Denver is a beautiful city nestled nicely next to the Rocky Mountains, and because of the natural beauty and urban charm, it’s a popular place for renters. In fact, 38% of Mile High City residents rent rather than own homes^, and just about all of them should consider buying renters insurance.

Renters insurance ensures that your personal belongings are protected. There are countless reasons you should consider renters insurance if you live in Denver, from rate affordability to the high risk of weather-related damage to break-ins. Read on to learn more about why renters insurance makes sense for Denver residents.

Best renters insurance in Denver

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $10.42 | $10.42 |

Allstate | $17.00 | $16.00 |

Travelers | $21.00 | $19.00 |

Stillwater | $13.17 | $12.92 |

Lemonade† | N/A | N/A |

† Lemonade not available in Denver Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | N/A |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | N/A |

Medical payments to others | $1,000.00 | $1,000 | $1,000 | $2,000 | N/A |

† Lemonade not available in Denver

Understanding renters insurance quotes

Renters insurance is about far more than simply protecting your personal property. If someone is accidentally injured in your home and requires legal or medical expenses on your behalf, that financial burden is lifted off of your shoulders with renters insurance.

If you’re forced to move out of your apartment because of hazards like fire or water damage, renters insurance provides you and your family with additional expenses to cope with this misfortune. Meaning, if you normally spend $400 a month on groceries for your family, renters insurance may cut you a check for $500 instead, since you’ll be forced to eat out instead of cook. Loss of use may also supply funds for hotel expenses and additional car mileage if the need arises.

Here’s a rundown of the components you should look for in a policy when comparing renters insurance quotes.

Property coverage: reimbursement for lost, stolen, or damaged property.

Liability coverage: covers legal expenses in the event someone is injured in your residence and they sue you.

Loss of use: covers temporary living expenses if your residence becomes uninhabitable.

Medical payments to others: covers medical costs in the event someone is injured in your residence and requires medical treatment.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Denver?

Renters insurance is not a legal requirement in Denver or the state of Colorado, but landlords and management companies may put a clause in the lease requiring tenants purchase a policy.

In fact, considering Denver's penchant for blizzards and other harsh storms, it may be best for Denver residents if landlords included such a provision in the lease.

Reasons to buy renters insurance in Denver

Renters insurance is among some of the most affordable insurance types to buy, and considering your most cherished personal belongings are typically stored in your residence or storage units, it should be a no-brainer in any city.

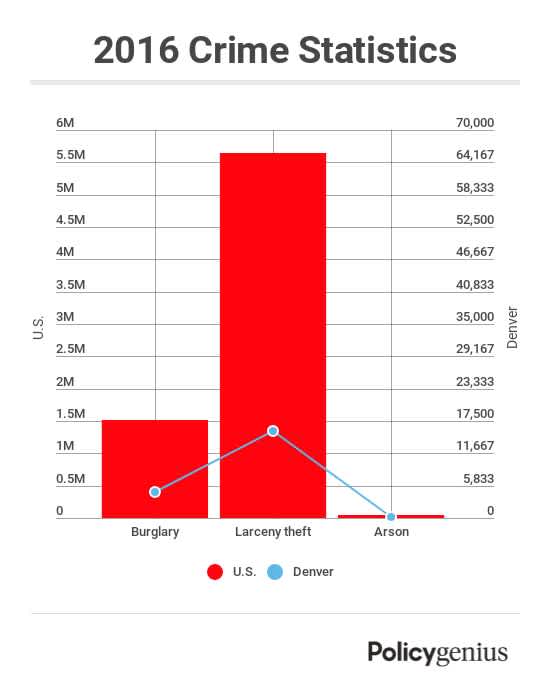

And while instances of burglary have decreased drastically over the past decade in Denver, property crime as a whole (arson, larceny, burglary) remains about 30% higher than the national average.† Renters insurance is a nice safeguard to have, given the high theft potential of urban areas.

Did you know that renters insurance covers avalanches? This is because avalanches are technically considered a “weight of snow or ice peril” rather than an earth-moving peril (like mudslides and earthquakes, which are not covered).

And while not everyone lives in the far reaches of Denver at the base of a mountain, city residents are still susceptible to avalanche-like snowfall. In fact, the Mile High City receives an average of 57 inches of snowfall each year.‡ Renters insurance will cover your personal belongings if that metric ton of snow on your roof causes it to fall through, or if the cold temperatures cause your pipes to freeze and burst.

Helpful resources

Denver residents looking for more information on renters rights and resources should check out the following:

Apartment Association of Metro Denver: Denver-based nonprofit dedicated to helping tenants understand their rights and provide legal assistance and quality housing for renters

Colorado Affordable Legal Services: Legal network for metro Denver residents

Denver Metro Fair Housing Center: nonprofit dedicated to eliminating housing discrimination through education, advocacy, and enforcement of the Fair Housing Act

City of Denver Landlord/Tenant Guide: Comprehensive guide for landlords and tenants to better understand the rights and obligations of Denver residents

† FBI CDE