up to $65 million in coverage.

Term life insurance is the best type of coverage for most people. It’s a pretty straightforward concept — just choose the term length (how long you want your policy to last) and death benefit amount (how much you want your loved ones to get if you die). If you happen to die while the policy is active, your beneficiaries will be able to file a claim and receive a payment.

Best no-medical-exam life insurance in New Hampshire: Pacific Life

Pacific Life is the best company for no-medical-exam life insurance in New Hampshire. Applicants in good health may be able to qualify for up to $3 million in coverage without needing to take a medical exam.

No-medical exam policies just cut out the medical exam and approval process that’s usually required when you buy term life insurance. Eligibility rules vary by company, but you’re most likely to be a candidate for no-med life insurance if you’re young or you have a clean medical history.

Best whole life insurance in New Hampshire: MassMutual

The best whole life insurance company in New Hampshire is MassMutual. We like that MassMutual received an A++ rating from AM Best, the top rating. A whole life policy doesn’t expire, so you want to be sure your insurance company will be around as long as you are.

Whole life insurance is like a cross between a retirement account and life insurance policy. It comes with a cash-value component that gains value over time and that you can access while you're alive.

Best guaranteed universal life insurance in New Hampshire: Pacific Life

The best guaranteed universal life insurance in New Hampshire is Pacific Life, which earned an A+ from AM Best for financial stability. Pacific Life also has a terminal illness rider that lets you take out 75% of your policy’s death benefit if you’re terminally ill.

Guaranteed universal life insurance is a type of permanent coverage that’s may be a good option for people who have lifelong dependents and want to make sure they’re cared for. Policies are generally affordable and include a slow-growing cash-value component.

Best life insurance for seniors in New Hampshire: Prudential

We found that the best life insurance company for seniors in New Hampshire is Prudential, which accepts applicants up to age 70. Prudential also offers coverage for applicants with a number of age-related health conditions, like high blood pressure, osteoporosis, and even past heart attacks.

Best life insurance for young adults in New Hampshire: Legal & General America

The best life insurance company for young adults in New Hampshire is Legal & General America. Young applicants can qualify for Legal & General’s long term lengths and high coverage limits, even if they’re smokers. People 20 and over can apply for Legal & General’s no-med coverage option.

Best life insurance for pre-existing conditions in New Hampshire: Corebridge Financial

The best life insurance company in New Hampshire if you have a pre-existing condition is Corebridge Financial. Corebridge Financial offers coverage to applicants with certain common health conditions, like high cholesterol, Parkinson’s, or a history of some types of cancer.

Best life insurance for marijuana users in New Hampshire: Lincoln Financial

Lincoln Financial is the best life insurance company in New Hampshire if you use marijuana. Lincoln Financial doesn’t classify marijuana users as smokers, so your rates will be cheaper than with companies that group marijuana and tobacco users together. You may be able to find affordable rates even if you use marijuana up to six times a week.

Make sure to let your insurance company know if you use marijuana, since misrepresenting anything on your application can put your policy in jeopardy.

Best life insurance for smokers in New Hampshire: Corebridge Financial

Corebridge Financial is the best life insurance company for smokers in New Hampshire. Life insurance is always more expensive for smokers, but you may still be able to find affordable rates with Corebridge Financial. You can also reapply for cheaper coverage a year after quitting smoking — other insurance companies make you wait longer.

How is life insurance different in New Hampshire?

Simply living in New Hampshire won’t affect your life insurance rates, but there are some state-specific rules and regulations that you should know about. [1]

Contestable period: New Hampshire has a two-year contestability period for new policies. Your life insurance company can cancel your coverage or deny a claim if it finds out during this time that you misrepresented yourself when you applied for coverage.

Free look period: You can cancel a new policy within 10 days of buying it and still get a full refund.

Grace period: New Hampshire requires companies to give you a grace period of at least 31 days after a missed payment, though you can be charged interest during this period.

Guaranty Fund protection: New Hampshire’s Guaranty Association will cover up to $300,000 of your death benefits and $100,000 of your policy’s cash surrender value if your life insurance company goes out of business.

Time to settle a claim: Your life insurance company has to process a claim within 30 days of receiving proof of death or your benefit starts collecting interest.

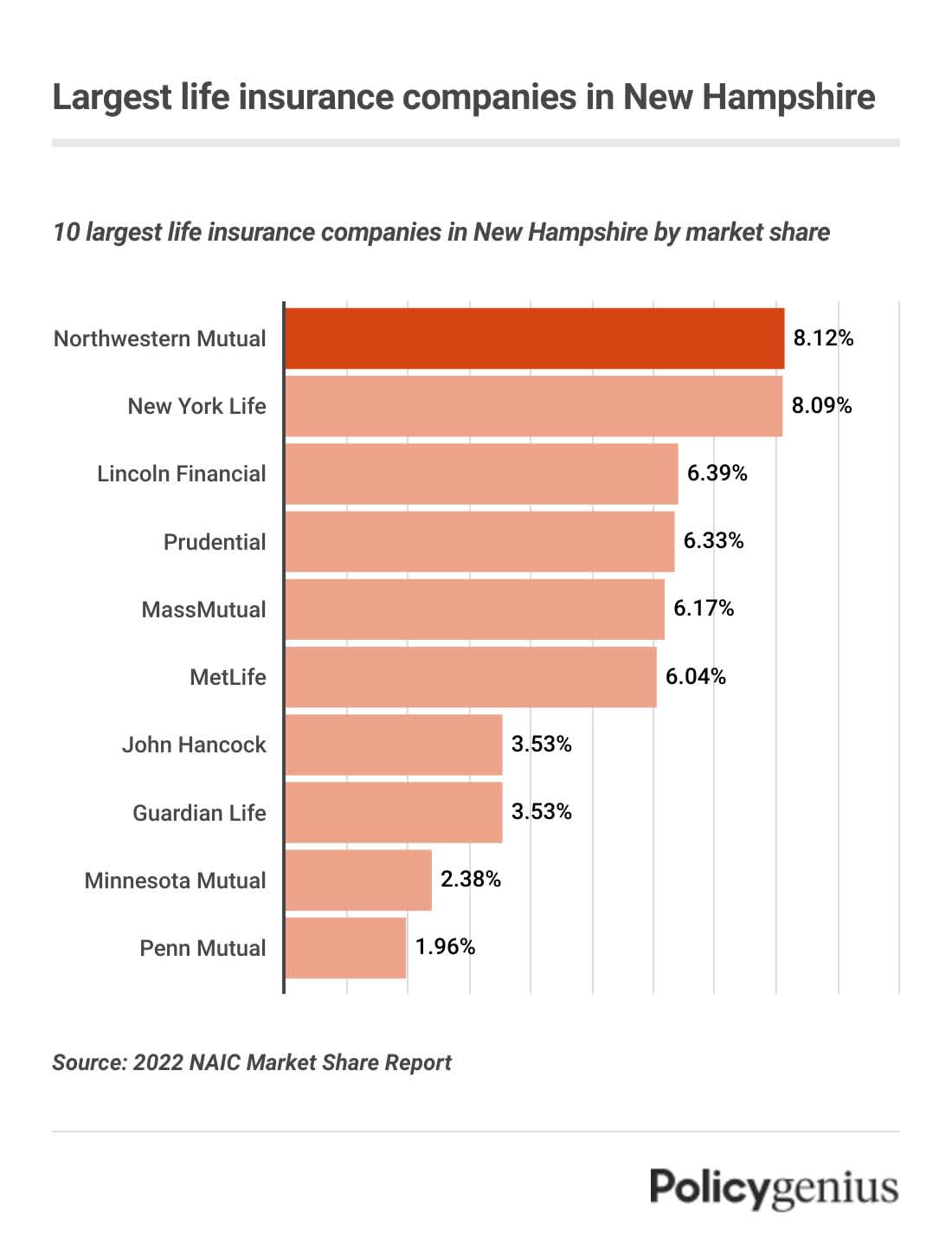

Largest life insurance companies in New Hampshire

Here are the 10 largest life insurance providers in New Hampshire. [2]

Market share in New Hampshire | |

|---|---|

Northwestern Mutual | 8.12% |

New York Life | 8.09% |

Lincoln Financial | 6.39% |

Prudential | 6.33% |

MassMutual | 6.17% |

MetLife | 6.04% |

John Hancock | 3.53% |

Guardian Life | 3.53% |

Minnesota Mutual | 2.38% |

Penn Mutual | 1.96% |

What happens if a life insurance company goes bankrupt in New Hampshire?

New Hampshire has a Guaranty Association that will cover part of your policy’s benefits if your life insurance company goes bankrupt. It covers up to $300,000 of your policy’s death benefits and up to $100,000 of its cash surrender value. As long as you keep paying your premiums, you can keep your coverage.

How to find a lost life insurance policy in New Hampshire

As long as you’re related to the deceased person, you can find a lost life insurance policy in New Hampshire by using the Life Insurance Policy Locator Service from the NAIC.

Average life insurance rates in New Hampshire

Using Policygenius data, we found that the average cost of life insurance in New Hampshire for a $500,000, 20-year term life insurance policy is $27 per month ($307 per year) for women and $32 per month ($373 per year) for men — though your exact premiums will depend on other personal factors.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15 | $23 | $34 |

Male | $19 | $29 | $48 | |

30 | Female | $15 | $23 | $37 |

Male | $18 | $29 | $49 | |

40 | Female | $22 | $35 | $61 |

Male | $25 | $43 | $75 | |

50 | Female | $44 | $78 | $139 |

Male | $57 | $102 | $188 | |

60 | Female | $108 | $194 | $355 |

Male | $149 | $268 | $500 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 09/01/2024.