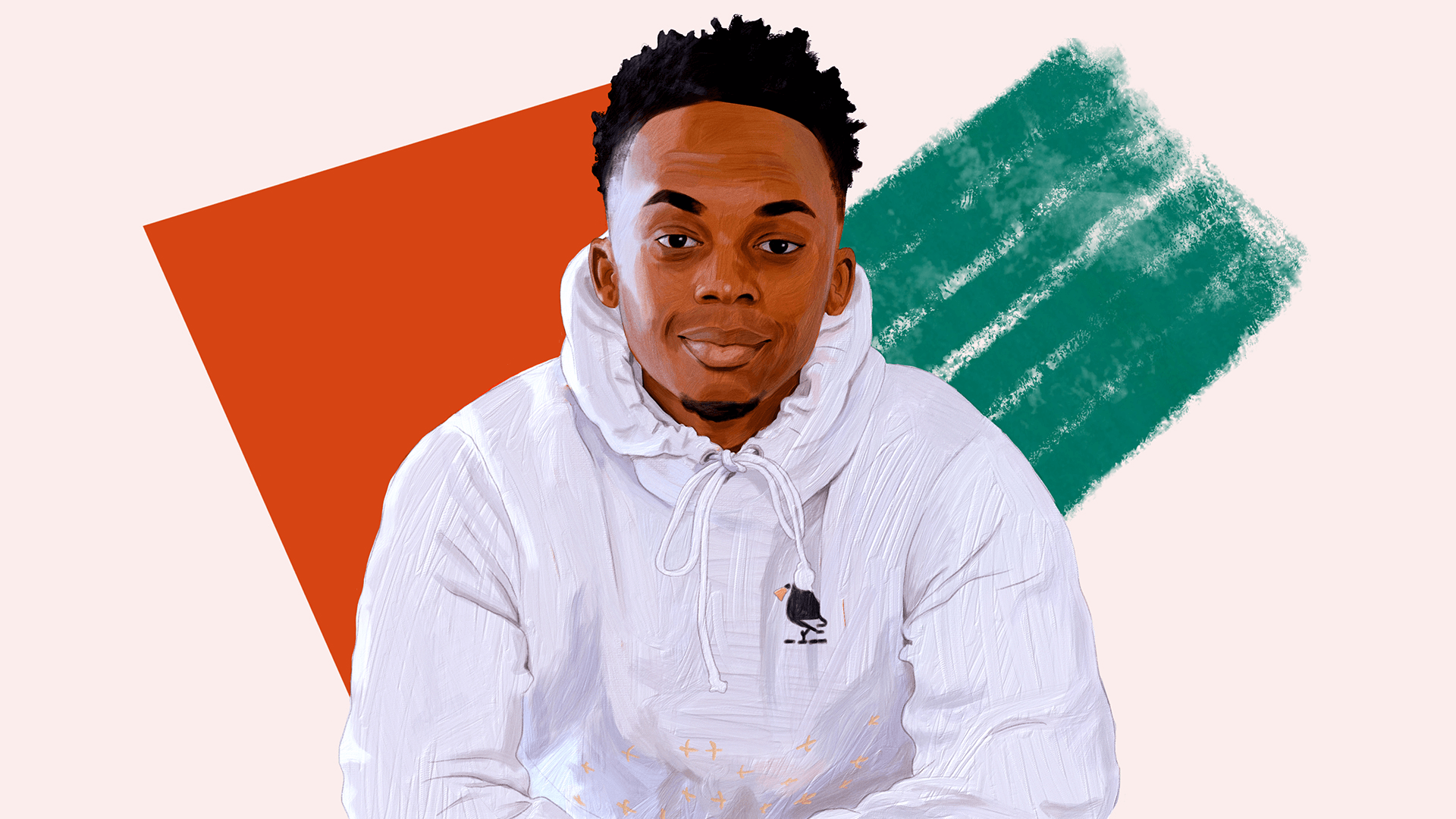

Brian Bristol is chief technical officer and co-founder of Pigeon Loans, a startup helping people make loans to friends and family. We asked him how he budgets.

How he got started with Pigeon Loans

Bristol had the idea for Pigeon Loans at the onset of the COVID-19 pandemic.

During 2020, a family member asked to borrow money, and Bristol wondered whether an app existed to help facilitate the loan. When he couldn’t find one, Bristol, then a software engineer at Intuit, spent the summer building a basic version of what would become Pigeon Loans.

“It was kind of a natural evolution,” Bristol says. “I knew exactly the pain points or problems because I had seen it throughout my whole life.”

He didn’t grow up in a rich family. “I was fortunate enough not to be on the cusp of abject poverty, but we were one or two bad paychecks away from being almost there,” he says.

Family members and friends frequently made loans to one another. “Moving money between our friends and family was maybe the secondary way to get cash,” Bristol says. “I would often lend money to my siblings, my cousins would lend money to us, stuff like that in order for us to make it through life.”

Pigeon Loans has since facilitated more than $1 million in loans and recently raised $2.5 million in seed funding.

How budgeting as a startup founder is different from other jobs

“There’s two phases of the startup founder life,” Bristol says. “Phase one, you literally have nothing. No investor money, no traction, no revenue.”

Bristol spent a year balancing his full-time job and Pigeon Loans before he quit to focus on the business. He gave himself a three-month deadline: If he didn’t start getting traction with Pigeon Loans, he’d find another job. He did not pay himself during that time.

“You’re spending credit card debt, you’re doing personal loans, until you can finally get enough investment to pay yourself,” Bristol says.

The prospect of another job was especially tempting in the wake of the pandemic, when many people were leaving their jobs for better opportunities.

“The fear was, am I being dumb by starting my own thing and not paying myself as opposed to just going to a big company and getting two or three times my pay,” Bristol says. “You have to wake up every morning with conviction that what you’re building is right and it’s helping people.”

Today, he still pays himself less than he got at his old job, but enough to pay his bills and rent.

“Out of all my employees I’m probably the least paid,” Bristol says. “That’s just the founder lifestyle. To keep yourself slightly uncomfortable.”

A startup founder's big costs

One big one is networking, especially when your business is still dependent on outside investment, Bristol says. “You’re going out to events. You’re talking to investors. You’re paying $50 or $60 in tabs to get drinks and talk to them. You’re going to pay for transportation to get there, you’re going to pay for materials to distribute yourself.”

And all that expense can sometimes have zero payoff. Once you clear that hurdle and your business has runway, your expenses start to look like those of other businesses, ranging from making sure your finances are good enough to get a business credit card to making sure you can pay employees and file taxes on time.

Bristol's favorite budgeting tool

“I’m a big proponent of spreadsheets,” Bristol says.

His personal budget includes his recurring expenses and income.

“In terms of my one-time expenses, I don’t track them as much,” Bristol says. “If I were a more granular budget person I would, but I like having some freedom.”

As for the business, Bristol tries to know every single transaction.

“We want to be able to exist without having to beg investors for money,” Bristol says. “We try to spend to give ourselves three months of runway. If we ever get to the point where we’re spending so much that our money isn’t going to get to that three-month point, that’s when we’ll have to start dialing things back.”

Insurance for a startup founder

Pigeon Loans covers its employees’ health insurance costs, including for Bristol. He also has life insurance and car insurance. He struggled to pay for his health insurance for a few months after leaving his job, but managed to cover his costs.

“If I had done longer than three months I probably would have started to explore government benefits,” Bristol says.

Bristol's financial obstacles

“With the rising costs, things are getting interesting, especially here in Miami, where people are moving in droves,” Bristol says.

But his bigger challenge is more psychological. “When I was at Intuit, I had a high-paying job. I could make investments. Now I can’t invest. Now I have to spend money on my needs. I have to figure out, do I cut my lifestyle, do I reduce how much goes to my day-to-day so I can invest more? Or do I put in my time at Pigeon and have that be an investment in itself?”

Bristol’s financial goal

“When I was in college my goal was to be a millionaire by 30,” Bristol says. The 25-year-old believes he’ll hit that goal within a few years.

“Now my goal is to be one of the world’s youngest billionaires,” Bristol says. Why? “Part of me has always had a chip on my shoulder. That comes from the fact that I grew up poor and I had a lot of health issues growing up.”

He’s always wanted to prove himself, and believes one way to do that is to “make a bunch of money.”

“My goal is to prove that what I put my mind to, I can do,” Bristol says. “And there’s no one that can stop me in that race.”

Bristol believes Pigeon Loans can get him there.

“We’re working on a lot of things this year that I think will make us a household name in the next 12 to 18 months,” Bristol says. “I believe helping people causes us to have enough revenue that will cause us to be a billion dollar company.”

Image: Michelle Kondrich