What is variable life insurance?

Variable life insurance is a type of permanent life insurance that stays active your entire life. It includes a cash value account in addition to the standard death benefit your beneficiaries can claim if you die while your policy is active.

But unlike other types of permanent life coverage, the cash value in a variable life policy can be used as an investment vehicle. While you can choose how to invest your cash value, your investment options are very limited, and there’s not a guaranteed return on your investment.

How does variable life insurance work?

Variable life policies let you invest your cash value in various funds offered by the insurance company, including mutual funds.

Before you activate your policy, the insurance company will provide a prospectus, which is a document that explains the details of the policy, including fees, expenses, investment options, and other features. Variable life policies are highly specialized, so it’s crucial to read this thoroughly.

The terms of your policy will dictate how much you have to pay in premiums in order to keep your policy active. Your premiums will cover the administrative costs of the policy as well as investment fees.

Most often, your premium payments will be fixed. Some policies might allow you to change how much you pay toward premiums over time, but it depends on your insurer.

Once you buy your policy, you’ll choose how you’ll allocate your premiums as they fund your cash value, which is invested in sub-accounts.

Every time you pay a premium, a portion goes toward the costs of maintaining the policy, and the rest goes toward your selected investments.

Other considerations for variable life insurance

The cash value will fluctuate based on the overall market and there’s no guaranteed minimum.

The death benefit amount will also fluctuate over time, but your beneficiaries are guaranteed a minimum payout when you die. The terms of the payout will be outlined in your policy’s prospectus.

Investment performance will reflect broader market trends. You may earn more interest than you would with a whole life insurance policy, which has a cash value component that grows at a fixed interest rate. But you, as the policyholder, will bear the investment risk if the fund underperforms.

As with other cash value life insurance policies, you can withdraw money or take a loan from your cash value while you’re alive. How much you can borrow from your life insurance policy depends on your cash value amount.

“Typically, permanent life insurance policies allow cash value withdrawal up to a certain amount depending on the size of the overall cash balance (up to about 95%),” says Anthony He, insurance agent and disability insurance operations manager at Policygenius.

Who should consider buying variable life insurance?

People who have a high net worth and are financially prepared to take on investment risk, since variable life insurance policies run the risk of losing money if the selected funds underperform.

People who have already maximized contributions to traditional tax-advantaged investment accounts, and are seeking additional investment vehicles. Most people will see higher returns using traditional investments, so it’s best to utilize those first.

People who feel comfortable taking a hands-on approach to investing, since they’ll be selecting which sub-accounts their cash value is invested in.

People who have discussed their long-term goals with a financial advisor and fully understand how the features of a variable life policy work.

Many shoppers prefer to avoid permanent life insurance policies altogether and instead opt to buy a term life insurance policy and invest the rest of their savings in a retirement account such as an IRA or 401(k). This way, you aren’t tied to high premiums for the rest of your life, and you don’t run the risk of surrender fees or losing out on your investment gains.

It’s best to consult with a financial professional and tax expert if you’re working on incorporating permanent life insurance products — especially variable life — into your long-term financial strategy.

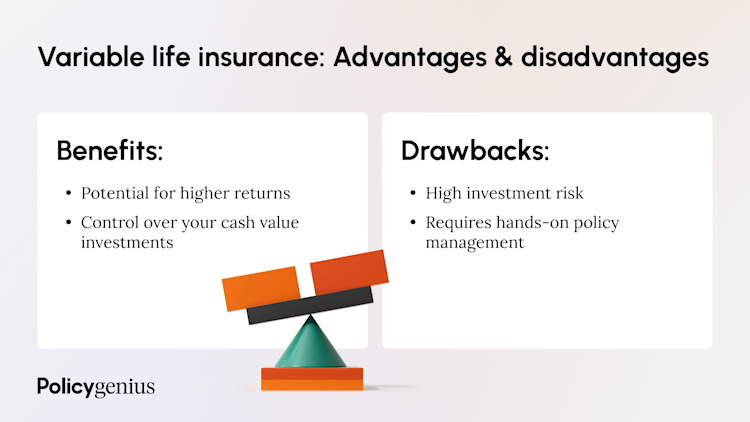

Pros & cons of variable life insurance

Pros

Variable life insurance offers you the potential for more cash value growth than whole life or other permanent policies.

You can choose how your cash value is invested within your insurer’s provided funds.

The death benefit can be used as a tax-free inheritance for beneficiaries, which can be especially useful if you have a high net worth.

You can access your cash value while you’re alive.

Cons of variable life insurance

It’s much more expensive than term life insurance for the same level of protection for your beneficiaries.

There’s no guaranteed minimum cash value if your chosen investments underperform.

You take on all of the investment risk, rather than the insurance company.

It has limited investment options for the cash value you’ll build.

You risk your policy lapsing if you can’t keep up with expensive premium payments, which would leave you facing surrender charges.

If you borrow from your cash value and die before paying it back, the difference will be deducted from your death benefit and your loved ones will receive less money.

How much does variable life insurance cost?

Variable life insurance rates are comparable to whole life insurance rates According to Policygenius data, a 30-year-old male in good health could pay $472 per month or more for a whole life policy with a $500,000 coverage amount. However, variable life premiums also include investment management fees (which usually average around 1% of assets managed annually). These fees make them some of the most expensive insurance options.

If you’re considering a variable life policy, the best way to get an idea of how much you’d pay is to connect with a licensed life insurance professional who specializes in these policies. Policygenius doesn’t offer variable life insurance at this time.

Variable life insurance vs. whole life vs. term life insurance

If you’re considering variable life insurance, you may be wondering how it compares against other more traditional policies, like term life and whole life insurance.

Whole life insurance is one of the most common types of life insurance policies. Like variable life, it comes with a cash value, but the cash value grows at a set low interest rate. You don’t have the option to select how your cash value is invested.

Term life insurance lasts for a set number of years and then expires. It offers basic protection in the form of a guaranteed death benefit — it doesn’t come with a cash value and is not used for investment purposes. Term life is also significantly cheaper than whole and variable life insurance.

The details | Variable life insurance | Whole life insurance | Term life insurance |

|---|---|---|---|

Coverage | Lifetime | Lifetime | Temporary — usually 10 to 30 years |

Guaranteed death benefit | Yes | Yes | Yes |

Guaranteed cash value | No | Yes | No |

Cash value growth | Subaccounts — pool of investor funds offered by insurer | Earns interest at a fixed rate | None |

Premiums | Level | Level | Level |

Investment risk | Risk of holding expensive insurance policy with little to no cash value | No risk compared to other permanent types, but there are other investment products that yield higher returns | No risk, no investments — pure insurance |

How to buy variable life insurance

In order to buy variable life insurance, you’ll need to connect with a life insurance professional who’s licensed to sell these specific products. Because of the investment component, variable life is considered a type of security and requires extra licensing to sell. [1]

Aside from that, you’ll complete the application process as you would with other life insurance policies.

You’ll complete an application and fill out basic health and financial information.

The insurance company will review your application details during a process called underwriting — and you’ll take the standard life insurance medical exam, which resembles an annual physical at your doctor’s office. This helps the insurer assess risk and determine how much you’ll pay in premiums.

After that, the insurance company will extend a final offer, and you can decide to activate your policy and pay your first premium.

Learn more about how to buy life insurance