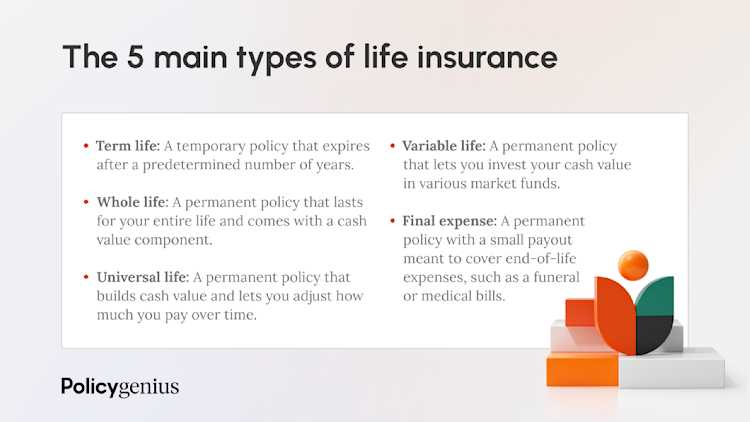

Life insurance provides a financial safety net for your loved ones in the event of your death, but each type of policy offers different benefits. The best type of life insurance for you will depend on your coverage needs and budget.

Here’s everything you need to know about the most popular types of life insurance policies, including how they work, pros and cons, how long they last, and who they’re best for.

Term life insurance

Term life insurance is a popular choice for most people because it’s affordable, only lasts for as long as you need it, and doesn’t come with many tax rules or restrictions.

Term life is usually the easiest and cheapest way to provide a financial safety net for your loved ones — but it can also be used to cover business partners or even key executives whose death would cause a financial loss to the company they work for.

Best for: Most life insurance shoppers. Anyone looking for affordable life insurance lasting 10 to 30 years should buy term life insurance.

How it works: Term life insurance offers coverage for a set number of years before it expires. You make premium payments toward the policy, and if you die during the term, the insurance company pays a set amount of money, known as the death benefit, to your designated beneficiaries.

Pro: Affordability — term life policies are less expensive than other types of life insurance and generally have lower premiums.

Con: Limited length — term life expires at the end of its term, but you can choose a term that aligns with when your loved ones need the most financial protection; for example, while you’re paying a mortgage or raising children.

Whole life insurance

Whole life insurance is a popular type of permanent life insurance because it’s relatively simple and your premiums remain the same for the length of the policy. Like most permanent policies, it comes with a cash value account, which acts as a tax-deferred savings account and earns interest at a fixed rate set by the insurer.

Best for: High-net-worth individuals who want to diversify their investment portfolio with a low-risk investment option, or people with dependents who may need long-term care.

How it works: Whole life insurance has a guaranteed death benefit and cash value that earns interest over time. A portion of your premium goes toward the cost of maintaining the insurance policy and the rest goes toward the cash value account. Once you’ve accumulated enough cash value, you can borrow or withdraw money from the account.

Pro: Cash value and lifelong coverage. Cash value life insurance can contribute to endowments or estate plans. And since this coverage lasts for your entire life, it can help support long-term dependents such as children with disabilities.

Con: High cost and potential fees. A whole life insurance policy is usually many times more expensive than a comparable term life policy. The cash value component makes whole life more complex than term life because of potential surrender fees, taxes, interest, and other stipulations.

Universal life insurance

Universal life insurance is an adjustable permanent life insurance policy that also builds cash value. What makes it unique is that it lets you decrease — or increase — how much you pay toward your monthly or annual premiums over time. If you decrease how much you spend on premiums, you can choose to cover the difference with your policy’s cash value.

A universal life insurance policy can be a good fit if you have a higher budget and are looking for some flexibility in your life insurance. A universal policy can be even more expensive than a standard whole life policy, especially as you age and your premiums increase.

Best for: High earners who are trying to build a nest egg without entering a higher income bracket.

How it works: Universal life insurance allows you to adjust your premiums and death benefit depending on your needs. If, after some time, you decide to stop paying or lower your monthly premiums, you can use the cash value to cover your premiums.

Pro: Flexibility. You can adjust your premiums based on your financial needs.

Con: High investment risk. Interest earned from the cash value can be based on market performance depending on the type of universal policy you have, so it’s not the best option to save money for the future.

Variable life insurance

Variable life insurance is another type of adjustable permanent life insurance that allows you to invest the money from your cash value in various funds offered by the insurance company, including mutual funds.

While variable life insurance comes with a guaranteed minimum death benefit, the cash value amount isn’t guaranteed and will depend on market conditions.

You may earn more interest than you would with a whole life insurance policy, but you could also lose money if the fund underperforms.

Best for: High earners looking for permanent coverage options to diversify their investment portfolio.

How it works: Variable life lets you invest the cash value in various funds offered by the insurance company, including mutual funds. Investment performance will reflect broader market trends. Since they’re investment products, variable policies must be registered with the Securities and Exchange Commission and regulated by FINRA. [1]

Pro: High potential returns. Variable policies may earn more interest than traditional whole life.

Con: High investment risk. Potential for losing money if the funds you picked underperform. [2]

Final expense life insurance

Final expense insurance, also known as burial insurance, is a type of permanent life insurance designed to pay a small death benefit to your family to help cover end-of-life expenses, such as a funeral or medical bills.

Unlike traditional term life insurance, which is meant to replace decades’ worth of income, burial insurance is usually suited to older adults who want a smaller policy to cover their funeral costs.

Because of its high rates and lower coverage amounts, final expense insurance is usually not as good a value as term life insurance.

Best for: People who have trouble qualifying for traditional coverage, like seniors and people with serious health conditions, or those who may only need a small amount of permanent coverage.

How it works: Unlike most traditional policies that require a medical exam, you only need to answer a few questions to qualify for final expense insurance. And there’s a shorter waiting period to get covered — as quick as one to three days.

Pro: Fewer health requirements to buy a policy. Easy access to a small benefit to cover end-of-life expenses, including medical bills, burial or cremation services, and caskets or urns.

Con: High cost. Expensive premiums for lower coverage amounts.

The right policy for you depends on your personal circumstances, how much coverage you need, and your budget. The best way to find the right policy for your specific needs is to talk with a financial advisor and work with an independent broker. At Policygenius, our experts are licensed in all 50 states and can walk you through the entire life insurance buying process while offering transparent, unbiased advice.

Learn more about how life insurance works

Types of life insurance at a glance

Life insurance type | Coverage length | Builds cash value? | Death benefit | Premiums |

|---|---|---|---|---|

Term | Temporary —usually 10 to 30 years | No | Fixed | Fixed |

Whole | Lifetime | Yes | Fixed | Fixed |

Universal | Lifetime | Yes | Flexible | Flexible |

Variable | Lifetime | Yes | Flexible | Fixed |

Final expense | Lifetime | Yes | Fixed | Fixed |

Other types of life insurance

Now that you’re familiar with the basics, here are a few more life insurance options. Many of these types are subtypes of those policies featured above, meant to serve a specific purpose, or they’re defined by how their application process — also known as underwriting — works.

How to decide what type of life insurance is best for you

The best type of life insurance for you depends on your budget and your financial responsibilities.

Term life insurance policies are usually the best solution for people who need affordable life insurance for a specific period in their life. If your goal is to protect your family from financial loss if they had to live without your income, term life is likely a good fit for you.

Permanent life insurance policies, including whole, universal, and variable life insurance, are best for people who can afford much higher premiums, have permanent coverage needs, or want to use life insurance to diversify their investment strategy.

If you’re already maximizing contributions to traditional tax-advantaged accounts like a 401(k) and Roth IRA and want another investment vehicle, permanent life insurance could work for you.

If you’re looking for a flexible policy that allows you to change your death benefit and premiums, or even choose your investment options, an adjustable life insurance option like universal or variable life insurance might be a good fit for you.

Final expense insurance can be an option for people who might not be able to get insured otherwise because of age or serious health conditions, or elderly consumers who don’t want to burden their families with burial costs.

“The right type of life insurance for each person is completely dependent on their individual situation,” says Patrick Hanzel, a certified financial planner and advanced planning manager at Policygenius. “It’s always recommended you speak with a licensed agent to determine the best solution for you.”

Read more about how long your life insurance should last

How to buy your life insurance policy

Once you know what type of life insurance could be a better fit for your needs, you can connect with a Policygenius expert to go over next steps as they pertain to your specific situation.

First, you’ll provide some basic information about your financial goals and responsibilities, as well as your age and health.

Then, they’ll be able to help you compare life insurance policies quickly and easily, and find the best life insurance company for your circumstances.