Your location doesn’t actually affect your life insurance rates — your life insurance quotes will depend mostly on the type of policy you want, how much coverage you need, and personal details about your health and medical history.

That’s why our recommendations for the best life insurance companies in Oregon are similar to our picks for the best overall life insurance companies. But there are some Oregon-specific life insurance laws and regulations you should know about before you get a policy.

Policygenius rating | Best for … | AM Best score | Number of complaints | Cost | |

|---|---|---|---|---|---|

4.9/5 ★ | Overall, cheapest, term life, young adults | A+ | Fewer than average | $ | |

4.6/5 ★ | Smokers | A | More than average | $ | |

4.8/5 ★ | Pre-existing conditions, marijuana users | A | Fewer than average | $ | |

4.9/5 ★ | Whole life | A++ | Fewer than average | $$$ | |

4.1/5 ★ | Seniors | A+ | Fewer than average | $$ | |

4.8/5★ | Guaranteed universal, no-medical-exam life | A+ | Fewer than average | $ |

Best overall life insurance company in Oregon: Legal & General America

The best life insurance company in Oregon is Legal & General America, which also does business as Banner Life and William Penn in some states. Legal & General America is our top choice because you may be able to get cheap life insurance rates even if you have a spotty medical record or if you’re a smoker.

We also like that Legal & General receives fewer complaints from its policyholders than some competitors. According to the National Association of Insurance Commissioners, it gets about 60% fewer complaints from its policyholders than what’s expected.

Cheapest life insurance company in Oregon: Legal & General America

Legal & General America has some of the cheapest average life insurance rates, even for applicants who aren’t in perfect health (but remember that your location doesn’t affect your life insurance rates).

You can find affordable coverage no matter where you live by comparing quotes from multiple life insurance companies before you buy. It’s also a good idea to get coverage while you’re young, since your rates will only get higher as you age.

Best term life insurance in Oregon: Legal & General America

We found that the best term life insurance in Oregon is Legal & General America, which offers term lengths as long as 40 years. That’s more coverage than the 30-year term most other life insurance companies offer.

Term life insurance is the most straightforward type of life insurance. You choose the length of your policy (its term) and the amount you want your loved ones to get after your death, and if you die while your policy is active your family will collect a payment.

Best no-medical-exam life insurance in Oregon: Pacific Life

Pacific Life is the best company for no-medical-exam life insurance in Oregon. Applicants in good health may be able to qualify for up to $3 million in coverage without needing to take a medical exam.

No-medical exam policies just cut out the medical exam and approval process that’s usually required when you buy term life insurance. Eligibility rules vary by company, but you’re most likely to be a candidate for no-med life insurance if you’re young or you have a clean medical history.

Best whole life insurance in Oregon: MassMutual

MassMutual is the best whole life insurance company in Oregon. We chose MassMutual for its financial strength, which is especially important because whole life is permanent, meaning you want to make sure the company is around as long as you are.

In addition to a death benefit, a whole life policy has a cash value component that can gain interest over time, and even pay out dividends. You can also access your cash value portion while you’re alive.

Best guaranteed universal life insurance in Oregon: Pacific Life

The best company for guaranteed universal life insurance in Oregon is Pacific Life. It has great stability (an A+ for financial strength AM Best), which is important for permanent life insurance. You apply for coverage up until you’re 80 years old.

Guaranteed universal life insurance is worth considering if you’re looking for the lasting coverage of a permanent policy without paying the higher premiums for whole life insurance.

Best life insurance for seniors in Oregon: Prudential

We found that Prudential is the best life insurance option for seniors in Oregon. You may qualify for coverage until you’re 70 years old, even if you have a pre-existing health condition related to your age. Prudential also has a living benefit option that lets you take advantage of part of your benefits if you’re terminally ill.

Best life insurance for young adults in Oregon: Legal & General America

Legal & General America offers some of the cheapest life insurance rates for young adults regardless of their health profile. The company offers no-medical-exam and instant-decision options for young people who are in excellent health or have just one or two minor and well-controlled health conditions.

Best life insurance for pre-existing conditions in Oregon: Lincoln Financial

The best life insurance company in Oregon if you have a pre-existing medical condition is Lincoln Financial. It can be hard to find coverage at all if you have certain pre-existing conditions, but Lincoln Financial may offer you life insurance even if you’ve had a heart attack, or if you have asthma, epilepsy, and other conditions.

Best life insurance for marijuana users in Oregon: Lincoln Financial

Lincoln Financial is the best company in Oregon for life insurance if you use marijuana. That’s because Lincoln Financial won’t classify you as a smoker, meaning you can get cheaper rates than tobacco users. You may even be able to get affordable rates if you’re a regular user.

Make sure to be honest with your life insurance company if you use marijuana. If you die and your insurance company finds out you weren’t up front about your marijuana use, your loved ones may not be able to collect the death benefit.

Best life insurance for smokers in Oregon: Corebridge Financial

The best life insurance company for smokers in Oregon is Corebridge Financial. Your rates will still be more expensive than non-smoking rates but you can apply for better rates after one smoke-free year. Corebridge Financial also allows cigar smokers to qualify for the best rate tier provided they smoke four cigars a month or fewer.

How is life insurance different in Oregon?

There are some state-specific laws and regulations in Oregon that can affect your life insurance. [1] Here’s what you need to know before you buy life insurance:

Contestable period: Oregon has a two-year contestable period. This means that if you die in the two years after you get a policy, the insurance company can deny a claim if it finds out that you misrepresented yourself.

Free look period: The mandatory free look period in Oregon is 10 days from when you buy a policy or 30 days if you switch from another policy. During this time you can cancel your life insurance and receive a full refund.

Grace period: The grace period for a missed payment in Oregon is 30 days. You’ll also have to pay slightly more if you miss a payment since what you owe will gain interest.

Guaranty Fund protection: If your life insurance company goes bankrupt, Oregon’s Guaranty Association will step in and cover up to $300,000 of your death benefits and $100,000 of your policy’s cash surrender value.

Time to settle a claim: Your life insurance company has to process a claim within 30 after receiving proof of death to process a claim or pay interest on your death benefit.

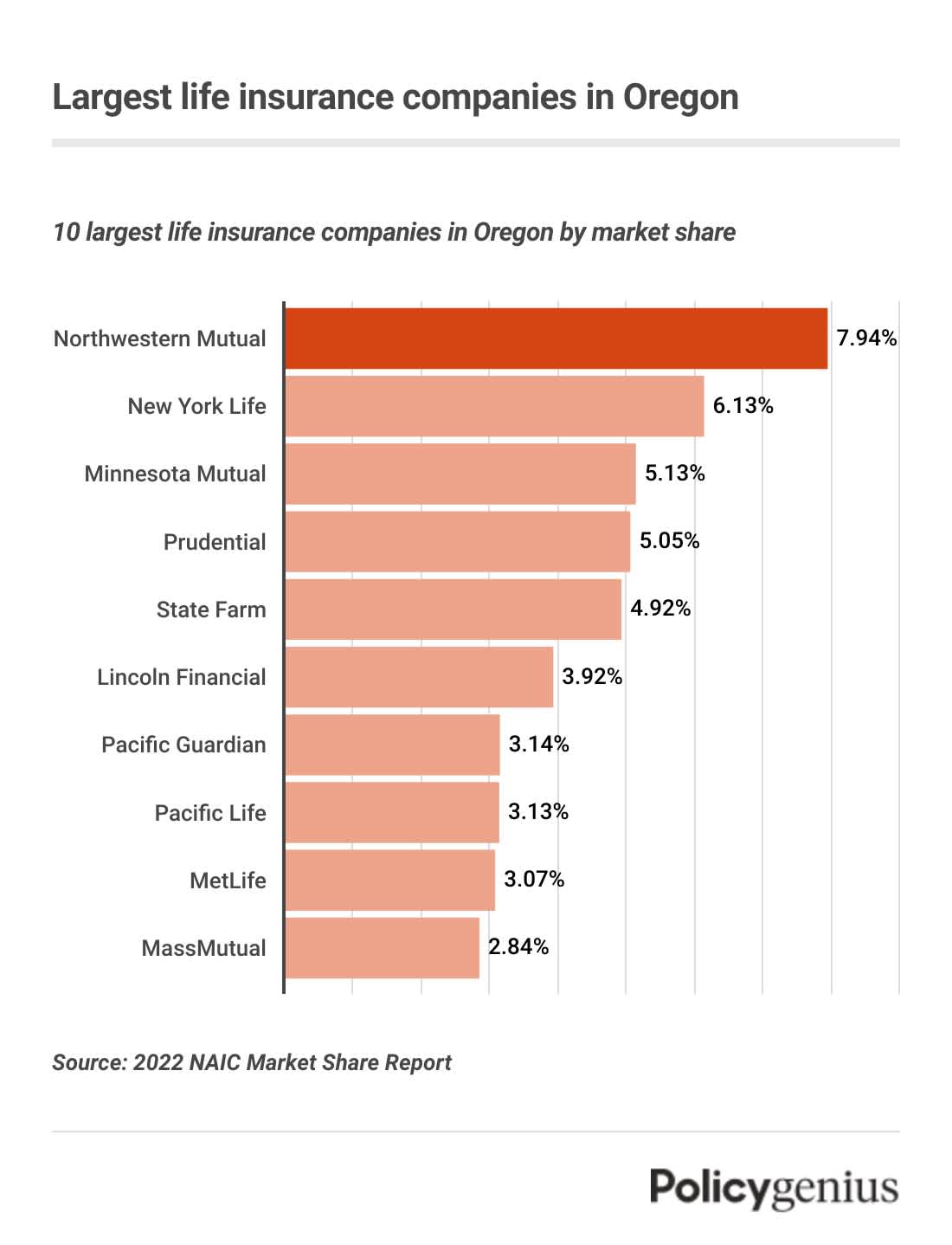

Largest life insurance companies in Oregon

Many of the largest life insurance companies in the country offer policies in Oregon. Here are the 10 largest life insurance companies in Oregon by market share. [2]

Company | Market share in Oregon |

|---|---|

Northwestern Mutual | 7.94% |

New York Life | 6.13% |

Minnesota Mutual | 5.13% |

Prudential | 5.05% |

State Farm | 4.92% |

Lincoln Financial | 3.92% |

Pacific Guardian | 3.14% |

Pacific Life | 3.13% |

MetLife | 3.07% |

MassMutual | 2.84% |

What happens if a life insurance company goes bankrupt in Oregon?

If your life insurance company goes bankrupt, the Oregon Life and Health Insurance Guaranty Association will cover part of your policy’s benefits. You can find coverage from another company or stick with the Guaranty Assocation’s coverage.

Oregon’s Guaranty Association covers you for up to $300,000 in death benefits and $100,000 in cash surrender value. If you move to another state, your new state’s Guaranty Association will take over.

How to find a lost life insurance policy in Oregon

You can use the Life Insurance Policy Locator Service from the National Association of Insurance Commissioners to find a lost life insurance policy, but only if you have a connection to the deceased person.

Average life insurance rates in Oregon

Based on our analysis of Policygenius data from 2024, the average monthly cost of life insurance in Oregon for a healthy 35-year-old in buying a $500,000, 20-year term life insurance policy is $27 per month ($307 per year) for women and $32 per month ($373 per year) for men — though your exact premiums will depend on other factors specific to you.

Age | Gender | $250,000 coverage amount | $500,000 coverage amount | $1 million coverage amount |

|---|---|---|---|---|

20 | Female | $15 | $23 | $34 |

Male | $19 | $29 | $48 | |

30 | Female | $15 | $23 | $37 |

Male | $18 | $29 | $49 | |

40 | Female | $22 | $35 | $61 |

Male | $25 | $43 | $75 | |

50 | Female | $44 | $78 | $139 |

Male | $57 | $102 | $188 | |

60 | Female | $108 | $194 | $355 |

Male | $149 | $268 | $500 |

Methodology: Average monthly rates are calculated for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy. Life insurance averages are based on a composite of policies offered by Policygenius from Brighthouse Financial, Corebridge Financial, Foresters Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, Symetra, and Transamerica, and the Policygenius Life Insurance Price Index, which uses real-time data from leading life insurance companies to determine pricing trends. Rates may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 09/01/2024.