The start of a new year often means revisiting goals like eating healthier, exercising more, losing weight and getting rid of bad habits. Another resolution may be to do money better.

If that’s the case, you may be able to tackle both at once. Aside from the physical benefits of improving one’s health, some new year’s resolutions, like losing weight, can also save you money in the long run.

We took a look at the healthiest and unhealthiest states in America to find out more on how health can impact your finances.

About this data

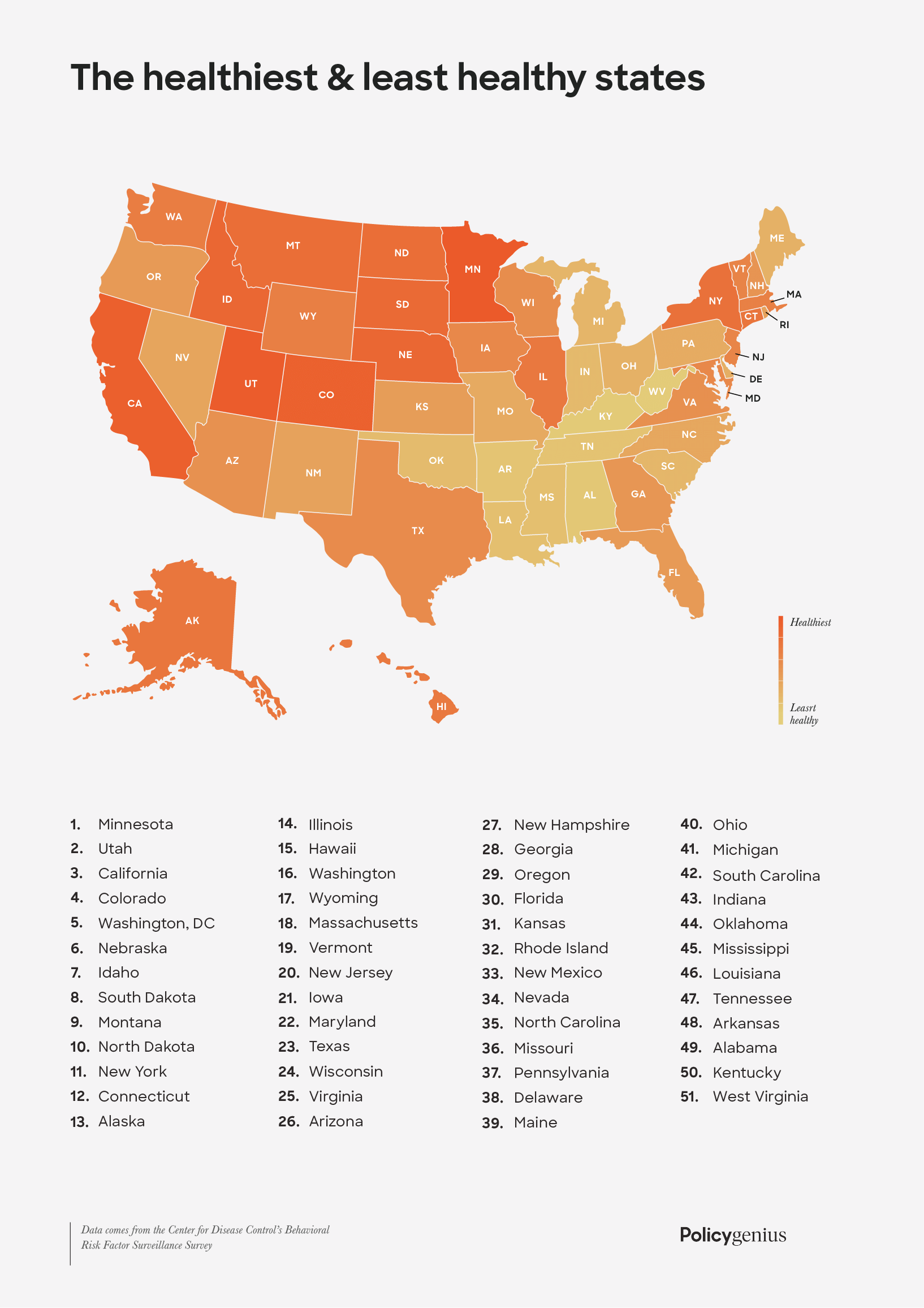

To create this index, we looked at common health conditions in America, including high blood pressure, high cholesterol, diabetes, cigarette use, asthma and depression. We took these conditions and weighted them equally to create a ranking of which states had the healthiest and unhealthiest people. The data comes from the Center for Disease Control’s Behavioral Risk Factor Surveillance Survey.

Here’s what we found.

Americans are unhealthy

American have high rates of chronic health conditions, including high cholesterol (33%), high blood pressure (32.2%), diabetes (9.4%) and asthma (7.9%). Almost 14% Americans use cigarettes, and 12.4% say they experience regular mental distress, according to CDC data.

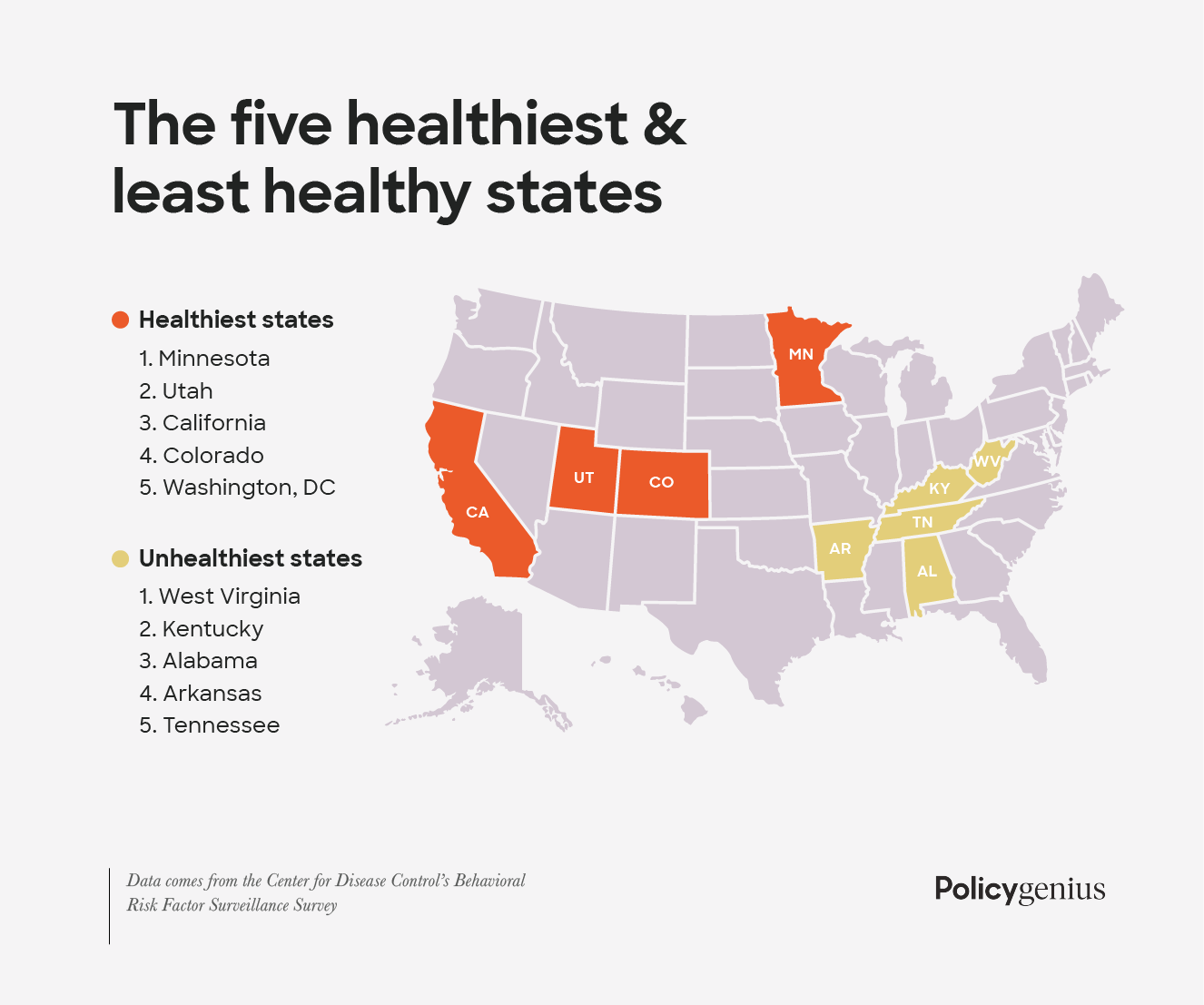

Health conditions vary widely across the country. Here’s a geographical look at the rankings.

Exploring the data

Minnesota was ranked the healthiest state, due to its low rates of high blood pressure (26.6%), asthma (7.3%) and cigarette use (14.5%).

West Virginia was ranked the unhealthiest state, due to its high rates of high cholesterol (39.7%), cigarette use (26%) and high blood pressure (43.5%). The state’s asthma rate was nearly twice as high as Minnesota’s.

Questions about the index? You can ask in the comments below.

How does health impact finances?

Living a healthy life can save you money in the long run. A recent study by researchers from Johns Hopkins Bloomberg School of Public Health found that weight loss at any age leads to long-term savings. For example, a healthy 50-year-old could save up to $36,000 in direct medical costs and productivity loss.

But what about other habits, like cigarette use? Quitting unhealthy vices can positively affect things like life insurance premiums.

Insurers use your health information to determine how likely you are to die during the coverage term. This helps them set premium rates. The riskier and less healthy you are, the bigger the chance insurers will pay out a benefit, so they charge higher rates as a hedge against that risk.

Applicants with harmful health habits will typically pay more for life insurance. For example, a 30-year-old man looking for a $500,000, 20-year term life insurance policy would pay $28.58 per month on average in premiums. A smoker would pay nearly three times more.

Unlike life insurance, health insurance companies can’t take your current or past health history into account when setting your premium, under the Affordable Care Act. The only exception is tobacco use. Learn more about the price impact of health conditions on insurance here.

How you can get life insurance when you’re unhealthy

Life insurance applicants are healthier than the average American. Even if you have a health condition, you may still be able to get affordable life insurance. Conditions like terminal cancer will mean you can’t get life insurance. But other chronic conditions, like high blood pressure or diabetes, could simply mean higher rates.

Lifestyle choices like losing weight or quitting smoking can lead to lower rates, though you typically have to keep the weight off for one year or have quit smoking for more than two years before your rates are affected.

“Getting healthy is always a good idea and can improve your rates in the long term,” said Nick Mancuso, senior operations manager for disability and advance planning for Policygenius. “The best time to start is now.”

Physical and financial health go hand in hand. If you’re still looking for resolution ideas for the next year (and decade), we have a list here.

Graphics: Nastia Kobzarenko

Image: Aleksander Nakic