There’s a lot of reasons to consider moving to Cleveland right now — it’s a well-located rust-belt city on the rebound, the cost of living is cheap, and it's a renter’s market. In fact, if you live in Cleveland, chances are you rent rather than own a home† and if you do, you should probably consider purchasing renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Cleveland, from rate affordability to break-ins. Read on to learn more about why renters insurance makes sense for anyone who calls Cleveland home.

Best renters insurance in Cleveland

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | N/A† | $13.67 |

Allstate | $20.00 | $18.00 |

Travelers | $24.00 | $21.00 |

Stillwater | $18.08 | $13.50 |

Lemonade | $10.92 | $9.59 |

† No $500 deductible option in Cleveland Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance is about far more than just protecting your personal property. Here’s a rundown of the components you should look for in a policy when comparing renters insurance rates.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Cleveland?

While renters insurance isn’t required in Cleveland or the state of Ohio, landlords and management companies may include a provision in the lease that requires renters insurance as a condition for signing.

This practice is completely legal, and Cleveland landlords could actually be doing renters a favor by including such a clause in the lease. Renters insurance is cheap in Cleveland, too — a policy with a $500 deductible has an average cost of $18.25 per month, and a $1,000 deductible policy has an average cost of just $15.15 per month.

Reasons to buy renters insurance in Cleveland

Renters insurance is among the most affordable insurance types to buy, and also provides renters with peace of mind by protecting their personal belongings both inside and outside the residence. This is especially pertinent for Cleveland residents, who experience high rates of burglary.

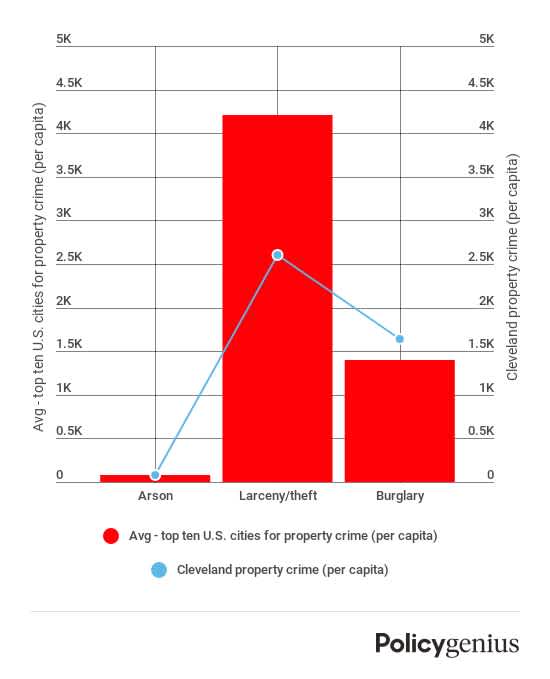

Cleveland’s burglary rate is actually higher than the average rate of the ten most burglarized cities in the U.S., and while instances of burglary have decreased by almost 40% over the last five years, the rates are still high enough to make renters insurance seem like a necessity.‡

Renters insurance also covers personal property and belongings when bad weather befalls your residence. Snowstorms are a common occurrence in Cleveland during the winter months, increasing the likelihood of wind and weight of snow damage to your residence, both perils of which are covered by renters insurance.

Flooding is another familiar catastrophe for Cleveland residents with the Cuyahoga River running through the city. Unfortunately, flood damage isn’t covered by renters insurance, however, luckily flood insurance will cover this unfortunate peril.

Helpful resources

Cleveland residents looking for information on renters rights and resources should check out the following:

Legal Aid Society of Cleveland: Provides legal help and information for low-income Cleveland tenants

The Cleveland Law Library: Excellent aggregation of resources for tenants to understand both Ohio and federal housing laws and better understand their rights

Housing Cleveland: Online resource for prospective and current tenants to list and find affordable housing in Cuyahoga County

Heights Congress: Aggregation of fair housing resources for Clevelanders

‡ FBI CDE