Per stirpes and per capita are terms that describe how life insurance proceeds — also called the death benefit of the policy — are distributed to your beneficiaries. Per stirpes life insurance benefits are passed on to your beneficiaries’ heirs if they die before you, whereas per capita life insurance benefits are distributed equally among living beneficiaries. These terms are relevant when it comes to estate planning.

What is a per capita death benefit?

A per capita (Latin word meaning “by head”) death benefit payout is distributed equally to all living beneficiaries. This is the default option when you designate beneficiaries in your life insurance policy, so unless you specify what percentage each beneficiary receives, the death benefit will be distributed evenly when you die.

This type of distribution is sometimes referred to as pro rata (Latin for “in proportion”). It makes sense for people who want to designate their spouse, a trust, or a legal guardian as their beneficiaries.

Examples of per capita distributions

Using the Pritchett family from “Modern Family” as an example, if Jay Pritchett has a $1 million life insurance policy, he could name his wife, Gloria Delgado-Pritchett, and his adult children, Claire Dunphy and Mitchell Pritchett, as per capita co-beneficiaries.

If Jay dies, a life insurance claim that involves a per capita designation would pay out equally to each beneficiary: one third to Gloria, one third to Claire, and one third to Mitchell:

$333,333 to Gloria

$333,333 to Claire

$333,333 to Mitchell

But if Jay and Gloria both die at the same time, then under a per capita designation, 50% of the death benefit would go to Claire and 50% would go to Mitchell:

$500,000 to Mitchell

$500,000 to Claire

$0 to Jay and Gloria’s minor children, Manny and Joe

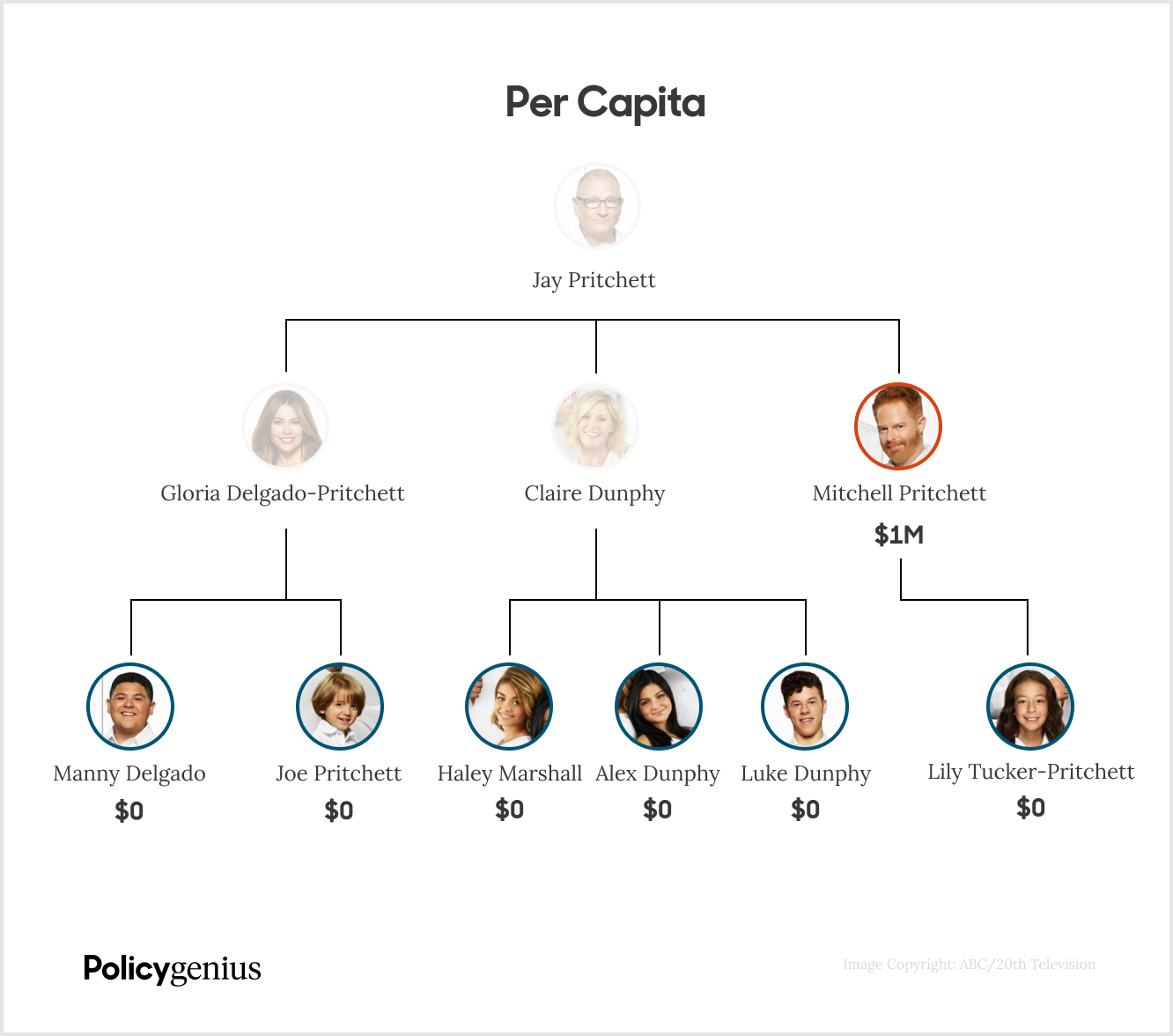

If Claire dies at the same time as Jay and Gloria, the funds would pay out 100% to Mitchell, the only remaining beneficiary:

$1 million to Mitchell

$0 to Jay and Gloria’s minor children, Manny and Joe

$0 to Claire's children, Haley, Alex, and Luke

In a future scenario, Jay could designate per capita benefits to Gloria, Mitchell, Claire, and his other (now adult) children, Manny and Joe. If Jay dies, then Gloria, Mitchell, Claire, Manny, and Joe would each receive 20% of the payout:

$200,000 to Gloria

$200,000 to Mitchell

$200,000 to Claire

$200,000 to Manny

$200,000 to Joe

However, if Claire dies before Jay, then the payment would be split into fourths between Gloria, Mitchell, Manny, and Joe:

$250,000 to Gloria

$250,000 to Mitchell

$250,000 to Manny

$250,000 to Joe

$0 to Claire’s children, Haley, Alex, and Luke

What is a per stirpes death benefit?

Per stirpes comes from the Latin word meaning “by roots,” and allows the death benefit to support younger generations of your family, even if one of the original beneficiaries is unable to accept the life insurance payout. Most people don’t need a per stirpes death benefit payout because they can provide for any descendants with the standard per capita payout.

When a life insurance policy pays out per stirpes, if one of the beneficiaries dies before you, their portion of the death benefit goes to their next of kin, usually their children, instead of being split between the other listed beneficiaries.

Examples of per stirpes distributions

Using the Pritchett family example again, say Jay leaves his wife, Gloria, and his two adult children, Mitchell and Claire, equal portions of the $1 million death benefit per stirpes, which would look identical to a per capita designation at first:

$333,333 to Gloria

$333,333 to Mitchell

$333,333 to Claire

If Gloria and Claire both die before Jay, a per stirpes payout would direct one third of Jay’s death benefit to Gloria and Jay’s two children (Manny and Joe), one third to Claire’s three children (Haley, Alex, and Luke), and one third to Mitchell. As you can see, if a beneficiary dies before the insured, the payouts for per capita vs. per stirpes begin to differ:

$333,333 to Gloria and Jay's children ($166,500 to Manny and $166,500 to Joe)

$333,333 to Claire’s children ($111,000 to Haley, $111,000 to Alex, and $111,000 to Luke)

$333,333 to Mitchell

There can be other unique circumstances where a per stirpes death benefit would be necessary, such as debt repayment or care for elderly parents. For example, if Jay owes his ex-wife, DeDe, a loan of $250,000, he may list DeDe as a co-beneficiary in addition to Gloria, Mitchell, and Claire to cover the unpaid loan:

$250,000 to Gloria

$250,000 to Mitchell

$250,000 to Claire

$250,000 to DeDe for the unpaid loan

In this case, if Jay didn’t choose a per stirpes death benefit payout and he and Gloria both died, DeDe, Mitchell, and Claire would get the entire death benefit per capita and his two children with Gloria wouldn’t receive any of it:

$333,333 to Mitchell

$333,333 to Claire

$333,333 to DeDe

$0 to Jay and Gloria’s children, Manny and Joe

A per stirpes death benefit ensures Jay and Gloria’s shared children would receive the portion of the death benefit designated for Gloria.

How do you designate a per capita or per stirpes payout?

Designating a per capita or per stirpes payout is fairly simple. When you appoint your policy’s beneficiaries, you simply state if your payout should be per stirpes because the default is per capita: Your beneficiary’s name (Per stirpes).

The life insurance agent you’re working with can help you make sure you’re designating your beneficiaries the way you intend to.

Per stirpes vs per capita: How to choose

Generally speaking, it’s best to select a per capita distribution (the default option) if you’re only naming one beneficiary in your life insurance policy, such as a spouse or a trust for your children. You should always have contingent beneficiaries listed in case your primary beneficiary predeceases you — otherwise your death benefit could be paid out directly to your estate, which can delay the payout significantly..

You can select a per stirpes distribution if your death benefit payout isn’t as straightforward, like if you want to leave money to your grandchildren, so that all of your intended dependents receive a portion of the death benefit. If you have multiple primary beneficiaries — or if the death of one of your beneficiaries would impact the financial wellbeing of the others — you may also consider a per stirpes payout plan.

If you’re not sure which death benefit distribution would be best for your personal situation, it can help to consult a financial advisor. You can also speak to a Policygenius agent for free to discuss your options.