Renters insurance is a relatively cheap type of insurance policy. It protects your personal property in the event of damage or theft, your personal liability, and any additional living expenses that accrue while you’re displaced from your home.

And if the thought of another $100-plus monthly expense is keeping you from buying renters insurance, you should know a renters insurance policy isn’t likely to cost nearly that much. Renters insurance is significantly cheaper than other types of property insurance, like car insurance or homeowners insurance, or insurance products like life insurance.

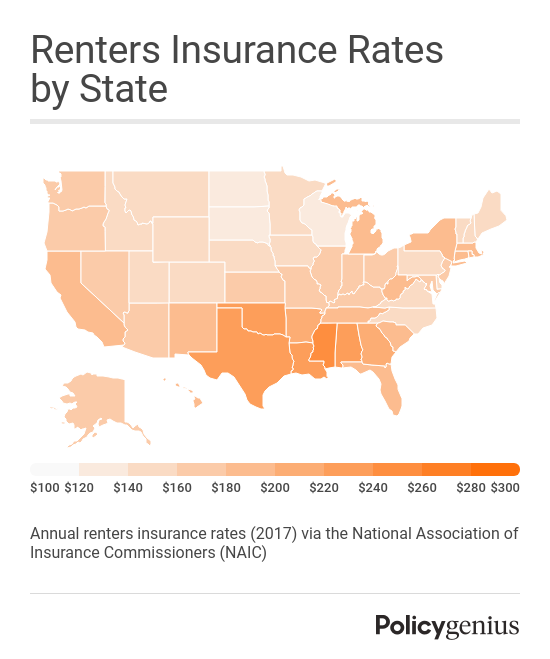

The average cost of renters insurance in the U.S. was $180 a year, or just about $15 a month, in 2017 per data from a 2019 report by the National Association of Insurance Commissioners (NAIC), ranging from a high of $258 to a low of $120. The cost of your renters premium depends on a few things, but a main factor is how much liability coverage and personal property coverage you buy.

Now that you know that the cost of renters insurance is closer to a car wash than a car payment, read on to learn more about how that number is determined.

How much does renters insurance cost in each state?

Given that your neighborhood and building type can influence your premiums, it stands to reason the cost of your insurance policy varies dramatically across state lines. Keep in mind, though, pricing gets more granular than that, and the cost of an insurance policy can also vary dramatically across any given state, depending your insurance company and what they offer. The cost of your premiums will also vary depending on how much coverage you purchase, and the price of your deductible.

With that caveat in mind, here are the average annual renters insurance premiums in each U.S. state as of 2017, per the NAIC:

Average Annual Premium by State, 2017

State | Avg Annual Premium |

|---|---|

Alabama | $235 |

Alaska | $166 |

Arizona | $178 |

Arkansas | $212 |

California | $182 |

Colorado | $159 |

Connecticut | $192 |

Delaware | $159 |

District of Columbia | $158 |

Florida | $188 |

Georgia | $219 |

Hawaii | $185 |

Idaho | $153 |

Illinois | $167 |

Indiana | $174 |

Iowa | $144 |

Kansas | $172 |

Kentucky | $168 |

Louisiana | $235 |

Maine | $149 |

Maryland | $161 |

Massachusetts | $194 |

Michigan | $182 |

Minnesota | $140 |

Mississippi | $258 |

Missouri | $173 |

Montana | $146 |

Nebraska | $143 |

Nevada | $178 |

New Hampshire | $149 |

New Jersey | $165 |

New Mexico | $187 |

New York | $194 |

North Carolina | $157 |

North Dakota | $120 |

Ohio | $175 |

Oklahoma | $236 |

Oregon | $163 |

Pennsylvania | $158 |

Rhode Island | $182 |

South Carolina | $188 |

South Dakota | $123 |

Tennessee | $199 |

Texas | $232 |

Utah | $151 |

Vermont | $155 |

Virginia | $152 |

Washington | $163 |

West Virginia | $188 |

Wisconsin | $134 |

Wyoming | $147 |

United States | $180 |

The most expensive states for renters insurance

The unifying theme here: Extreme weather. Mississippi, Texas, Louisiana and Alabama are coastal and susceptible to strong storms, while Oklahoma frequently experiences tornados. Insurance companies will determine these states to be higher-risk, meaning people living there are more likely to file a claim.

Mississippi: $258

Oklahoma: $236

Alabama & Louisiana (tie): $235

Texas: $232

Georgia: $219

The cheapest states for renters insurance

Conversely, the states with the cheapest renters insurance are much more insulated from extreme weather and natural disasters. It's good to know about state-by-state disparities if you’re planning a move so you can account for the cost difference in your budget.

North Dakota: $120

South Dakota: $123

Wisconsin: $134

Minnesota: $140

Iowa: $144

What determines the cost of renters insurance?

Renters insurance provides protection for your belongings, plus liability coverage and loss-of-use coverage, in case your home becomes uninhabitable and you need to temporarily stay in a hotel. Renters insurance rates are determined by a few factors, some of which you can choose, and some of which you can’t.

Renters insurance cost factors that are set by your circumstances:

Your location: Renters insurance rates can vary widely by location (see the table above) and can even vary within cities and neighborhoods and property by property (older buildings tend to cost more, while newer buildings with more security and safety features can garner lower premiums).

Your credit score: Your credit score influences a lot of the rates you’ll get in your financial life, and renters insurance is among them. A good credit score is considered a sign of financial wellness and is a big factor in lowering your premiums.

How much stuff you have: Generally, the more value your home inventory has, the more it’ll cost to insure. We’re saying value because, while having a lot to insure generally costs more, the total price of your possessions is the real driver here. So a two-bedroom full of Ikea furniture may be valued less than a studio full of Eames.

Renters insurance cost factors that are set by your choices:

How much coverage you want: More coverage costs more money. If you’re willing to accept lower payouts in the event of a claim, then your premiums will be lower. And if you’re willing to gamble that your entire vintage guitar collection isn’t covered, then you’ll save some money upfront. But if you want higher coverage limits and additional endorsements for expensive items (and you probably do), expect your premiums to be higher.

How high (or low) you want your deductible to be: That’s the amount of money you pay out of pocket before your coverage kicks in. The higher your deductible, the lower your premium.

How you want to be paid in the event of a claim: Actual cash value renters insurance will pay you the value of belongings at the time of a claim, not the price you paid for them or the price it would cost to replace them. Replacement cost renters insurance covers the cost of repairing or replacing the item at the time of the claim. Replacement cost renters insurance pays out a lot more if you need to file a claim, but it also costs more.

What affects the price of renters insurance?

Since your circumstances are generally set, it’s your choices about coverage that allow you to have some control over the rates you’ll get.

How much does a basic renters insurance policy cost?

The average renters insurance policy costs between $120 and $190 a year. These basic policies generally offer $25,000 personal property coverage, $100,000 liability coverage, loss-of-use coverage and a $500 deductible, though those numbers are just ballpark figures and your particular insurance policy’s basic coverage may be different.

Some examples of what a basic renters insurance policy will cover:

Damage to your belongings that is caused by covered perils like fire, smoke, vandalism, short-circuits, and more.

At least part of the replacement cost of a laptop that gets fried by a water damage from a burst pipe.

Some coverage for medical expenses if a friend gets hurt in your apartment — plus some legal expenses if that friend decides to sue you.

Coverage for personal property that is stolen when you’re away from home.

If a covered event renders your apartment uninhabitable, your policy will also pay additional living expenses so you can stay in a hotel during repairs.

Read to learn more what renters insurance does and doesn’t cover.

What is the cheapest renters insurance you can buy?

The cheapest renters insurance will have the least amount of coverage. If you opt for low coverage amounts for personal property (say, $10,000), personal liability ($100,000), and medical payments to others ($1,000) and you choose a high deductible ($500 to $2,500), you can conceivably get renters insurance for as little as $5 to $8 a month. You can compare quotes online when shopping for the most affordable renters insurance.

How much does additional coverage cost?

Renters insurance does not cover natural disasters, so if you live in an area that experiences things like floods or earthquakes, you will need to add additional coverage to your policy to cover those perils. As you raise the coverage limits of your renters policy, you also raise your premiums. But remember, renters insurance is super affordable, so even huge leaps in coverage can result in just a few more dollars a month.

For example, if you increase to the most common coverage amounts — $25,000 for personal property, $300,000 for personal liability, and $2,000 for medical payments to others — your premiums can still often be under $20 per month.

You can also purchase endorsements to increase your coverage for specific belongings, so if a basic policy only covers $1,000 worth of jewelry but you have a $5,000 ring, an endorsement could make up the coverage difference.

These additions can be as low as a few more dollars a month, or in some cases, even less than that.

Read more about popular renters insurance riders, floaters, and endorsements.

How can you get discounts on renters insurance?

You can lower your insurance rate by increasing the number of safety and security features in your home. Many renters insurance companies offer discounts if you have one or more of the following features in your home:

Local fire/smoke alarms (sounds in home)

Central fire/smoke alarms (alerts monitoring system)

Automatic sprinklers

Local burglar alarm (sounds in home)

Central burglar alarm (alerts monitoring system)

Deadbolt lock

An insurance company may also offer discounts if you bundle your renters insurance plan with another insurance plan, like auto insurance, or if you pay your annual premium at once instead of monthly.

Another huge way to save: increase your credit score. This one takes time, but as your score gets higher, you can get better renters insurance rates.