Even after children graduate from college and embark on their careers, 79% of parents continue to provide their adult children with some type of financial support. [1]

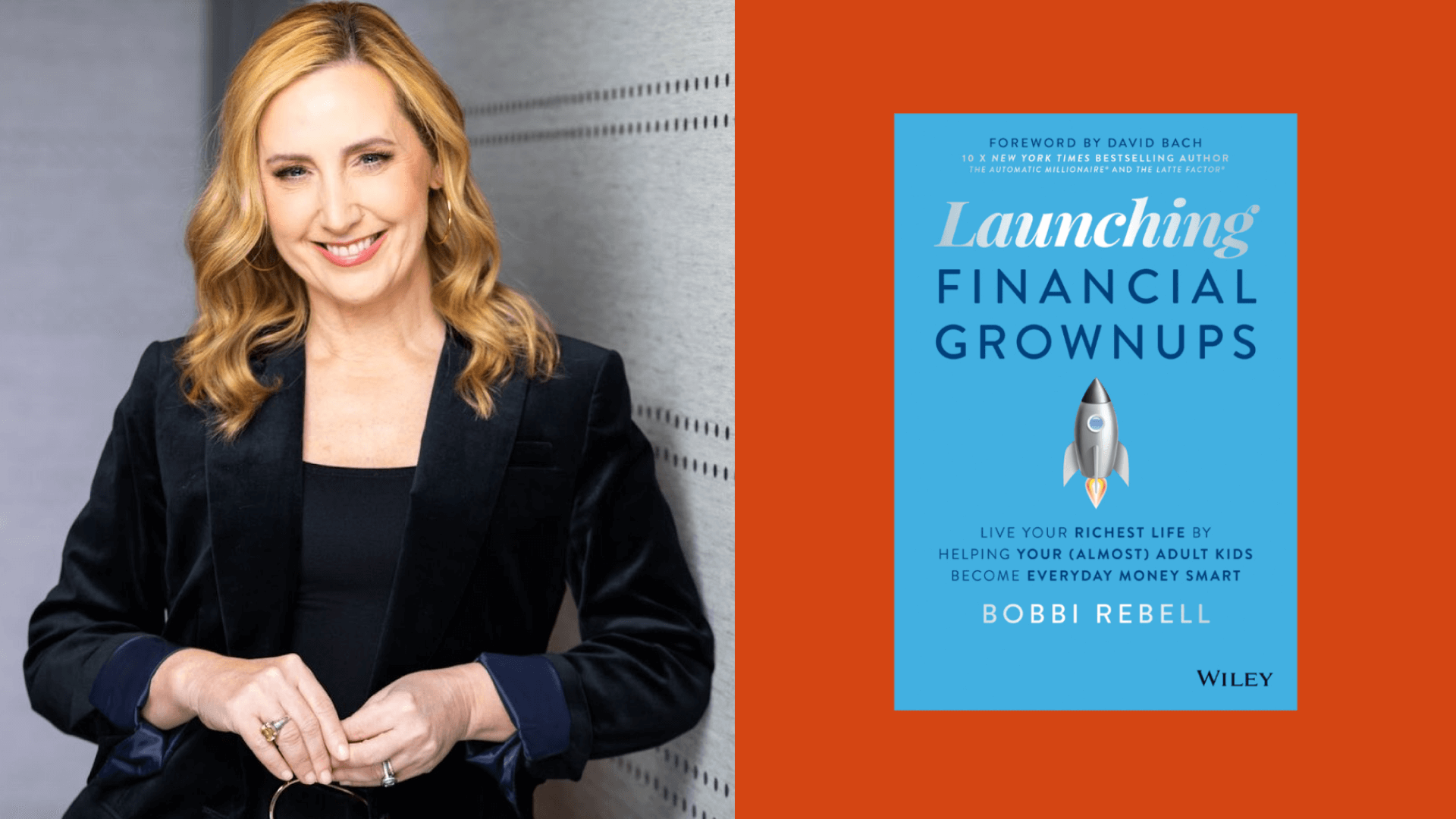

Six years ago, Bobbi Rebell, a certified financial planner and host of the “Money Tips for Financial Grownups” podcast, wrote a book to help young adults master their finances: “How to Be a Financial Grownup.” Since publishing that book in 2016, she saw that parents of adult children also have a big stake in helping their kids “grow up” — if your kids aren’t financially independent, you risk your own goals by continuing to support them.

Her new book, “Launching Financial Grownups,” is a guide to raising children to be financially responsible. Rebell talked to Policygenius about how parents can help their children reach financial independence.

This conversation has been edited for length and clarity.

How did the pandemic change this book?

It made it so much more relevant and urgent! So many young adult kids found themselves back home with their parents — but they were no longer children. Relationships had to adjust. But this also was an opportunity for candid conversations about money and everyone’s future — not just the younger generation but also for the kids to see their parents as also having financial goals and challenges. It really opened up new, more mature family conversations about money.

What's one thing in “Launching Financial Grownups” you wish you taught your kids?

That we all make mistakes but we aren’t defined by them. We actually grow from them and we all need to understand that while sometimes there isn’t a do-over, there is a next time.

I'm guessing this book would be very different if it was written by your parents, or maybe even you a decade ago. What's the biggest way parent-child conversations around money have changed in recent years?

Yes! I love this observation because it is spot on. There are so many unique and new challenges that parents today of young adults and older teens are facing that our parents never had to face. This ranges from massive student debt, so a new level of pressure to live a certain lifestyle thanks to social media. It is important that we as parents listen as much, or more, than we talk and that we understand that the economic challenges they face are not the same as the ones we did, even though in many cases our goals, like financial freedom, are very similar.

How do you feel about some states including personal finance education in their curricula? Good idea or something parents should handle?

It’s all good! Schools absolutely should be teaching personal finance. Also, parents should be a lifelong resource for their kids when it comes to teaching them money-related skills and values. They complement each other. But remember, in the end, school is short term. It is parents, grandparents, friends, and loved ones who are the stakeholders here, and so they need to be there when real-life money decisions and challenges happen. A textbook has information but not always real-world solutions and support.

So many financial concepts, like debt, are complicated even for grownups to understand. How do you make sure you're “translating” properly as a parent?

When in doubt, don’t be afraid to say that you don’t know either and then find the answers together. We have so many resources available to us these days, and I hope “Launching Financial Grownups” is a book they will reach for over and over again when they face challenges.

Finally, sell me your book from a personal finance perspective: Why should people spend their money on it?

The truth is, many of us know what our kids should do. I did. But getting them there is so hard. I was struggling, so I reached out to my network of experts for help and the book is the result. Now we can all benefit from these incredible experts. “Launching Financial Grownups” brings together the top money and parenting experts, as well as financial therapists and everyday parents to share their wisdom and put all of us on the path to richer lives with our (almost) adult kids.

Image: Courtesy of Bobbi Rebell